BOEM extends decommissioning requirements rule deadline

The Bureau of Ocean Energy Management (BOEM) has extended a deadline to implement more stringent financial assurance and risk management requirements to ensure that operators are able to pay for decommissioning and removal of offshore production facilities.

In an update issued on Jan. 6, BOEM agreed to delay implementation, originally set for last September, by another six months to provide the agency and the industry with an “opportunity to focus on providing additional security for sole liability properties, and to allow an opportunity for additional time and conversation, including with interested stakeholders, regarding issues that arise in the context of non-sole liability properties.”

Last July, the BOEM issued a final notice to lessees (NTL), which detailed procedures to determine an operator’s ability to carry out lease obligations in the offshore (NTL 2016-01). The directive updated decommissioning procedures for outer continental shelf (OCS) oil, gas or sulfur leases, primarily in the Gulf of Mexico (GoM), and guided whether a lessee should be required to pay more to guarantee financial assurance.

However, representatives of the US offshore oil and gas industry objected to the new rule, claiming the reforms were overly burdensome. The rule, according to industry experts, could force some smaller operators to sell their assets to companies better positioned to meet the significant costs of supplemental bonding. The rules also could influence investment decisions by larger producers, which might conclude that the US regulatory system to work offshore is too burdensome.

Industry trade groups representing US GoM producers and operators asked the BOEM in November for more clarity about why the financial assurance changes were made. A group of offshore producers also launched a coalition in November whose first order of business was to oppose the risk management regulations.

In its Jan. 6 announcement, the agency said that through its “continued engagement with industry, it has become apparent that navigating the multi-party business relationships that exist between co-lessees and predecessors-in-interest can prove challenging and time-consuming.” The agency recognized that because some properties may include several co-lessees and prior interest owners, “their existing financial arrangement may require assessing the extent to which these existing financial arrangements can be considered in determining whether BOEM needs additional security.”

The BOEM said that exceptions would be made if the agency determined there was a “substantial risk of nonperformance” for some decommissioning liabilities. Even with the delay, BOEM encouraged interest holders to continue to propose and negotiate “tailored plans” for financial assurance.

At the conclusion of its announcement, the agency said that: “Our goal is to ensure industry’s continued engagement in developing and implementing a risk management program that enables industry to meet its legal obligations and protects the American taxpayers from shouldering any liability for decommissioning the existing or future facilities on the OCS, while recognizing the industry’s current economic realities and concerns.”

Hess boosts budget for 2017

Hess Corp. has announced an 18% budget increase for E&P in 2017, including significant activity offshore Gulf of Mexico. The $2.25-billion budget is up from its actual spending in 2016 of $1.9 billion.

Hess is assigning $375 million primarily for production activities in the deepwater Gulf, including the drilling and completion of a production well at the Penn State field in which it has a 50% stake and is the operator.

And it is allocating $425 million to drill two wells and complete three wells, install a TLP and advance development of the Stampede field in the deepwater Gulf. It is expected to achieve first oil in 2018.

The upward trend contrasts with a year ago, when the company reduced its capital and exploratory spending budget by 40% following a reported $1.8-billion net loss in the final quarter of 2015.

W&T Offshore reports new findings at Mahogany field

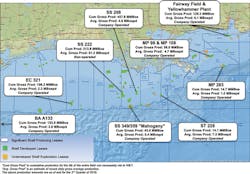

W&T Offshore, Inc. says that its Ship Shoal 359 A-18 well has logged 149 ft (45.4 m) of net oil pay in five zones, and extended the size and depth of the Mahogany field.

The SS 349 A-18 well was drilled on the western side of the Mahogany field to extend the productive limit of the ‘T’ sand, which was discovered in mid-2013 by the A-14 well. The A-18 well not only confirmed that the ‘T’ sand is present and oil bearing on the west side of the field, but it also logged and penetrated four additional attractive pay sands in addition to the main ‘T’ sand target.

After casing the ‘T’ sand, the company drilled an exploratory tail (about 950 ft/290 m deeper) beneath the main well target to test seismic reflectors imaged with its newest 3D seismic data, and discovered an additional pay interval in a deeper ‘U’ sand interval. W&T holds a 100% working interest in the Mahogany field.

Tracy Krohn, W&T Offshore’s chairman and CEO, said: “After pausing our Mahogany field development drilling program since early 2015 when commodity prices slipped, we are very pleased to have resumed drilling activity there to further unlock the significant potential of this huge field. We are benefitting from our recent analysis of our new WAZ seismic data over the field, which allows us to more clearly image the sub-salt formations and assess the additional upside of this field.”

With a number of development and low-risk exploration locations yet to be drilled, the Mahogany field is expected to be the cornerstone of our capital program in 2017 and possibly beyond, Krohn added. “Our focus on lowering drilling and operating costs in the Gulf of Mexico, combined with Mahogany’s outstanding reservoir characteristics and existing infrastructure on the shelf, delivers very compelling economic returns for our shareholders.”