Norway: PGS takes the helm at Varg

PGS Production has an agreement with Norsk Hydro to take on its 42% stake and operatorship in the Varg production license. Assuming approval by the government, this will make it the second contractor licensee on the Norwegian continental shelf. PGS sees this as a model which will open the way to more profitable operations in small field development.

The company has the largest fleet of owned and operated Floating Production, Storage, and Offloading vessels (FPSOs) in the North Sea. In addition to the Petrojarl Varg, this includes Petrojarl 1 on Statoil's Glitne Field; and, in the UK sector, Petrojarl Foinaven on BP's Foinaven Field and Petrojarl Banff on Conoco's Banff Field.

"Our format has gradually developed over time, taking on board a degree of risk in the form of both reservoir risk and oil-price risk," says President Kaare Gisvold. "In this kind of work we have to align ourselves with the customers, sharing both the upside and the downside.

"Often the amount of capital risk we take on is equal to or greater than that of our customers. Our vessels cost $200 million or more, while the development cost of some smaller fields may be $100 million. So we see ourselves as owners of infrastructure, just like the oil company, which owns a platform or a pipeline. We see no reason therefore why we should not be regarded as a partner rather than a subcontractor. And if we are going to get into this position, we have to take a license interest."

In addition to providing the production facility and an experienced crew, PGS can bring a wealth of reservoir expertise to field development. Thus the group is well placed to take on the responsibility for a substantial part of the development requirements.

In seeking to become a licensee, PGS has taken great care not to step on the toes of sensitive oil companies. As Gisvold says, "We've been very careful not to be perceived to be competing with our customers. We wrote to all our major seismic customers in Norway telling them what we intended to do. We made it clear we would not be bidding for new licenses using our seismic data – our focus is on the use of our FPSOs."

These communications sparked interest and questions, but no objections. They also brought PGS its first opportunity, when Norsk Hydro, intent on re-focusing its portfolio, proposed selling the contractor its interest in Varg. The deal involved a minimal payment, NKr 3 ($0.33) to be exact. The main financial burden consists of Hydro's abandonment obligation, which PGS will assume. Deducting the government contribution, this will present PGS with an estimated bill of $17 million before tax deductions. This figure drops to $6 million if full tax benefits can be used.

In addition to buying the license interest, PGS Production has also applied to take over the operatorship. It expected a decision from the oil and energy ministry on both issues before the end of the first quarter. Assuming the ministry says yes, PGS will take over both the license interest and the operatorship on August 1. The license interest will be held by the newly established PGS Petroleum.

Reserve shortfall

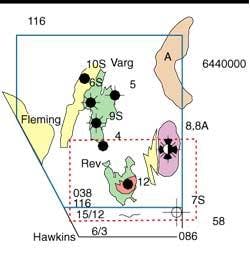

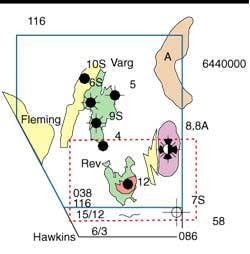

Achieving profitable operations on Varg will be a challenge for PGS. Since Varg was brought on stream in late 1998 by Saga Petroleum, and later taken over by Hydro, the field has performed disappointingly. Recoverable reserves, originally thought to be in the region of 50-70 MMbbl of oil, are now expected to be no more than 35 MMbbl. At present the field, which is currently producing 15,500 b/d, could remain in production until spring next year, depending on oil prices and reservoir performance.

However, last year Hydro made an interesting discovery, named Rev, to the south of Varg. The well, 15/12-12, was not tested, but PGS believes the field holds reserves of some 40 MMbbl of oil and a gas cap containing at least 3 bcm.

Before Rev can be profitably developed, PGS will have to find a new partner. The situation arose after it agreed in March to buy Statoil's 28% stake, giving it a total of 70%. The remaining 30% interest is held by State's Direct Financial Interest (SDFI), which has put its 30% stake up for sale. Statoil is also working with PGS on the marginal Glitne Field, which entered production last year.

Various scenarios exist for the development of Rev, Gisvold says. It could be a subsea tieback to the Varg wellhead platform, or it could be produced directly to a floater. Liquids recovery could be maximized by reinjecting the gas then producing it in a second phase. The gas could be exported via BG's Armada Field just across the median line with the UK. Alternatively, Rev could be produced simultaneously with Varg, prolonging the latter's tail-end period. Or alternatively it could be a stand-alone operation.

The likely development scenario involves four wells, three producers and one injector, with the exploration well recompleted as a gas injection well. PGS aims to have a plan for operation and development ready by July, but it also wants to drill a new well on the field before finalizing its plans.

If the plans for Rev do not include the Petrojarl Varg, work for this vessel will have to be sought elsewhere. If it is used to produce Rev, some modification of the gas process equipment will probably be required. But with a 25-year design life, the ship still has a lot to offer. Since acquiring it from Saga, PGS has increased the crew to 35, strengthening the maintenance program. This has resulted in uptime close to 100% and a very good HSE record.

FPSOs are ideal for producing small fields, and Gisvold sees no shortage of work potential in the Norwegian sector, where so far only one prospect assumed to be less than 100 MMbbl has been drilled. PGS' involvement on Glitne is interesting as Statoil sees this as the first of a possible series of small field developments. It holds an option on its contract with PGS for a second field, which at the moment could be Volve.

In seeking the right framework for developing small fields economically, a series of linked developments offers interesting synergies. The contractor-cum-licensee model could also make a positive contribution. Such topics are clearly high on the agenda for the oil industry in Norway these days. But Gisvold stresses that the bottom line is to achieve the most profitable operation, whether as licensee or contractor.