Sixth-generation semisubs face declining rig values

By Sofia Forestieri, Esgian

As the offshore rig market recalibrates, sixth-generation international semisubmersibles are facing a dual challenge: limited demand and declining rig values.

Once the backbone of deepwater development, these mid-age floaters are now being cold-stacked, sold for non-drilling purposes, or sold to niche opportunities in emerging markets, often at steep discounts compared to historical valuations.

While more modern units remain competitive, the wider category is being squeezed from within the floater segment, as drillships absorb a growing share of deepwater work. In a market where competitiveness is rapidly evolving, rig values are revealing the segment’s growing struggle to retain its former role.

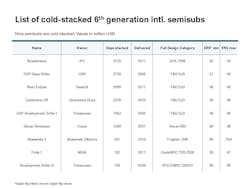

Cold-stacked rigs

As of June 2025, nine sixth-generation international semisubs are cold-stacked globally. These include units stacked as recently as early 2025 to others idle for nearly a decade. For many of these long-idled rigs, a return to drilling appears increasingly unlikely, and recycling/conversion is becoming the default outcome.

Recent moves by Valaris underscore this shift. The company sold three of its Ensco 8500-design rigs – the Valaris DPS-3, DPS-5, and DPS-6, for recycling. Notably, DPS-5 was working less than a year ago, and had only been cold-stacked since early this year, but was retired alongside the others, reflecting the growing emphasis on strategic fleet optimization. Other long-term cold-stacked units could also likely follow this path.

The GSP Deep Driller (cold-stacked for 2,730 days) is being marketed by Vantage Drilling for a specific opportunity under a MoU signed with GSP, but its extended stacking time still marks it as a recycling candidate. Noble’s 1976-built Ocean Apex, even though currently drilling, could still be a potential retirement case as the company continues to optimize its fleet following the Diamond Offshore acquisition.

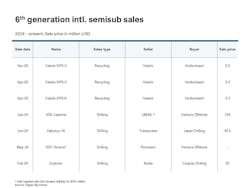

Three sixth-generation international semisubs were sold for recycling this year, a trend likely to continue. Additionally, four rigs have been sold for drilling purposes since early 2024, highlighting the shrinking resale market.

With reactivation costs estimated to range from $60 to $100 million, the economics of returning cold-stacked rigs to work are challenging. Even short-term stacked rigs see $40 to $50 million valuation discounts versus comparable active rigs. For example, GVA 7500-design Independencia 2, currently warm-stacked in Mexico, is valued at $104 to $115 million, while the same-design long-term cold-stacked Bicentenario is valued at $33 to $43 million. A similar case is F&G ExD-design Hunter Queen and Ocean Courage, currently drilling in Brazil, valued at $82 to $93 million, while same design long-idle West Eclipse and Centenario GR are valued at $38 to $46 million. Considering that scrap value typically ranges between $4 to $6 million for a sixth-generation international semisub, this highlights the narrow economic gap between reactivation potential and retirement, especially for stranded rigs.

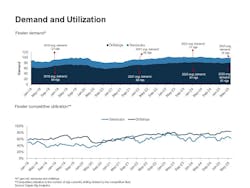

Demand and utilization

Demand trends clearly reflect a steady operator preference for drillships over semisubs, especially in regions like Brazil, West Africa, and the US Gulf. Originally, the semisub fleet supported presalt development in Brazil and early deepwater frontiers. But as drillships brought superior efficiency, greater storage capacity requiring less field support services, and higher specification capabilities, they quickly became the preferred choice.

This is very clear when analyzing demand and utilization for floaters since 2018. In 2018, global demand averaged 23 semisubs versus 64 drillships. By 2025, semisub demand has fallen 22%, averaging just 18 active rigs, while drillship demand has increased by 25%, now averaging 81 rigs globally. Semisub competitive utilization has hovered around 60% since the pandemic recovery, fluctuating with regional demand, while drillship utilization has remained stronger, in the low 80% range. Contracting activity for semisubs has also slowed, particularly as operator interest concentrates in high-spec rigs, as mentioned. West Africa and South America are selectively awarding work to newer rigs, leaving older sixth-generation international semisubs sidelined. The result is a two-speed market: one segment approaching full utilization, and another facing prolonged inactivity.

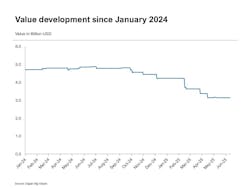

Fleet valuation

Valuations for sixth-generation international semisubs have fallen sharply since January 2024, driven by a weakening in the market and macroeconomic pressures.

Esgian Rig Values data shows that the total semisub fleet value has dropped from $4.7 billion in January 2024 to $3.1 billion as of June 2025. A 13% reduction in 2024 reflected growing white space and weaker floater demand, while an additional 26% cut so far in 2025 followed ongoing market uncertainty, new US tariffs, and OPEC-plus’s announcement of production increases. The average rig value now stands at $84 million, with cold-stacked rigs marked down by nearly 50%.

Rig values have always tracked market cycles closely, rising and falling with changes in demand, supply overhang, and macro shifts. But among floater categories, sixth-generation international semisubs have been more acutely impacted in this cycle. An aging fleet, reactivation costs, declining demand, a narrowing buyer base, and competition from newer or more regionally suited designs have all combined to push values down faster and further than for harsh-environment semisubs and drillships.

Looking ahead

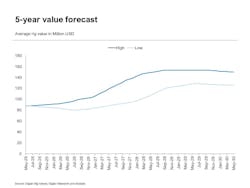

The short-term outlook remains cautious. Even though most of the market negativity has already been considered, Esgian forecasts a flat to slight value decline through late 2025, followed by a gradual recovery starting in late 2026. Values are expected to peak between $125 to $150 million by early 2029, assuming a tightening rig supply, sustained deepwater activity, and no major economic shocks. This marks a notable downward revision from the December 2024 forecast, highlighting how quickly sentiment can shift.

About the Author

Sofia Forestieri

Sofia Forestieri is a senior analyst at Esgian, specializing in offshore rig market analysis and energy economics. She has over seven years in the energy sector where she has in that time covered a diverse range of areas energy transition topics, economics modeling, rig market analysis and rig valuation, and energy sustainability issues. Forestieri previously held positions as an upstream Latin American analyst with Rystad Energy and senior field engineer-wireline with Schlumberger. She is also a member of Offshore's 2026 Editorial Advisory Board.

She can be reached at [email protected].