Norway’s drilling future may hinge on high-impact wells

Offshore staff

ABERDEEN, UK – Norway’s exploration performance has declined markedly over the past five years, according to consultant Westwood, as the quality of the prospect portfolio has deteriorated.

Results from high-impact drilling planned over the remainder of this year could prove critical to the country’s ability to sustain exploration into the future.

Westwood’s Norway Exploration Performance 2014-2018 report concluded that activity levels and returns were down markedly compared to the previous five years.

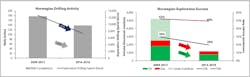

The number of exploration wells completed fell by around a quarter, and discovered commercial volumes were down by more than 50%, even taking into account volumes from Johan Sverdrup in the North Sea.

Commercial success rates (CSR) fell from 30% to 20%, but technical success rates (TSR) only dropped slightly from 52% to 49%. According to Emma Cruickshank, Head of Northwest Europe at Westwood, this reflects the lesser quality of the pool of prospects being drilled as the proven plays continue to mature.

Norway’s annual exploration well count in Norway has remained steady at 21-22/yr since 2016, down from 39 in 2014. Over the past five years, the industry spent $7.3 billion drilling 138 wells to find 1.2 Bboe of commercial oil and gas with an average discovery size of 44 MMboe and a pre-tax drilling finding cost of $6.1/boe.

Fewer than half of the discoveries were deemed commercial, and of the 27 finds that were commercial on the shelf during the last five years, only three were greater than 100 MMboe.

The northern North Sea Middle Jurassic play was the most prolific in terms of discovered commercial hydrocarbons and CSR, but the average discovery size was small.

At the same time, there are a growing proportion of exploration targets with stratigraphic trapping elements offshore Norway as fewer traditional fault block prospects remain undrilled.

The Barents Sea is not delivering the returns expected. While the TSR is high, Cruickshank said, the CSR is the lowest of the Norwegian basins due to the high minimum threshold for an economic field size. However, interest in the region remains high because of the potential prizes on offer.

Across the Norwegian shelf, M&A activity has been consistently high, consolidating the number of active players. As a result of mergers, divestments or acquisitions, 16 of the 33 most active players of the past five years are no longer active.

This year, Westwood foresees 15 high impact wells, up 67% from 2018. Results so far have been disappointing, although several significant wells are yet to spud.

06/07/2019