Top 10 drilling rig contractors look forward to new year with cautious optimism

Newly merged entity Valaris ends 2019 with the largest fleet

Cinnamon Edralin, IHS Markit

The overall trend for offshore drilling rigs in 2019 was that of decreasing supply and increasing working count. This trend takes into account drillships, jackups, semisubmersibles, submersibles, and tender-assist units; as well as Arctic rigs and drill barges (but not inland barges).

In addition, the number of rigs under construction dropped substantially last year.

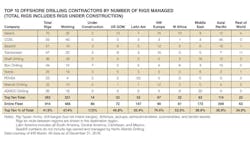

In terms of their managed fleets, the top 10 drilling contractors controlled approximately the same number of rigs in 2019 as in 2018 (383 vs. 389), but there have been some notable changes to the list.

The most prominent change is that 2018’s largest rig contractor by number of rigs is no longer Ensco. The top spot in 2019 was held by Valaris, the company formed by the April 2019 merger of Ensco and Rowan Companies. Despite some rigs being retired from the combined fleet, the overall result was a wider gap between the top two spots. In 2018, Ensco was in the top spot with 59 rigs, followed by Transocean with 56. For 2019, Valaris topped the chart with 70, followed by COSL with 55.

While the table continues to list three state-owned oil companies – China’s COSL, Venezuela’s PDVSA, and Abu Dhabi’s ADNOC Drilling – COSL grew its fleet by four rigs to 55 and moved from the fourth spot to the second. PDVSA remained in the eighth position, even after shedding six rigs to end the year with 23 units, and ADNOC Drilling stayed in tenth place with 20 rigs.

Only one rig cut steel in 2019

As mentioned, the global offshore rig supply decreased over the course of the year. The final rig count at the end of 2018 was 973. For 2019, the final total was 914. Early last year, IHS Markit changed the status on 14 legacy rigs that had been deemed ‘out-of-service’ for about a decade or longer to ‘retired,’ which eliminated them from the global supply. In addition, nine Sete-owned rigs that had been in the early stages of construction were cancelled early in the year. Another six units that never progressed beyond the early stages of construction were also removed from the database. Attrition, which includes retirement, scrapping, accidents, and conversion to non-drilling units (such as mobile offshore production units or accommodation units), accounted for 31 rigs that were removed from the global fleet. Conversely, only one rig was added to the under-construction count. An as-yet unnamed newbuild known in the IHS Markit database as Awilco Semi Tbn2 cut steel in November 2019. These changes bring us to the 2019 year-end supply of 914 rigs.

In contrast to the shrinking supply, the working count rose markedly from 2018, reflecting an increase of 55. This shows the strengthening of rig demand as the market ascends from the depths of the downturn that began in late 2014. Of the 466 units working at the end of 2019, not quite half (47.4%) were managed by the top 10 largest drilling contractors. While Valaris ended the year with the greatest number of rigs, it was actually the second-largest rig contractor, COSL, that has the most units working, besting Valaris by 10 with 45. This trend of an increasing working rig count is expected to continue in 2020.

Northwest Europe market

The region most dominated by the largest contractors is Northwest Europe, where they control 74.4% of the fleet. Valaris and Transocean are the most represented rig contractors in the region with 15 units each. Due to harsh-environment conditions, higher-specification rigs are needed to work in the region. The additional capital expenditure to build North Sea-capable rigs means contractors also demand higher day rates than for rigs working in benign regions. Furthermore, Norway has one of the strictest safety and technical regimes in the world and requires rigs working in its waters to obtain an Acknowledgement of Compliance certification. Rigs that work in Norwegian waters generally claim the highest day rate benchmarks. The desirability of these higher day rates and contractors’ existing technical expertise in this market means that drillers continue to maintain and add to their North Sea fleets, which is why we see such a concentration of the top 10 contractors in this region.

Turning to West Africa, the top 10 contractors manage 52.5% of the fleet, representing only a slight increase from 52.2% last year. However, both the number of rigs managed by the top 10 and the entire fleet count fell from last year, by three and six rigs, respectively. Rig demand is expected to pick up a bit this year, but because of the large number of stacked rigs already in the region, the fleet size is not likely to grow and may actually shrink by the end of this year if some of those stacked rigs pick up work in other regions.

In the US Gulf, 45.8% of the region’s rigs were managed by the top 10 contractors last year. This was concentrated among only five of the 10, meaning a full half of the top 10 do not have any rigs in the region. With the new year barely started, the number of top 10 contractors with rigs in the US Gulf has already dropped to four. The sole Maersk rig in the region, which had been undergoing contract preparations, departed for Latin America, where it has an upcoming job in Mexico that is due to start later this quarter.

