Oil price set to drive up offshore well P&A

Offshore staff

OSLO, Norway – Rystad Energy expects several hundred offshore oil and gas wells to cease operations by 2021.

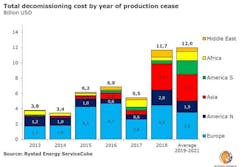

It calculates that global decommissioning obligations last year rose to $11.7 billion, and anticipates commitments totalling $12 billion annually from 2019-2021.

Rystad’s Audun Martinsen said that last year’s costs represented an all-time high, with the company’s review of offshore assets showing that around 9,000 offshore wells globally are barely profitable at $60 Brent oil prices.

“This is a relatively high breakeven price that was the Achilles heel of many fields in 2018,” he said.

Rystad Energy expects these wells to beP&A’d over the coming years.

“In 2013 and 2014, when oil prices were high, very few operators initiated plans to decommission older assets,” Martinsen explained. “Instead, they sought to maximize returns from their producing assets.

“However, as oil prices dropped to painfully low levels in 2015 and 2016, many of these field life extension plans were de-prioritized or scrapped altogether.

“Although oil prices have recovered to more sustainable levels, the elusive $100/bbl still seems like a distant dream for most operators. As a result, numerous operators have begun realizing their obligations to decommission elderly uncompetitive assets.”

Europe, in particular the UK, has been the most active market foroffshore decommissioning, accounting for more than 50% of the market in recent years.

Rystad expects UK offshore oil companies to spend more than $2 billion/yr on decommissioning over the next three years, with a growing number of fields also under assessment for closure offshore Asia, North America, and Latin America.

02/21/2019