Deepest US Gulf well to date and frontier Libya carbonates test among Westwood’s latest high-impact drilling line-up

Key Highlights

- The Bandit well in the US Gulf aims to set a new depth record at over 12,000 m.

- Offshore Suriname sees exploration of carbonate plays at Macaw and Korikai.

- West Africa's Angola and Namibia are key regions for deepwater exploration.

- Libya's Matsola prospect in the Sirte Basin will be the first frontier carbonate test in Libyan waters.

- In Bulgaria and the Black Sea, discoveries like Sakariya and upcoming drilling at Vinekh and Krun prospects could unlock significant gas resources in complex deepwater settings.

By Jeremy Beckman, Editor-Europe

Major oil companies and their NOC partners will drill multiple play-opening prospects in offshore basins worldwide over the next few months, according to Westwood Global Energy Group.

Some of the activity will also be in proven but technically demanding plays, as highlighted by various consultants in Westwood’s recent "High Impact Exploration: H1 Review and Key Wells to Watch for 2H 2025" webinar.

Gulf of Mexico

Bandit, operated by Occidental in partnership with Chevron, will be potentially the deepest prospect ever drilled in the US Gulf of Mexico, said Jamie Collard, exploration research manager in his overview. The planned depth is just over 12,000 m, or more than 40,000 ft, which would eclipse the present record set by Cobalt’s Ardennes well in 2013, 30 km to the southwest.

The geological setting for Bandit is the same as for the Constitution Field in Green Canyon blocks 679 and 680, which produces oil from the Pliocene. The targets are the shallower Miocene and Palaeocene Wilcox intervals, with the latter having delivered a 20% commercial success rate from wells drilled to date, Collard said.

On average, the successes have proved about 230 MMboe, he added, but the wells also experienced very high-pressure conditions. The key risks for Bandit, he suggested, might be charge access and reservoir conductivity.

Other fields recently onstream or under development in this region are Anchor, Shenandoah, Sparta and Kaskida.

Offshore Suriname

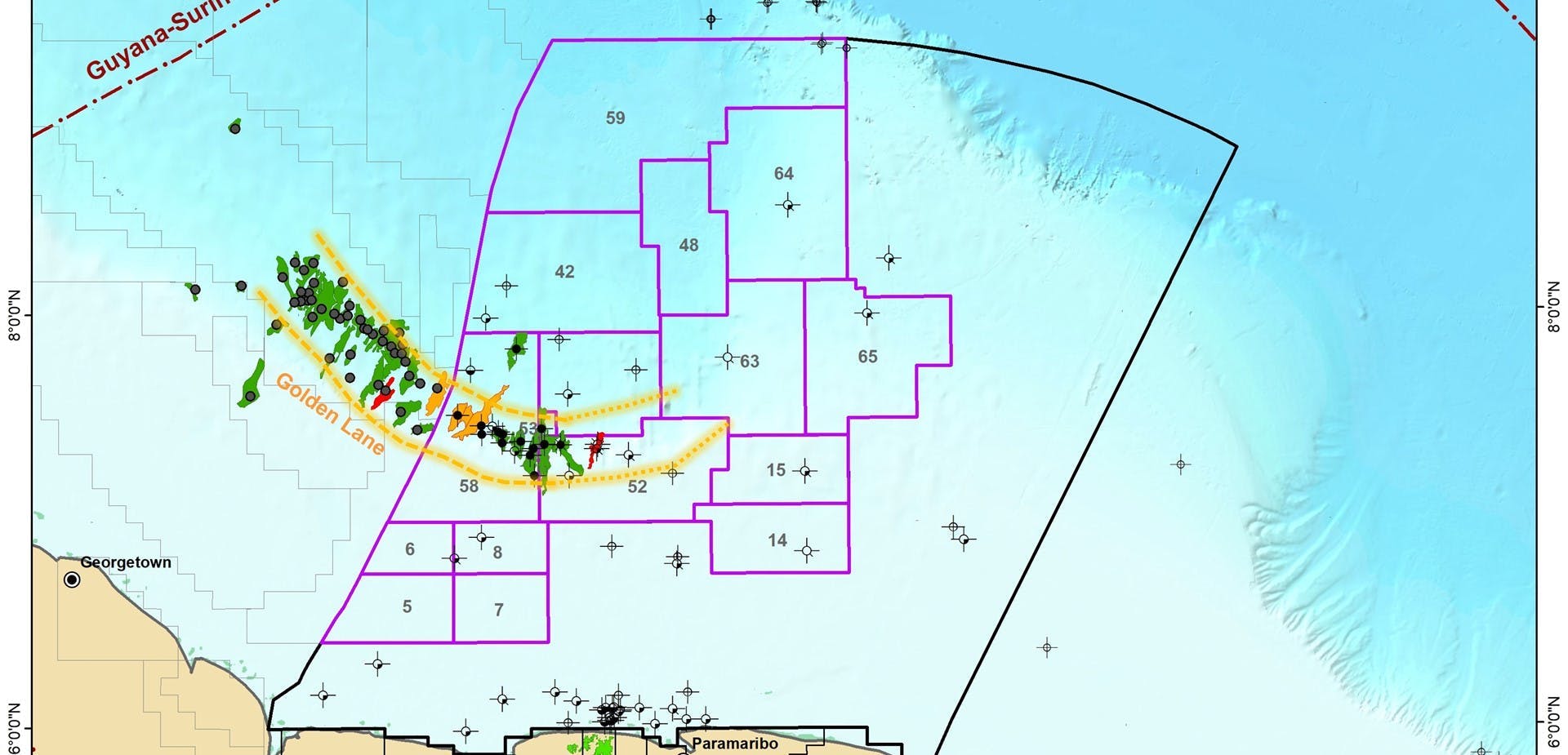

Among the upcoming programs offshore Suriname, senior exploration and appraisal analyst Andrew Jackson highlighted wells on the deepwater Macaw and relatively shallow-water Korikai prospects.

