Report highlights implications of further offshore Guyana project delays

Offshore staff

OSLO, Norway – The Payara-Pacora development project in the Stabroek block offshore Guyana is already plagued by delays. If prolonged, the delays will decrease the nation’s planned oil revenues, the asset’s net present value (NPV) and its expected production, according to a report from Rystad Energy.

The Payara-Pacora development was once envisaged to be sanctioned in 2019 and deliver first oil by 2023 but has faced challenges to securing approvals in recent months. From a highly contested elections season earlier this year to no resolution more than three months after March’s election, the prolonged political uncertainty could further impact the next project offshore Guyana, the analyst said.

The delays have already removed more than 50 MMbbl of production that could have been achieved by 2030 if the project had been sanctioned in 2019. The partners involved in the project – ExxonMobil, Hess, and CNOOC – are hoping to receive approval later this year, but in Rystad’s updated base case scenario it assumes the Payara-Pacora fields will not be sanctioned until the first half of 2021 and will achieve first oil by 2024.

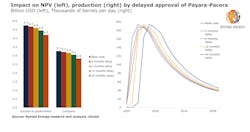

The analyst has looked at four potential scenarios with delays ranging from three to 24 months. Its analysis shows that Guyana may lose around 10 MMbbl of oil that could be produced from the project by 2030 presuming just a three-month delay, a number which climbs to around 75 MMbbl assuming a 24-month delay.

Palzor Shenga, senior upstream research analyst, said: “Despite recent delays, the Payara-Pacora development is still in a position to produce more than half of its reserves by 2030 if it is able to commence production by 2024. Any further delay could cost the stakeholders – the project partners and Guyana – dearly.”

In the base case, the Guyanese government could generate around $4.4 billion in oil revenues by 2028, meaning within five years of production start. However, revenues diminish quite substantially if the project faces delays. With a six-month delay, the project would generate around $800 million less than what it would in its base case, and around $1.6 billion less with a 12-month delay.

The delay would also cost the project partners, including the government of Guyana, quite heavily. In the base case, the Payara-Pacora fields could generate a cumulative free cash flow of around $3.5 billion by 2028. However, with a six-month delay, free cash flow would drop to around $2.6 billion, and to around $1.7 billion with a 12-month delay.

Guyana has already lost around $300 million in NPV as a result of project delays. In the base case, the NPV of the revenue that Payara-Pacora could generate for the government now stands at around $4.75 billion. However, if the project gets further delayed, the analyst sees NPV dropping to $4.45 billion with a 12-month delay and to $4.2 billion with a 24-month delay.

Companies involved in the project are also losing money. In the base case the project partners’ NPV stands at around $3.3 billion. This figure could drop by $200 million if the project gets delayed by a year and by an additional $300 million if the lag extends to a second year.

“Approval delays for Payara-Pacora could have a domino effect on numerous other projects in the Stabroek block. This would in turn have a substantial impact on the investments made in Guyana, thereby also dragging down job creation and GDP generation in the country,” Shenga added.

ExxonMobil has identified Payara as the third potential development project within the Stabroek block after Liza phases 1 and 2. The Payara discovery was announced in January 2017. The discovery well was drilled in a new reservoir and encountered more than 29 m (95 ft) of high-quality oil-bearing sandstone reservoirs. It was drilled to 5,512 m (18,084 ft) in 2,030 m (6,660 ft) of water.

The Payara development plan includes an FPSO named Prosperity. It is expected to produce 220,000 b/d supporting up to 45 wells, including production, water injection and gas injection wells.

07/15/2020