Despite this, the US Gulf is a region to watch in 2020. During the downturn, the floating rig supply shrank from a high of 63 in January 2015 to a low of 33 between February and April 2019 before slowly starting to creep up. Out of the year-end 2019 supply of 35, the marketed supply was 27. As a few new jobs are expected to commence early this year, the marketed utilization rate is quickly nearing 100%. Market sources indicate that a few rig contractors are keeping an eye on the region, and are waiting to see whether adding floating rig capacity would be worth their while, should demand continue to increase.

The Asia/Pacific region experienced the greatest drop in supply from year-end 2018 to year-end 2019, falling from 351 to 309. This is partly a result of several rigs that had been stranded at shipyards either after delivery or just prior to delivery finding work in various parts of the world. In particular, the Middle East and Mexico took on several newbuild jackups from Asian yards. This is evidenced by the initial appearance of Borr Drilling in the Latin America region. Borr now has five jackups in Latin America, all in Mexico. Four of these are for their inaugural jobs, only one of which was delivered in 2019, while two were delivered in 2018 and one in 2017. The fifth unit was mobilized from Southeast Asia. It had been delivered in 2013 and had a job prior to its stint in Mexico. Additional newbuilds are expected to depart the Asia/Pacific region in 2020, and demand is expected to pick up in the region, particularly for jackups; meaning we should once again see a noticeable change in the region’s numbers at the end of this year.

In Latin America, the top 10 contractors bumped up their presence by one rig from 2018. The drop in the regional fleet supply from 150 to 147 aided in raising the coverage by the top 10 to 35.4%. Latin America has several small, local rig contractors, who tend to have the advantage over foreign companies when it comes to winning rig jobs in the region. We expect to see more participation from outside rig contractors in 2020, as many of the local contractors have gotten their rigs back to work and have limited-to-no availability for upcoming programs. In particular, foreign rig contractors are expected to start picking up more floater contracts in Brazil and more jackup contracts in Mexico.

Besides these opportunities, as more deepwater exploration programs get under way in Mexico, we anticipate that floating rigs will move back and forth between Mexico and the US Gulf with increasing frequency until the projects reach the development phase at which point, operators will require rigs for longer-term campaigns.

In the Middle East, the top 10 contractors lost a bit of traction in 2019, dropping from managing 39.7% of the fleet at the end of 2018 to 36.6% by the end of last year. While none of the top 10 increased its presence in the region, a few companies held their rig counts steady, namely local contractor ADNOC Drilling, as well as Seadrill, Noble, and Borr. Demand is forecasted to increase this year, and the region is expected to be a key absorber of newbuild jackups that come out of the yard this year, as it was in 2019. Out of the 22 jackups that mobilized into the Middle East last year, 15 of them were for their inaugural jobs following construction.

Offshore drilling rig contractors continued to build their presence in smaller markets as well. The ‘Rest of the World’ category on the table accompanying this article shows the top 10 drillers held 34.9% of those sectors last year. This is an increase from 32.8% at the end of 2018. The total number of rigs managed by the top 10 rose by one, while the fleet decreased by one. Transocean beefed up its presence in the smaller markets by two rigs, and Shelf Drilling added one, while Noble dropped two rigs.

Getting back to work

Despite the global increase in demand – the year-end working count for 2019 was up by 51 over year-end 2018 – the market is still oversupplied. In all, 270 rigs were stacked at the end of 2019. The US Gulf was the region with the largest number of hot-, warm-, and cold-stacked rigs totaling 41. Southeast Asia followed with 38, then South America with 37. Some of the hot- and warm-stacked units already have contracts in hand with start dates in 2020. But many of the idle rigs, in particular the cold-stacked units, have not worked in years and are unlikely to return to active drilling. However, they continue to count toward the global fleet.

For 2020, IHS Markit expects to continue to see some delivery dates pushed forward for some jackups, semis, and drillships that are still under construction. However, many deliveries will take place as operators continue to show a preference for newer equipment with more safety features. Lingering financial issues such as high debt levels at many rig contractors and decreased access to global financing dollars likely means more rigs will change hands this year, whether through mergers/acquisitions or post-bankruptcy auctions. And finally, after putting some projects on hold for years, pent-up demand should continue to boost the working rig count over the course of 2020. •