Lebanese offshore licensing round back on agenda

Offshore staff

WOKING, UK – Spectrum Geo says Lebanon’s Ministers of Finance and of Foreign Affairs have requested that Prime Minister Tamam Salam place the country’s delayed first licensing round back on the agenda of cabinet meetings as soon as possible.

The intention is to open up designated offshore blocks to tender and ultimately award two or three blocks, depending on the quality of bids received.

The next step in re-starting the round is for the government to approve two pending decrees - the first delineates the Lebanese offshore area into 10 blocks while the second sets the tender protocol and the model exploration and production agreement to be signed between the government and the successful bidders.

Both parties also agreed to finalize the taxation law applicable to oil and gas companies, which must now be approved by the Lebanese parliament.

Spectrum, which performed G&G studies over Lebanon’s offshore area, expects the government to approve the decrees within weeks.

According to a statement from the Lebanese Petroleum Administration (LPA): “The deadline to submit bids for the first licensing round shall take place in a maximum period of six months from the date of the adoption of the two decrees.”

In 2013 the LPA staged apre-qualification process for oil and gas companies interested in participating in the licensing round. Twelve oil majors pre-qualified as operators and 34 as non-operators.

Lebanon’s Offshore Petroleum Resources Law stipulates that bidders must form a consortium containing at least one operator and two non-operators in order to participate in the process. However, a second pre-qualification process will likely be launched during the period of the tender preparation in case new players want to participate in the licensing round.

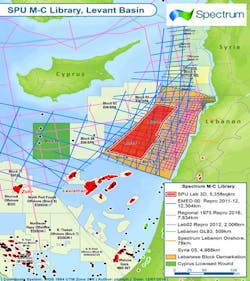

Analysis of extensive seismic surveys suggestoffshore Lebanon may have substantial hydrocarbon resources and a recent study by the LPA provides further supporting evidence, Spectrum said.

Offshore Lebanon is an extension of the prolific South Levant basin containing the giant gas fields ofTamar and Leviathan. However, although 30 tcf of gas is in accumulations that run up to the border with Israel to the south, Lebanon’s offshore area has never been drilled.

Spectrum says the Northern Levantine basin is deeper than the southern part of the basin and more than 10,000 m (32,808 ft) of Mesozoic and Cenozoic sediments show up clearly on seismic. In this deep basin, the Oligocene and Eocene source rock is buried deep enough to mature oil, making this potentially the most prospective part of theEastern Mediterranean for exploration.

The proven deepwater play in the south is within massive sands of Early Miocene age, in large anticlinal structures. Spectrum’s 3D seismic data has identified more than 20 large anticlinal structures, up to 40 sq km (15 sq mi) in size, and characterized by three-way dip closure and one-way fault closure to the north at the same Early Miocene level as the Tamar-equivalent discoveries.

These structures appear to be larger and less complex than those associated with the recent gas finds offshore Israel. Additionally, correlating the objective section from the recent discoveries into the 3D dataset, the Early Miocene section appears three to five times thicker in the North Levant basin.

Plate reconstruction models support the derivation of these sands from an early Nile Delta, supplying mature, clean sands in vast quantities to the Northern Levant basin. The recentZohr gas discovery in Early Cretaceous carbonates north of the Nile further supports the theory that sands were transported to the east of the Eratosthenes platform, pouring into and filling the basin offshore Lebanon.

Spectrum has identified other potentially prospective play types at various stratigraphic levels, all supported by AVO anomalies, fluid escape features, and potential BSRs with free gas amplitude anomalies.

07/28/2016

Share your news withOffshore at [email protected]