New mooring system enables safe deepwater tendering

By Christopher Beato

Haavard Strommen

Drillmar Inc.

Susan Peterson

Consultant

Robert Harrell

SparTEC Inc.

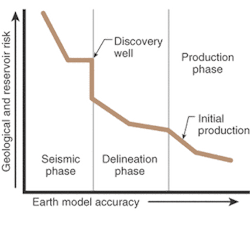

The risks associated with oil and gas fields are considerable, but no more so than those associated with the reser-voirs. There are three significant evalu-ation processes in the life of a field where knowledge is acquired to reduce these risks: seismic, exploration and delineation wells, and production performance analyses. This data is integrated to develop an accurate earth model of a field.

The ideal field development strategy provides early production information for the earth model without incremental cost and is sufficiently flexible to allow the more accurate model to improve the overall development plan. This lowers the reservoir risk and increases the value of the asset.

An economic risk analysis was conducted with this ideal development plan in mind. It compares a deepwater tender-assist strategy with the basic dry tree strategies being implemented today.

Dry tree alternatives

The drilling dry tree unit (DTU) strategy is based on a DTU that can accommodate a platform drilling rig. The rig is either part of the DTU or erected on the DTU after installation. The wellheads for the development wells are batch set on the seafloor by a mobile offshore drilling unit (MODU) while the DTU is under construction.

Once the DTU is installed and the rig is operational, the previously drilled delineation wells are tied back, re-entered, and completed, after which the remaining development wells are drilled and completed sequentially. First production can be achieved within 1,000 days of project sanctioning with the delivery of the DTU on the critical path of the project.

After the initial development, the platform drilling rig is maintained on the DTU and reactivated whenever its use is required for well intervention or future wells.

The pre-drilled field strategy enables the use of a smaller, low-cost DTU that can be constructed in 22 months. It requires the pre-drilling of all wells with a MODU while the DTU is being fabricated.

Once the DTU is installed over the pre-drilled wells, a completion rig is temporarily placed on the DTU. This rig is used to tie back, re-enter, and complete the pre-drilled wells. This strategy delivers first production 750 days from project sanctioning, assuming the wells can be pre-drilled in less time than the DTU can be constructed. During the life of the field, a self-erecting "rig of opportunity" is used for well interventions. Additional wells are drilled with a tender or a mobile drilling unit conducting an offset drilling operation during non-hurricane season.

The tender strategy uses the same DTU as the pre-drilled strategy. A MODU batch sets the wellheads for the development wells on the seafloor. A semisubmersible tender unit supports the installation of the DTU, after which the large construction crane on the tender erects a modular derrick equipment set (DES) on the DTU.

The DES, with capabilities similar to a fifth-generation semisubmersible, weighs less than a 1,000-hp workover rig and requires less than three days to install. The DES ties back and completes the previously drilled delineation wells to deliver first production less than 750 days from project sanctioning.

The remaining development wells are drilled and completed sequentially. As in the case of the pre-drilled strategy, a workover "rig of opportunity" is used to conduct well interventions. Future wells are drilled with either a tender or an offset MODU.

Drillmar's patented mooring technology makes the tender strategy possible. The passive mooring system synchronizes the low frequency movements of a semisubmersible vessel (tender) to a DTU (tension leg platform or Spar), maintaining their relative positions to provide an efficient and safe tender operation with a 99% operational up-time. Drillmar and SparTEC have completed engineering and model basin testing to prove the system's feasibility.1

Economic risk analysis

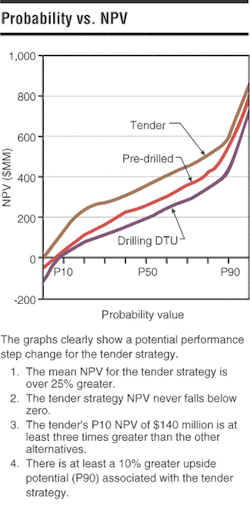

A stochastic analysis compared the three dry tree strategies. Assumptions are based on eight projects in the Gulf of Mexico verified through discussions with both major and independent operators. These assumptions can be reviewed following the conclusions of this article. To investigate sensitivity to project size, this analysis was conducted on projects ranging from four to 20 wells.

