Petrobras in talks with SBM on largest Búzios FPSO

Offshore staff

RIO DE JANEIRO – Petrobras has entered contract negotiations with SBM Offshore for use of the FPSO Almirante Tamandaré on the Búzios field in Brazil’s presalt Santos basin.

This will be the sixth production system on the field, with start-up scheduled for the second half of 2024. It will also be the largest oil production platform operating off the Brazilian coast and one of the largest in the world, Petrobras claimed, with processing capacity of 225,000 b/d of oil and 12 MMcm/d of gas.

Bids are also out for two further FPSOs for Búzios, the P-78 and P-79: each will have the capacity to process 180,000 b/d of oil and 7.2 MMcm/d of gas, and should start operating in 2025.

Petrobras also revealed that Brazil’s National Agency of Petroleum, Natural Gas and Biofuels (ANP) has approved a change in name for the producing Lula field in the presalt Santos basin to Tupi. This is to ensure compliance with a recent ruling in a citizen lawsuit, ordering the annulment of the designation of the Tupi area as the Lula field (enacted in 2010).

Other areas comprising the Tupi field that have undergone name changes are Sul de Tupi and Tupi Leste (East Tupi), a non-contracted area belonging to the federal government, represented by Pré-Sal Petróleo S.A. (PPSA).

The Tupi field lies mainly in the BM-S-11 concession, 230 km (143 mi) offshore Rio de Janeiro State: Petrobras operates in partnership with Shell and Petrogal Brasil.

Production started in 2010 via the FPSO Cidade de Angra dos Reis. Tupi is currently Brazil’s largest oil and gas producing field.

In addition, Petrobras has announced that it is revising its Exploration & Production (E&P) portfolio due to the impact of COVID-19. The company’s focus will be on world-class deep and ultra-deepwater fields.

Other goals include attaining a gross debt target of $60 billion in 2022; prioritizing projects with a Brent price breakeven of no more than $35/bbl; and revision of the company’s investment and divestment portfolios.

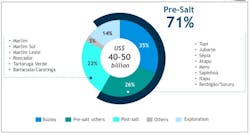

This should lead to estimated capex on E&P of around $40-50 billion during 2021- 2025, down from the $64 billion announced in the company’s 2020-2024 Strategic Plan.

Búzios and other presalt assets will become more influential in the company's portfolio, representing 71% of the total E&P investment for 2021-2025, against 59% in the 2020-2024 Strategic Plan.

Petrobras has also decided to include new some assets in its divestment portfolio.

09/15/2020