Macaw, operated by TotalEnergies in partnership with Petronas and Qatar Energy, is in Block 64 west of the Demerara Plateau, where water depths range from 1,200-1,500 m. The well is designed to test a carbonates play; only a few carbonate wells have been drilled offshore Suriname, one of which led to the non-commercial oil discovery Ranger in 2018.

The drillship Stena DrillMAX spudded the Macaw-1 well a few weeks ago, and this may have already reached the planned TD of 5,180 m, following a path through Lower Cretaceous or Upper Jurassic stratigraphy.

Macaw is just inboard of the Paleocene shelf, Jackson said, and the partners are probably relying on the presence of a mature Jurassic source rock. In this remote area, a discovery would likely need to hold 500 MMboe recoverable for a standalone commercial development.

Later this year, Shell and QatarEnergy plan to test Araku Deep in offshore Block 65 in a similar setting, again using the Stena DrillMAX. This is understood to be a reentry of the abandoned Araku-1 well drilled in 2017, but targeting deeper sections of the basin.

Toward year-end, Chevron’s planned Korikori well in Suriname’s shallow-water Block 5, in partnership with QatarEnergy and Staatsolie, will test an inboard extension of the Upper Cretaceous play that has proven prolific for discoveries in deeper water to the north. The risks for Korikai include charge access; a success could stimulate further drilling, Jackson suggested, as even a modest find in these water depths (up to 45 m) could be commercial.

Offshore Angola

In West Africa, the drillship VALARIS-7 is due to spud the Kianda-1 exploration well this quarter offshore Angola for Azule Energy and partners Equinor and Sonangol, in water depths beyond 2,500 m. It will test a possible extension of a proven play into the outer fold belt of the Congo Basin.

This could be a key well for Angola with the country’s production in decline, said Westwood’s senior exploration analyst Bryan Gill. Chevron will likely watch the outcome with interest as its blocks 39 and 50 to the south are in similar play settings.

Offshore Namibia

Drilling in the deepwater Orange Basin offshore Namibia has brought mixed results this year. TotalEnergies and partners QatarEnergy, Impact and NAMCOR will be hoping for better luck than their dry-hole Marula-IX in the southern part of Block 2913N, when they test the Olympe prospect in adjacent Block 2912 later this year.

Gill described this as a four-way faulted structure in a unique fairway that, in the event of a success, could deliver stacked pay across multiple Cretaceous intervals. A positive outcome could lead to tests of further structural traps in this distal part of the basin.

Offshore Libya

In the Mediterranean Sea offshore Libya, operator Eni and partners bp and NOC should spud a well on the deepwater Matsola prospect in the offshore extension of the Sirte Basin around year-end or early in 2026.

This will be a long-awaited first frontier carbonates test in Libyan waters in a Cretaceous interval, Gill added. Hess made a small offshore gas/condensate discovery nearby with the A1-54/01 well in 2009, in 850 m water depth. The key risks with Matsola are thought to include faulting and reservoir pressure.

Libya’s government is due to award further offshore licenses following a licensing round staged earlier this year. According to Gill, Turkey’s state-owned TPAO and NOC recently agreed to cooperate in offshore research licenses.

Offshore Bulgaria

In the deepwater western Black Sea, TPAO finally managed to prove an extension of the Sakariya gas play earlier this year, after several attempts, with its 75-Bcm Göktepe-3 discovery in 2,154 m water depth.

Sakariya is 50 km southwest of the Han Asparuh license offshore Bulgaria, where the drillship Noble Globetrotter I will drill the Vinekh and Krun prospects back to back later this year for OMV and partner NewMed Energy.

The Vinekh well will target Upper Miocene and Pliocene turbidites, with a pre-drill estimate of 3.3 Tcf, said senior analyst Joe Killen. This will be followed by drilling of the 3.2-Tcf Krun prospect in the same play in 1,760 m water depth.

Offshore Kuwait

Offshore Kuwait, the jackup Oriental Phoenix started drilling Kuwait Oil Co.’s (KOC) Riqah well in June, as a follow-up to KOC’s breakthrough discovery last year of the Al-Nokhatha oil and gas field. Previously there had been little exploration offshore Kuwait and no production to date, Killen noted.

The Riqah well is targeting Jurassic carbonate reservoirs, a play proven and producing in the North and Marjan fields offshore Qatar and Saudi Arabia, but never previously tested in the Mesopotamian Basin offshore Kuwait. KOC could follow up with a 3D survey and six to nine exploration wells, Killen added.

Offshore Papua New Guinea

Finally, TotalEnergies and partner Petronas are preparing to drill Papua New Guinea’s first deepwater well on the Mailu structure in PPL 576 in the country’s easternmost offshore region, using the drillship Noble Viking.

Mailu has been drill-ready for several years, according to Westwood’s Jamie Higton. It is a 1-Bbbl oil prospect within a post-rift Eocene carbonate build-up in almost 2,000 m of water. It is also 500 km south of recent onshore finds in PNG.

Drop-cores taken from an active onshore oil seep suggest the region could be oil-prone. Proving a Late-Cretaceous working source rock could open up further offshore plays over which TotalEnergies and others have acreage, he added. A gas find, however, might be hard to commercialize.

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.