Brazil, Guyana boosting offshore drilling services revival

Offshore staff

LONDON – Drilling activity has picked up globally during the first half of 2019, according to Westwood Global Energy Group, helped by the Brent oil price remaining above $60/bbl since February.

Various large-scale offshore projects have passed final investment decisions, with significant drilling and well services (DWS) costs, such as Mero 2 off Brazil, North Field South Expansion off Qatar, and the Mozambique LNG project.

And several E&P companies have revealed ambitious, longer-term investment plans, which should further sustain the DWS market between now and 2023.

Overall, Westwood expects further modest improvement, with stronger growth rates in the coming years.

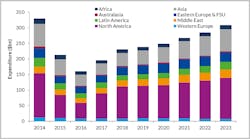

The 2Q 2019 edition of the company’s World Drilling & Well Services Expenditure Market Forecast predicts total expenditure over 2019-2023 of $1.3 trillion, 19% up on 2014-2018, with the US, China, and Russia accounting for 63% of the global DWS spend.

But Latin America too should grow strongly. Offshore, the emergence of Guyana and the development of various large discoveries in the Stabroek block should boost DWS spend significantly. During 2019-2023 Westwood expects more than 60 subsea wells to be drilled in the country.

At the same time, a resurgent Brazil will see more than 200 subsea wells drilled, making the region the largest for these type of wells which are typically high cost, particularly in the presalt region.

However, significant oversupply remains an issue for many DWS service lines and this, combined with strict capital discipline by operators, has held pricing down, Westwood said.

07/02/2019