Oil price depends on three factors

Offshore staff

OSLO, Norway – Three essential factors will determine the direction of the oil price next year, according to Rystad Energy.

In a market update, Bjørnar Tonhaugen, head of oil market research at Rystad Energy, argues that a balanced oil market in 2020 is contingent on:

1. No global recession

2. Continued OPEC production cuts

3. The effect of new IMO 2020 regulations.

“Markets can balance with an extension of OPEC cuts through 2020, as we believe the IMO 2020 regulations will create more demand for crude oil. Moreover, the global economy needs to avoid a sharp slowdown and oil demand recover to more normal growth rates of between 1 MM and 1.2 MMb/d,” Tonhaugen said.

“If the stars fail to align, however, OPEC may need to discuss much deeper cuts to support the market,” he added.

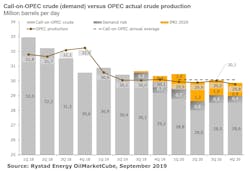

In its latest Oil Market Balances Report, Rystad Energy finds that the market can come into balance in 2020, even at current oil prices. The analyst’s latest revisions suggest a call-on-OPEC crude oil reaching 30.1 MMb/d next year, compared to 29.5 MMb/d in last month’s report.

However, a balanced market next year also implies that the global economy does not enter a technical recession and that demand recovers to around 1.2 MMb/d growth, the analyst said. OPEC needs to maintain current production levels, with extended cuts through at least 2020, while the introduction of stricter shipping fuel regulations – the so-called IMO 2020 effect – will cause a net positive effect on crude demand growth next year of about 1.0 MMb/d in order to balance the global gasoil market.

“Without the expected additional crude runs in 2020, on top of the normal growth in refinery runs to keep up with overall products demand without IMO 2020, prices will be even lower next year – unless OPEC cuts its production to around 29 MMb/d in 2020,” Tonhaugen said.

The firm forecasts that crude oil and lease condensate production growth outside of OPEC and Russia will reach 2 MMb/d in 2020, down 0.2 MMb/d from its previous estimate. The US oil supply forecast for December 2020 is revised down by 0.5 MMb/d to 14.0 MMb/d, which represents a yearly addition of 1.15 MM/d.

09/06/2019