Farm-outs down but drilling success rates higher, report claims

Offshore staff

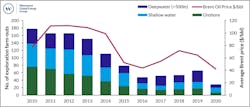

LONDON – Last year’s oil price dip and COVID-19 pandemic led to a 56% decrease in E&P farm-out deals compared to 2019, according to Westwood Global Energy Group.

The 29 exploration transactions completed represented the lowest of the past decade. Deepwater deals were down by 70%, with shallow water more resilient, only 24% lower, mainly due to agreements covering maturing and mature plays in northwest Europe.

Shell and Qatar Petroleum each completed three farm-ins, while Total and Equinor traded out equity in six and four deals, respectively.

On the other hand, the commercial success rate from farm-out drilling in 2020 represented a five-year high, at 38%, said Westwood senior analyst Vikesh Mistry.

Ten of the successes arose from the 26 wells that were drilled following equity transfers, the largest farm-out discovery being Maka Central-1 in block 58 offshore Suriname, where Total took a 50% stake from Apache.

Offshore the UK and Norway, the commercial success rate from farm-out wells in 2020 was 66%, compared with 46% for all wells drilled in those two countries.

In half of last year’s deals, the buyer paid no more than its proportional share of future costs.

The industry retains willingness to access drilling opportunities via farm-ins, Mistry claimed. Adding that there are plenty of opportunities for those keen on exploration.

04/22/2021