Decommissioning may dominate UK offshore spending

Offshore staff

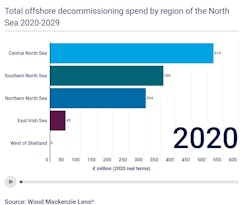

LONDON – UK North Sea production is set to rise this year, according to Wood Mackenzie. However, as the 2020s progress, capex on active fields will steadily decline, while decommissioning activity looks set to increase.

With various large UK hubs ceasing production and without new investment, decommissioning spending will likely overtake capex in 2025, according to Romana Adamcikova, senior research analyst, North Sea Upstream.

Two of the biggest decommissioning projects – Canadian Natural Resources’ Ninian and TAQA’s Cormorant in the UK northern North Sea – start after 2023.

By 2029, more than £17 billion ($21.88 billion) will be spent on UK decommissioning, twice the bill incurred by any other country, Adamcikova claimed.

Over the past few years there have been various UK M&A deals, with companies allowed to claim tax relief for decommissioning fields before transferable tax history was introduced, provided that they had generated taxable profits.

The new UK legislation offers added tax relief on decommissioning costs by allowing the tax histories of fields to be transferred from seller to buyer.

This mechanism is designed to allow purchasers of mainly late-life assets in order to take advantage of the full value of decommissioning tax relief, making the industry more attractive to new buyers.

02/27/2020