E&P spending recovery still at risk in 2021

Offshore staff

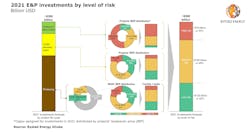

OSLO, Norway – Investments by E&P companies globally next year could total around $380 billion, according to Rystad Energy.

However, around 20% ($76 billion) may be at risk of deferral or reduction, with the remainder thought to be in the safer low to medium risk range.

By 2023, spending could recover to the pre-crisis level of $530 billion if the oil price rises to around $65/bbl. Although following the previous market crash of 2014, annual E&P investments never recovered to the then pre-crisis level of $880 billion, instead settling at $500-550 billion annually.

Much of that reduction was due to supply chain and efficiency improvements, the consultant pointed out, with little scope for further reductions this time round.

Instead, E&P companies are deferring infill drilling programs, final investment decisions and start-ups, and reshaping their portfolios in order to stabilize revenues.

“As E&Ps are also speeding up a transition into low-carbon energy, it is possible that this time, too, upstream investments will not return to pre-crisis levels in the long term, even if they do recover somewhat over the next few years,” said Olga Savenkova, upstream analyst at Rystad Energy.

Of the total $380 billion of projected investments for 2021, around 60% ($234 billion) is likely to come from producing fields.

Within facility capex, about 38% is spent on facility maintenance. Many operators postponed much of their planned maintenance this year due to coronavirus restrictions and lower oil prices.

In 2021, maintenance work will become more of a priority in order to avoid unplanned outages in future.

Rystad calculates that around 23% ($37 billion) of planned well capex relates to wells with a breakeven price above $55/bbl, so this spending is at high risk of deferral.

Wells with a breakeven less than $30/bbl are seen as low-risk drilling opportunities.

The consultant added that 10% of capex associated with projects under development and 30% of capex earmarked for discoveries and undiscovered projects may face deferral, due to weak economics.

11/24/2020