Most of the value in a typical oil and gas field is realized within the first five to seven years following project sanction. This is further emphasized in deepwater developments, where high initial capital expenditures are followed by high but quickly declining production flow-streams. This type of cash flow profile inherently creates significant risk.

A pragmatic and effective way to mitigate this risk is to minimize the cumulative negative cash flow, or out-of-pocket cash. The tender strategy reduces out-of-pocket cash for an eight-well project by at least $80 million, or 20%, while realizing a minimum 23% internal rate of return (IRR) improvement without sacrificing flexibility or capacity. This reduced investment is due to the cost savings associated with a production DTU as compared to a drilling DTU or the fact that all the wells must be pre-drilled at a 25% premium to implement the pre-drilled strategy.

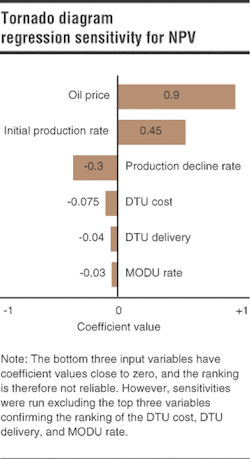

A tornado diagram clearly illustrates the dominant variables within the analysis. The coefficient values varied slightly between strategies, but average values were used to simplify this presentation.

The mean oil price assumed in the analysis is $16/bbl with a downside of $11/bbl. The potential advantage of the pre-drilling strategy is based on the acceleration of production, but risks much more cash to do so. As a result, this strategy is more oil price sensitive than the tender strategy.

Interestingly, this analysis indicates that oil price volatility has the potential to create negative value for both the pre-drilling and drilling DTU strategies but shows the tender strategy is able to protect its investment. This is primarily because the tender strategy requires 20% less out-of-pocket cash.

The initial production and decline rates are about as influential as the oil price when both factors were combined to represent well quality. Well quality is a function of placement in the reservoir (reservoir characteristics), completion design, equipment performance, and operational implementation.

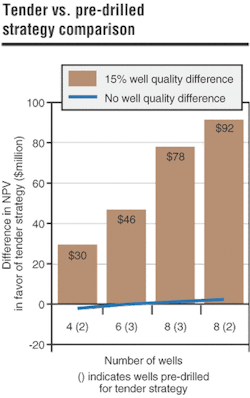

This analysis assumed that the DTU-drilled wells realized an average well quality improvement of 15% over pre-drilled wells. The following points justify this assumption:

- Production data integrated into a geological and reservoir earth model on an incremental basis influences subsequent reservoir locations. This increases the probability of the wells being placed through optimum reservoir take points on a 3D geometrical basis, which results in greater production rates and recovery factors per well

- Residual formation damage is reduced by immediately completing and producing the well after it has been drilled, minimizing the time that foreign fluids are exposed to the reservoir. Formation damage reduction is important even when wells are fracture gravel packed

- The learning curve associated with the optimization of the completion techniques used for a specific field can be climbed twice as fast when wells are drilled and completed sequentially. This is possible because lessons learned, which are based on production testing, can be applied from well to well.

This 15% well quality improvement benefits the tender and drilling DTU strategies by 2.5 MMBOE additional recovered per DTU-drilled well. Even ignoring well quality, the pre-drilled strategy would break even with the tender strategy on a net present value (NPV) basis but would still require $80 million more out-of-pocket investment for this eight-well case. It is also important to realize that this additional capital is invested before first production, when the reservoir risk is still quite high.

This analysis did not assess the value-added benefits available from dedicated completions systems provided through the tender operation. The potential completion quality improvement as a result of these dedicated systems could be significant.

