Drilling into the Lower Tertiary

Gero Farruggio - Wood Mackenzie

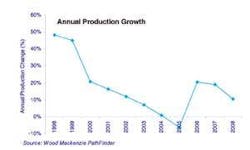

Data from the last few years would seem to suggest that the Gulf of Mexico is maturing as a production area, with a yo-yo slowdown in production growth from highs of 50% to flat in 2004 and a decline in 2005. Production growth is expected to recover in the short-term, as a series of fields discovered in the late 1990s come onstream.

But it’s the Lower Tertiary trend in recent weeks that has renewed optimism in the Gulf of Mexico, and was a key driver behind the surge in interest during the recent lease sale.

The focus of attention has shifted to the emergence of this new play and to fully understanding its potential.

Frontier exploration in the Lower Tertiary

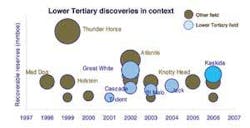

It was the recent extended well test on the Jack field that captured the imagination of many. But there have been a series of discoveries in the Lower Tertiary play over the last five years.

The first finds were Trident and Great White in a remote southwestern corner of the Gulf, in Alaminos Canyon. Since then, further successful Lower Tertiary wells have been drilled in Walker Ridge and more recently in Keathley Canyon with BP’s Kaskida field.

These discoveries have proven the Lower Tertiary play extends over at least three protraction areas. It may also reach north into Garden Banks and Green Canyon, although as yet no successful tests have been drilled in these areas. Last year, deep wells with Eocene targets were drilled at Shenzi and Mad Dog fields, but both proved to be dry. Water depths across the play ranges from 2,000-3,000 m, pushing the boundaries of deepwater drilling technology during the early finds - but beyond reach for exploitation at the time.

The Gulf of Mexico deepwater acreage consistently leads Wood Mackenzie’s rankings of exploration provinces in terms of value created. Over the last five years, nearly one-in-three exploration wells in the conventional Miocene and Pliocene deepwater plays were successful, delivering a healthy 50 MMboe per exploration well drilled.

To date, there are twelve Lower Tertiary discoveries from 12 exploration wells - over a 63% success rate. And the reserves discovered per well in the Lower Tertiary is estimated at 120 MMboe per well.

BP and Chevron have both capitalized on first mover advantage, discovering sizeable reserves, closely followed by Devon Energy, Petrobras, Shell, and Anadarko.

Increasing appetite for Lower Tertiary acreage

As mentioned, the majority of the Lower Tertiary play is found in three protraction areas, two of which featured in the recent lease sale. Total bids received for deepwater acreage virtually doubled on last year’s Western bid round to near record levels, with Keathley Canyon attracting over half of the total value bid. It also boasts the lease sale’s highest bid.

The appetite for this acreage has clearly soared. But on examining the current licensing, much of it is due to expire over the next two years. This is an interesting dynamic that will influence the level of exploration activity we can expect in the near future.

Clearly, it will be impossible to drill all of the prospects during this time. Rig availability will surely prove to be a bottleneck; access to such equipment will be valued as much as the acreage itself.

We could well see a series of farm-ins to ensure some of these prospects are tested. What is certain is that the bigger structures will be prioritized. Given the excellent success rate to date, there is good reason to have high expectation from each well.

The Cascade field, which was one of the first discoveries in the play, is not considered to be the largest, but its significance is in the fact it is likely to be the first developed. Current plans envision the use of an FPSO facility - the first of its kind in the Gulf of Mexico. It offers a solution to the production and transportation challenges of these remote Lower Tertiary fields.

The Cascade development will bring online first oil from the play by the end of the decade. This is likely to be a phased development, given some uncertainties surrounding the long-term deliverability of the Lower Tertiary still remain.

The Jack production test was a positive first indication, but is far from proving the reservoirs for the entire play.

What we will be looking out for is an indication of the sustainability of production, declining rates, and pressure drawdown over time.

Any attempt to put a figure on a production forecast from the Lower Tertiary beyond this would be pure speculation at the moment. What is certain, the upstream playground in the Gulf of Mexico has just got a lot bigger.

Editor’s Note: This is a transcript from a podcast. The video can be viewed at http://www.woodmac.com/energy/gomvideo.