Rig contractor woes likely to worsen, consultancy claims

Offshore staff

LONDON – Westwood Global Energy Group has contacted various drilling rig owners on the likely repercussions of current market conditions.

According to the company’s RigLogix service, the consensus seems to be that things will likely get worse before they get better, especially if current conditions persist.

Operators are typically cutting planned 2020 capex by 20-30%, and the COVID-19 virus is impacting movements of personnel and equipment/services to and from rigs.

This all means the number of idle rigs will soon increase substantially. For rig owners, some of which were slowly inching their way back to profitability, the road to recovery will be longer, and some will be impacted more than others.

According to Terry Childs, head of RigLogix, many companies are having to face up to debt payments due in 2021. One major rig owner believes nearly every public driller will be in Chapter 11 this year or next.

Currently, rig operations in most parts of the world, where no travel bans or quarantines are in place, continue to be supported by rig owners, but with strict protocols in place concerning crews, equipment and supplies.

But more operators are saying they will shut down drilling soon and warm-stack the rig, with the impact caused by COVID-19 on logistics cited as the main problem. And should more countries end up adopting no-travel bans or lockdowns, this will only extend the line-up of idle rigs.

Less than a week ago, Childs said, there were only a handful of instances of rig contracts being either suspended or terminated. However, news is coming through now of a growing number of contracts in various parts of the world.

These range from shortening existing programs or contract suspensions to options not being exercised, even the start of force majeure declarations.

And there are reports of operators planning to shut down drilling operations once a casing point is reached.

With a Force Majeure, a rig usually goes on a reduced rate for a set number of days, often followed by a contract termination or a rate renegotiation. The declaration may apply not to sickness arising from COVID-19 but to rig downtime, due to the inability to get crews and/or supplies and equipment to and from the rig.

One contract apparently awarded last month for a semisubmersible to work offshore Norway has been withdrawn, although that has yet to be confirmed, Childs said.

Some operators have already decided not to exercise existing contract options in West Africa and the UAE. And for operators that do not have the financial resources to withstand sub-$30 oil brings, the decision to release a rig will be easy, Childs said.

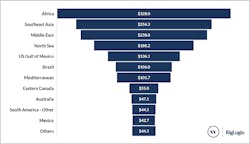

RigLogix’s data shows that Africa, Southeast Asia, and the Middle East have the highest dollar amounts at stake, and collectively comprise 50% of the total rig options value.

In Southeast Asia and the Middle East, the options are entirely related to jackup contracts, whereas the $136.1 million in the US Gulf of Mexico is mainly for floating rig options.

Valaris ($331 million) and Transocean ($195 million) are said to have the highest dollar amounts of options to be exercised and are therefore the most exposed.

Most of the nearly 300 drilling programs that currently have 2020 start dates will be delayed, Childs claimed. The planning process for certain drilling programs is continuing, but at a much slower pace.

Some contract awards should continue, particularly where drilling is not planned until 2021 or beyond, but it seems probable that the number of contracts finalized over the next few months will be minimal.

On the other hand, one contract has just been agreed for a short semi program in the North Sea, Childs said, so the situation is not entirely forlorn.

History tells us that eventually, the markets will recover but in the meantime, operators, rig owners and services companies will once again have to “hunker down” and ride out the storm, he concluded.

03/23/2020