The DTU cost and delivery schedule was the next most influential variable in the analysis. A 6,000-ton payload savings can be realized by both the tender and pre-drilled strategies for a nine-slot Spar DTU as compared to a Spar designed to accommodate a platform drilling rig. Estimates indicate that this payload reduction will decrease the cost of the DTU by at least $70 million.2

The simplicity of either the tender or pre-drilled strategies facilitates the potential to use an "off-the-shelf" standardized DTU design. This can further decrease the delivery cost, schedule, and construction risks associated with a project. These efficiencies have been proven over the last few years on several projects where standard design DTUs were delivered and installed in 22 months versus 30 plus months for a DTU with full drilling capabilities.

According to the tornado diagram, the MODU rate was not very influential. However, disregarding oil price, production rate, and decline rate, which are variables difficult to control, the MODU rate is one of the more important input variables. This is especially so for the pre-drilling strategy, which is more affected by a variance in MODU rate than the other strategies.

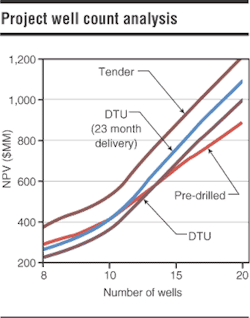

Project well count

As the number of wells increases in a project, the pre-drilling strategy becomes less competitive because the present value of this strategy's individual well cost is at least 25% greater. Additionally, first oil would be delayed for every well drilled after the ninth or tenth well. This delay is created because the DTU could be delivered in less time than it takes to pre-drill these additional wells, which places drilling on the critical path.

When comparing the platform drilling rig and tender operations, the difference in well cost is $1.7 million in favor of the platform rig. One would assume that the economics of the drilling DTU strategy improve relative to the tender as more wells are drilled. There should be a break-even point if enough additional wells are added.

This, however, is not the case because of the accelerated production associated with the tender strategy's shorter DTU delivery time. The accelerated cash flow more than makes up for the difference in well cost and actually results in a $4.5-million NPV increase per well for the tender strategy. If the shorter DTU delivery were ignored, the project well count would have to be over 50 wells (19 rig-years) for the drilling DTU strategy to break even with the tender strategy.

If the well count is less than eight, the pre-drilled strategy becomes more competitive, and the drilling DTU strategy becomes uneconomic. Even if well count is reduced to four, the tender strategy still provides potential upside due to well quality. This analysis confirms that even if improved well quality is not realized, the tender strategy has not detracted from the project NPV.

Future tender availability

Few deepwater semisubmersible tenders exist. Future tender availability could be considered a drawback compared to a DTU with a permanently installed rig. To quantify the potential incremental gain from the immediate rig availability associated with a dedicated platform rig, a scenario was investigated where a number of wells were drilled starting in the sixth year after first production.

It was assumed that the platform rig was kept in an operational ready condition at a leased standby rate equal to 60% of its oper- ating day rate. Alterna-tively, the rig could be purchased outright by the operator and managed by a contractor, but in most cases, this has proven to be a more expensive option. The analysis also assumed that the tender would arrive 18 months late to drill the additional wells, due to lack of availability. This analysis determined that 26 additional wells would have to be drilled for the drilling DTU strategy to break even with the tender strategy. This occurs because of the reduced out-of-pocket cash and cycle time associated with the tender strategy and the fact that the future drilled wells add less project value per barrel due to the time value of money.

Well intervention

The analysis also takes into account the effects of well intervention. It was assumed that rig interventions for both the tender and pre-drilled strategies would be conducted with a 1,000-hp self-erecting rig of opportunity. The drilling DTU strategy would use its drilling rig to conduct rig interventions. Due to the rig standby, maintenance, and management costs associated with the drilling DTU strategy, this option is always more expensive than the other alternatives, even on an incremental sunk-cost basis.

