Eldon Ball • Houston

Several times a year, representatives of Deutsche Bank venture into the enigma that is Washington, D.C., to interview senators, congressmen, lobbyists, and the usual suspects regarding the current and probable future of the U.S. oil industry. Paul Sankey of Deutsche Bank then prepares an analysis for the bank’s clients.

We value them for the fresh point of view compared to their US counterparts. The latest is no exception, as we’ll illustrate in a moment.

But first we jump ahead to yet another analysis, also by Deutsche Bank – again regarding US oils – in which is buried unobtrusively a forecast for $120/bbl oil by 2012. Lest you miss the full impact of that prediction, we remind you that 2012 is next year.

That figure -- $120/bbl – is not so surprising now, in light of the protests occurring in North Africa and the Middle East, but remember that it was made weeks before any of those events occurred. It is based not on an anticipated disruption of supply, which may or may not happen, but on change in the supply-demand balance based on evolving economic conditions. If supply disruptions occur – and that seems a real possibility – then the effect on oil prices will be much more dramatic, though possibly short term.

Train wrecks and sharks

A full discussion on how Mr. Sankey reaches that price lies ahead in this column, but first, let’s look at what the bank researches found in Washington:

“In the bewildering frenzy of Washington, DC, politics,” they write, “you meet lobbyists, staffers, lawyers, and journalists who have huge areas of ground to cover, and not enough time. To simplify the point, they get vivid with metaphors. Without irony, happy post-election Republicans refer to “sunshine as the best disinfectant” in reference to the EPA. EPA regulation, the GOP/industry claims, is a “train-wreck,” and they show you a spaghetti regulation map (the EPA shows the same map, but with just three stops).

“The Democrats’ concession on offshore drilling weeks beforeDeepwater Horizon is described as ‘a child reaching for the cookie of an Energy Bill, and putting their hand on the burner.’ They won’t reach for the offshore drilling cookie again for a while…And so it continues. The metaphors are clear, but the conclusions are…we came away with little other than deepwater drilling in the Gulf of Mexico is massively delayed, beyond any previous thoughts.”

Deepwater delays

Note that their final and only clear conclusion was that deepwater drilling in the Gulf of Mexico “is massively delayed, beyond any previous thoughts.”

But if $120 oil is sailing into view on the horizon – and Deutsche Bank believes it is – can a return of offshore drilling be far behind? The answer is obviously in favor of increased drilling, since $120/bbl oil would translate into about $4/gal gasoline, which in turn would generate enormous public pressure to increase supply.

The question then becomes, how likely is $120 oil?

To answer that, consider how Mr. Sankey reached $120 as a near-term price (and incidentally, the “point of destruction” for US oil demand).

The report posits three developing market phases that will move to tighten supply:

- A drawdown of oil inventories at sea (held in tankers when prices and demand were lower)

- A drawdown of OECD inventories – a process that started in 3Q 2010

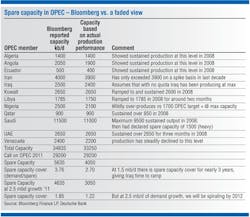

- A work-through of OPEC spare capacity until global demand growth equals OPEC spare Capacity (see accompanying table).

At that point, supply and demand would be in balance, but demand would still be growing.

Demand growth

Deutsche Bank expects global demand growth to come from countries that are coming off such a low base of oil demand with such high levels of GDP growth that oil demand strength is secular and largely unaffected by price – or from countries with subsidized oil product prices (Middle East, Latin America).

That explains the increase in demand, but what about working through OPEC spare capacity. That is, what is OPEC spare capacity?

“We have a less optimistic view of OPEC spare capacity, which we believe should reflect lower Nigerian, Venezuelan, and Iranian capacity than is quoted by Bloomberg,” Deutsche Bank explains. Indeed, their estimate is at 4 MMb/d of oil, compared to the Bloomberg estimate of 5.63 MMb/d.

“If we take the Bloomberg view of markets,” the report states, “we start with around 5.5 MMb/d of spare capacity. If we then view that spare capacity against global demand growth of around 1.5 MMb/d, which is more-or-less consensus (albeit under upward pressure) we have sufficient spare capacity cover to last us through 2014, even without Iraq growth. And by that year, we expect Iraq to be adding material barrels.

“But our view is that the real spare capacity number is closer to just 4 MMb/d and real demand is closer to 2.5 MMb/d, which leaves us out of spare capacity cover by mid-2012, before Iraq has had time to make a difference.

Of course, the Deutsche Bank scenario, although quite plausible, is only one of many. If supply disruptions occur -- and by the time you read this column they may already have -- then forecasts for $150/bbl and $5/gal gasoline in the US are not unlikely. If so, the price scenario Deutsche Bank put on paper a few weeks ago becomes even more intriguing.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com