Industry gears up for new year filled with challenges, opportunities

John Westwood

Douglas-Westwood

We begin 2015 with the offshore industry facing difficult times – oversupply of oil leading to low oil prices; the challenges to offshore from US onshore shale production; oversupply of some types of drilling rigs; high industry costs; the impact of Macondo, and others. But at the same time progress is being made on a number of fronts and for some players this could also be a period of great opportunity.

Challenging times

We all need to remember, but often choose to forget, that the oil business is highly cyclical. There have been seven significant price cycles since 1970 and also a few minor ones between times, so yet another should come as no surprise. The real surprise is that no one ever seems to build the probability into their business planning!

The reasons for the fall in Brent crude prices from $115 in June to below $70 following November's OPEC meeting are well documented, as is the realization that Saudi Arabia is now defending market share, rather than a minimum price. That said, the nature of the oil and gas business in 2015 will be very different compared to that immediately after the 2008 financial crash.

Seventy percent of the additional oil production in recent years is unconventional. Much of this is from US shales and is not cheap oil, mostly needing prices of $60-80 to be commercially viable. What is more, well decline rates are rapid, and without ongoing drilling the current production capacity will be quickly eroded. By comparison, most deepwater production needs about $80 oil.

Cutting costs

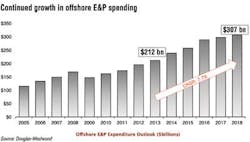

In the 13 years to the turn of the century, oil and gas exploration and production expenditures grew by 48%; between 2000 and 2013, expenditure growth was 287% as the industry supply chain was unable to meet demand for products and services. However, the increase in oil and gas production was a mere 24%, a situation that was clearly unsustainable.

The ensuing cut-back in oil company spending served to focus attention on project capital cost reduction and here progress is being made. In April, Total, Europe's third-largest oil company, cut the cost of its Kaombo project off Angola by about a fifth to $16 billion. Also great strides are being made in increasing the efficiency of drilling operations, which can form half the cost of many field developments. Baker Hughes, for example, has reported that by focusing on non-productive time, they saved some $10.4 million on a four-well project on the Terra Nova field offshore Newfoundland.

Rig oversupply

For the past two years, we have been warning about the potential for speculative building to result in oversupply in the mobile offshore rig market. The pattern is a familiar one across many sectors of the shipbuilding industry, from oil tankers to offshore vessels and rigs. As oil demand grows and prices increase, owners place orders – the first ones at low prices – but as yard capacity is taken up both build prices and delivery times increase. The early orders are delivered and owners sign contracts with the operators at lucrative day rates, but eventually deliveries exceed demand and day rates collapse – and as is presently the case – this sometimes coincides with an oil price downturn and investors get burnt. Time passes and eventually low oil prices boost oil demand, oil prices increase, drilling capacity is absorbed and so the cycle begins again.

In the case of drillships, unprecedented investment and supply additions will create a difficult market for the next five years. The current "order book to fleet ratio" is 61%. Of this, 44% is uncontracted!

New state-of-the-art rigs are needed to drill the deepwater presalt discoveries off Brazil and West Africa, and many units are coming onto the market. These will eventually be able to win contracts; but with growing oversupply, the question is at what day rate; and will we now see old units long past their sell-by date being retired?

Displaying 1/2 Page 1,2Next>

View Article as Single page