Nabors' dynamic rig conversion kits used to enable its seven Sundowner rigs to work on both Spars and TLPs on a call-out basis validate the rig of opportunity assumption made for the tender and pre-drilled strategies. This study confirmed that well intervention and production operating costs could almost be considered inconsequential in most dry tree scenarios as long as operational flexibility and alternatives are engineered into the development plan.3

Other operational elements have been analyzed with the result supporting the competitiveness of the tender strategy. These include: health, safety, and the environmental conditions; catastrophic risk reduction; logistics; and completion systems.

Conclusions

The tender strategy can realize a significant step in the way that deepwater fields are developed. The assumptions used within this analysis are believed to be conservative, and the overall outcome robust in the sense that manipulation of the variables does not change the results.

The tender strategy provides all of the advantages of a drilling DTU for the total cost of a pre-drilled "minimal" DTU development plan but with 20% less out-of-pocket investment. The advantages include:

- The tender strategy significantly reduces out-of-pocket cash

- The tender strategy improves the probability of delivering the highest quality wells possible due to improved well placement and completion strategies compared to the pre-drilled strategy

- The tender strategy facilitates the use of standard DTU designs, which lowers costs and accelerates production due to faster deliveries than are possible with an integrated platform rig

- Greater project well counts do not change the strategy selection

- Fewer project well counts do not place the tender strategy at a disadvantage but reduce the advantage compared to the pre-drilled strategy

- A delay in tender availability to drill additional wells during the later field life does degrade the value of the tender strategy, but not to a point where it ceases to provide significant economic advantage over the other strategies

- Well intervention and production operating costs typically do not influence the selection of a dry tree strategy.

On a sunk-cost basis, the potential disadvantage of the tender strategy is that the unit may not be immediately available to drill wells in the later life of a field. Mitigation of any potential loss of incremental value should occur through proper planning and contractual relationships.

This analysis is based on a Drillmar-designed tender unit drilling the tender strategy wells. This unit has the capacities and capabilities of a fifth-generation rig, including dedicated completion systems, tubular cassette handling systems, and offline horizontal stand (90 ft) building for drill pipe, bottom hole assembly, and casing. The multi-purpose unit capabilities allow it to operate with about $14,000/day less logistical and fluid maintenance spread costs than a platform rig operation. These operational advantages provide the basis for a conservative 10% performance improvement over a platform rig. Pre-drilled well costs were consistent for each of the strategies.

End Notes

- "Coupled tender mooring for Spar and TLP designs," C. Beato, Drillmar Inc.; David Tein (M), Donghui Chen (M), and Amit Katarya (AM), David Tein Consulting Engineers Ltd.; SNAME proceedings of the 11th Offshore Symposium, Houston, Texas, 2002.

- SparTEC technically verified the cost savings associated with a 6,000-ton payload reduction. A historical comparison of Spar and TLP actual delivery costs indicate that this estimate is conservative.

- "Deepwater Gulf of Mexico more profitable than previously thought," M. J.K. Craig, S.T. Hyde, Spirit Energy 76, Oil and Gas Journal, March 10, 1997.

Authors

Christopher Beato, P.E., is Vice President of Drillmar Inc. A graduate of the Colorado School of Mines, Beato has been involved with deepwater projects since 1987 as a member of Conoco's Jolliet TLWP development team. He can be contacted at (713) 221-1768 or [email protected].

Robert Harrell is General Manager for J. Ray McDermott's SparTEC Inc. A graduate of Georgia Institute of Technology and Harvard University, Harrell has been involved with engineering and delivery of offshore infrastructure for over 25 years, including six Spar developments. He can be contacted at (281) 870-5209 or [email protected].

Susan Peterson has 19 years of experience as a consultant, project manager, senior drilling engineer, and professor of petroleum engineering. As a consultant, she performs project-specific risk analysis and provides training on decision and risk analysis. Susan has PhD and MS degrees from Texas A&M University and a BS degree from Marietta College, all in petroleum engineering.

Haavard Strommen is Finance Manager for Drillmar Inc. Strommen holds a Sivilokonom degree from the Norwegian School of Economics and Business Administration and a Community of European Management Schools Master in Finance.