Offshore gas could quench Namibia's thirst for energy

GTE is a viable alternative

Klaus Endresen

Vanco Energy Co.

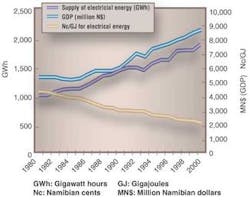

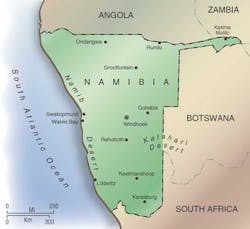

Namibia's commercial energy and elec-tricity consumption is growing as the country's economy expands. National energy consumption is about 60,000 terajoules/yr, about one-third of which is non-commercial. Namibia imports a growing share of its electricity from South Africa, but the current import agreement will expire in 2005. And South Africa's surplus is expected to be exhausted at about the same time. Namibia faces a short- to medium-term gap of 300 MW between peak demand and installed capacity.

This eventuality has sparked a keen interest on the part of the Namibian government to develop more of its own indigenous energy resources. In an energy white paper, the Nam-ibian government has stated the goal of achieving self-sufficiency in electricity supply.

Though Namibia has no proven oil reserves, offshore gas reserves are promising. With Namibia's domestic demand for electricity, combined with access to the South African market, there is a more than adequate market for a gas-to-electricity (GTE) plant in Namibia.

About 50% of Namibia's electricity comes from its own generating sources. The remaining 50% is imported from South Africa.

The main domestic electricity source is the Ruacana run-of-the-river hydropower plant. The production level is cyclical, so imports from South Africa are needed to make up the difference between local demand and the periodic gaps in production from Ruacana. Over the last few years, total demand has outstripped the local generating capacity so that even when Ruacana is producing at full capacity, imports are needed to meet Namibia's domestic demand for electricity.

Imported power from South Africa has historically been cheap. The exact import costs are not publicly known, but are probably less than 1-1.5 cents per kilowatt-hour. South Africa heavily over-invested in coal-fired generating capacity during apartheid in the 1980s, assuming a growth rate in demand that did not materialize. Drawing on this overcapacity has enabled South Africa to generate and export cheap electricity to its neighbors.

But demand growth in South Africa is catching up with the installed capacity, and the historic surplus will be gone within a few years. Thereafter, the price regime is likely to be different. The days of cheap electricity for neighboring countries could soon be over.

null

Electricity demand

Namibia's World Bank classification as a middle-income developing country and its population of about 2 million explain the country's level and structure of energy consumption.

A structural change in the demand for energy has taken place over the last 20 years. Withdrawal of the South African colonial administration followed by the installation of a democratic government in 1990 had a major impact on national energy consumption. The Namibian gross domestic product (GDP) has grown steadily for a number of years.

The demand for electricity in Namibia is growing significantly in two ways. There is natural growth every year due to a general increase in the size of the economy and expanding use of electricity. And there is an increase in demand based on major industrial projects. Two examples are the Scorpion zinc mine and the Ramatex textile industry, which have created significant demand growth.

Additional projects are envisioned, and they will have considerable impact on electricity demand. It is likely that within a few years, peak demand will exceed the domestic generating capacity by about 300 MW. Meanwhile, per capita energy consumption has increased by about 25% since 1990.

Just after independence, the government of Namibia embarked on a comprehensive rural electrification program to improve rural access to electricity to support economic development, equitable distribution of resources, and social uplift. The program, implemented in phases, started with the most densely populated areas in northern Namibia, moving clockwise through the country. A master plan for the current decade was approved last year.

Initially, the program was funded by government grants and official development assistance. Continued funding will come from the electricity levy and from proceeds from Nampower's concessionary loans. Between 1991 and 1996, $25 million was spent on the plan, and more than 90% of the funding came from the government.

In 1991, 25% of Namibians lived in urban areas. It has been estimated that 76% of the urban households have access to electricity. By 1998, only 8-9% of the rural population had access to electricity. A year later, less than 10% of rural households had been connected to the grid. A clear government goal is to improve these numbers.

The market for electricity generated in Namibia will also include South Africa, where the installed generating capacity is 42 GW. In practice the max capacity is less. Old, inefficient generating plants that are currently mothballed meet much of the difference between current peak demand and installed capacity. It will be impractical for some of the mothballed capacity to be used for economic and technical reasons, and it will be costly to bring the plants into production.

GTE viability

If a GTE plant in Namibia had a capacity of 800 MW, only about 400 MW would be needed instantly for domestic consumption. The remaining 400 MW would be sufficient to cover less than half a year's additional demand growth in South Africa. Electricity exported from Namibia would hardly make a dent in South African statistics, and would therefore not threaten South Africa's electricity industry.

Transmission distances are very long, and the transmission cost from Namibia to South Africa certainly would be high, but distance does not preclude pursuing this option. The distance from Windhoek to Cape Town is about the same as from Johannesburg (where much of the coal generating capacity in South Africa is installed) to Cape Town.

GTE in Namibia is similarly priced to South Africa's, and the relative transmission distances to the South African market are not out of line with the domestic distances in South Africa. It is quite likely that surplus gas based electricity from Namibia will be able to compete well in the South Africa market.

Eskom, the South African power utility, exports relatively small quantities to neighboring states. Interestingly, Eskom's sales to Namibia represent only 0.3% of the company's total sales, but 46% of total electricity consumption in Namibia.

South Africa has major exports to Namibia, but less goes in the other direction. Clearly, there are economic as well as political arguments for enhancing exports from Namibia to South Africa. A viable candidate is electricity based on gas.

Future supply options

Namibia has both hydro and gas resources than can be used for new generating capacity.

The Kunene River on the border of Namibia and Angola, for example, represents untapped hydropower potential. Alternative solutions have been studied, and the Namibian government is in favor of building a major dam on the Kunene. Though the development, called the Epupa project, has met with government approval, local and international environmental lobbies have voiced strong opposition.

Engineering studies show that the optimal installed capacity for Epupa would be 360 MW. Analysis incorporating significant operational and market simulations predicts an average load factor of 0.56. The objective of Epupa would be to replace current and future imports, and it is estimated that full capacity availability would be needed from the first year of operation.

Furthermore, Epupa would require an investment of $724 million in 1997/98 prices. The main results of the financial analysis (a cash flow analysis) of the project gives Epupa a financial internal rate of return of 11.8% on total capital employed (or as low as 9.7% if, for example, commercial uncertainties increase).

The financial analysis rests on the assumption that Nampower, Namibia's state-owned power utility, will sell the power at 4.5 cents per kilowatt-hour, as expressed in 1997 prices. Epupa costs include the cost of additional transmission capacity and losses to the wholesale point of delivery.

GTE is a more viable option than hydropower, in part because Namibia has proven gas resources. The Kudu field offshore southern Namibia is generally assumed to hold 1.3 tcf of gas, which would be adequate for a sizeable power plant. The licensees have been trying to firm up reserves to a level sufficient for LNG production, but plans for Kudu are not in the public domain.

An enormous portion of Namibia's offshore has yet to be explored. Vanco Energy Co., which holds offshore exploration license 1711 off northwestern Namibia, is optimistic that more hydrocarbon resources will be discovered soon. Extensive seismic surveys over 1711 have uncovered two major structures, and Vanco is looking for partners before drilling.

The license covers an area of almost 9,000 sq km and forms the southern part of the Namibe basin, which stretches well into Angola, but which has never been explored on either side of the border. Should 1711 be gas prone, the additional reserves will be absorbed into a GTE plan in the northern part of Namibia and would be able to supply both domestic and regional markets.