ASIA/PACIFIC

Australia: Hope may lie in the east

The Australian continent may have more to offer oil companies than just the Northwest Shelf, stated the Australian Geological Survey Organization (AGSO), The organization recently discovered around 100 large sedimentary domes in the Fairway Basin north-northeast of the state of New South Wales on the east coast of the continent.

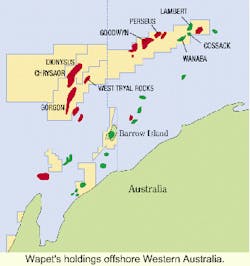

While exploration activity is still in a very early stage, the organization said that further exploration could prove the area as valuable as the Northwest Shelf, if it confirms the presence of petroleum-rich rocks. However, on the west coast activity remains steady. Chevron-led WAPET notched its second discovery in recent months with the Coaster-1 well. While test results have not been announced, the find is thought to be small but relatively important.

The well was drilled in a new area just five km offshore from Wapet's Thevenard Island production and processing unit in the Carnarvon Basin. Offering relative ease of development to infrastructure as well as proving potential of the shallow water area. The Coaster find follows the deepwater Geryon-1 gas discovery made in September in permit area WA-267-P. Geryon-1 encountered 113 meters of net gas pay over a 242-meter gross interval.

China: Big reserves, even bigger investments

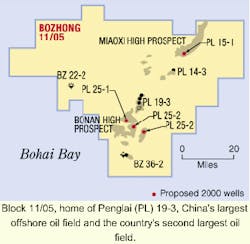

After a long drought of poor results from exploration in the early 1990s, China is hoping a massive discovery may put the country back on the list of oil exploration provinces. China has been touting the latest find by China National Offshore Oil (CNOOC) and US-based Phillips, Penglai 19-3, as the second largest oilfield in China and the country's largest offshore oil field. Penglai is located on Block 11/05 in the western flank of the Bohai Bay. Pursuant to results, CNOOC estimated Penglai 19-3 has reserves of 3.7-4.1 billion bbl of oil. This places the field just behind the massive 1959 discovery Daqing in northeast China.

To date, four successful appraisal wells have been drilled on Penglai and the companies plan to drill three additional appraisal wells and four new exploratory wells. The companies plan to take production up 30,800 b/d of oil by September 2001, starting with a pilot area.

Opinions differ on the magnitude of the discovery. CNOOC has been seen as overtly optimistic about the find and local analysts have said that reserves, while large, may not be in the 3-4 billion range, but rather in the 100-200 million recoverable.

CNOOC and Phillips have also expressed differing opinions about the fate of the project. CNOOC said it expects to start full-scale production by 2004 at over 300,000 b/d. But Phillips, taking a more conservative position, said if the pilot well is successful and sufficient recoverable oil is discovered, full-scale development would begin in 2003 and the field could come onstream in 2005 at around 226,000 b/d. However, Phillips did say that the field represented the largest discovery by the company in the past 30 years.

China is committed to turning the country back into a major oil province. As part of the development of Penglai, CNOOC has pledged to invest over $500 million in developing new oil fields in order to boost the country's output to 40 million tons of oil by 2005.

Besides Penglai, other fields planned for development this year include Bozhong 29-4, Bozhong 25-1, Caofeidian 11-1, Panyu 5-1, Qinhuangdao 32-6, the second phase of Suizhong 36-1, and Wenchang 13-1. In addition, with these developments and other activities, CNOOC expects over 160 wells to be drilled this year.

This aggressive plan expects to yield China an annual average increase of 20% in offshore pro duction over the next five years. Besides CNOOC, other companies are planning to pour money into China. US giant Chevron recently announced plans to invest $45 million in Chinese exploration and development. The company has said that it plans to drill three wells in the Bohai Bay, drill two wells onshore on the Sheng* Field, and maintain production on the South China Sea Huizhou 32-5 Field.

Also, China announced plans to launch state-owned PetroChina in the country's largest stock market listing. China hopes to sell around $5 billion in stock and increase foreign investment into the country.

India: Positioning for deepwater

The Indian government has begun making strides for the future - this time in deepwater. State-owned Oil and Natural Gas Commission (ONGC) and Oil India are planning to team-up to explore in deepwater. The impetus for the alliance is attributed chiefly to the increasing exposure of India's oil industry to foreign investment and operation as the direct result of newly liberalized oil exploration policies. The companies said that in order to face the increasing competition from foreign oil companies and maintain a "major player" status in India's oil industry, the companies needed to gain deepwater expertise.

A representative from India Oil said that the alliance will allow the company to learn from ONGC's existing expertise and together pool their resources to gain valuable deepwater experience.

India Oil's operations lie onshore, while ONGC operates several shallow water offshore fields such as Bombay High and has made one deepwater discovery. Furthermore, in order to bridge the gap between domestic consumption and production, the government awarded ONGC 12 new exploration blocks. The government said that 70% of consumption is imported, and with OPEC continuing production constraints and rising oil prices, the country needs to increase short-term domestic production to the maximum extent possible.

The new concessions are located in both onshore and offshore areas and were awarded because the company had already performed some initial work. However, in order to stay consistent with policy, the company was not granted permission to begin exploratory work. The new policy states that blocks for exploration are only awarded through competitive bidding on equal terms with private firms. But, the government added that the exception was made because they were not ready to make another round of oil blocks available for bidding.