Ekofisk partners approve three-field redevelopment in the North Sea

ConocoPhillips Skandinavia and its partners in licenses PL018B/F and PL044/D in the Norwegian North Sea have taken FID on their previously produced fields project in the Greater Ekofisk Area.

The company will submit plans for development and operation in first-quarter 2026 to Norway’s Ministry of Energy.

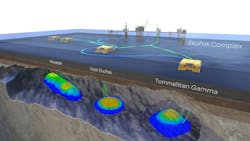

The project involves a combined redevelopment of the formerly produced Albuskjell, Vest Ekofisk and Tommeliten Gamma fields, with estimated overall recoverable gas condensate in the range 90 MMboe to 120 MMboe.

ConocoPhillips predicts total capex requirements for the fields and facilities in the two offshore licenses at about $1.8 billion. Plans call for 11 wells and four new subsea templates, all tied back to the Ekofisk production complex through a shared multiphase pipeline.

Assuming approval from the authorities, first gas should flow in fourth-quarter 2028.

Following recently agreed changes to the license partnership interests, ConocoPhillips will hold a 35.1% share of PL018B/F and 28.3% of PL044/D. The other partners are Vår Energi, Orlen Upstream Norway and state-owned Petoro.

Albuskjell, Vest Ekofisk and Tommeliten Gamma were all shut in prematurely in 1998 before the end of their anticipated lives due to projected decommissioning costs at the time and limited processing capacity at Ekofisk.

However, capacity should now become available in the late 2020s, enabling future gas production from the fields.

Exclusive content:

Vår Energi, which estimates its share of capex for the previously produced fields project at about $700 million, expects to gain 55 MMboe in net proved plus probable (2P) reserves.

It added that the development should provide a swift payback, with a breakeven price below $35/boe and a return on its investment of more than 25%.

Enablers for the development include improved well placement and advances in horizontal well technology that should deliver better reservoir exposure and production rates, with significantly higher reserves recovery.

In October the company raised its interests in the two licenses from 12% to 52% by agreeing to acquire TotalEnergies’ ownership interest in PL018B/F. The transaction should complete later this month.

Vår Energi has also signed a multi-year enterprise agreement with Kongsberg Digital under which the latter will roll out Kognitwin, its Industrial Work Surface digital twin solution service, on Vår Energi‘s operated fields and facilities offshore Norway.

The goal is to optimize day-to-day operations through introducing proactive and predictive support functions, and use of agentic AI and co-pilot capabilities to plan, schedule and execute end-to-end maintenance workflows.

In addition, the agreement covers provision of enhancement services.

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.