Subsea suppliers must boost workforce to confront looming capacity concerns

By Marit Lenes, Rystad Energy

Concerns are mounting about the ability of subsea tree suppliers to deliver on their project commitments and scale up the size of their workforce to meet the recent surge in demand, analysis by Rystad Energy shows. To avoid this looming problem, key suppliers have significantly ramped up production and streamlined their facilities, with supplier revenue surging and workforce numbers at manufacturing sites rising. Despite these efforts, concerns persist that supplier capacity may face significant constraints, endangering the likelihood of bringing several major projects online and on schedule.

The subsea tree market has experienced steady growth since the industry downturn in 2020, with projections indicating continued expansion through 2027. Subsea tree awards have increased remarkably over the past four years, reflecting an impressive 10% compound annual growth rate (CAGR) globally. South America has led this surge, securing more than 40% of the total awards between 2020 and 2024, followed by Europe and Africa. More than 1,000 subsea trees were awarded by the end of last year, with 216 of these in 2024 alone.

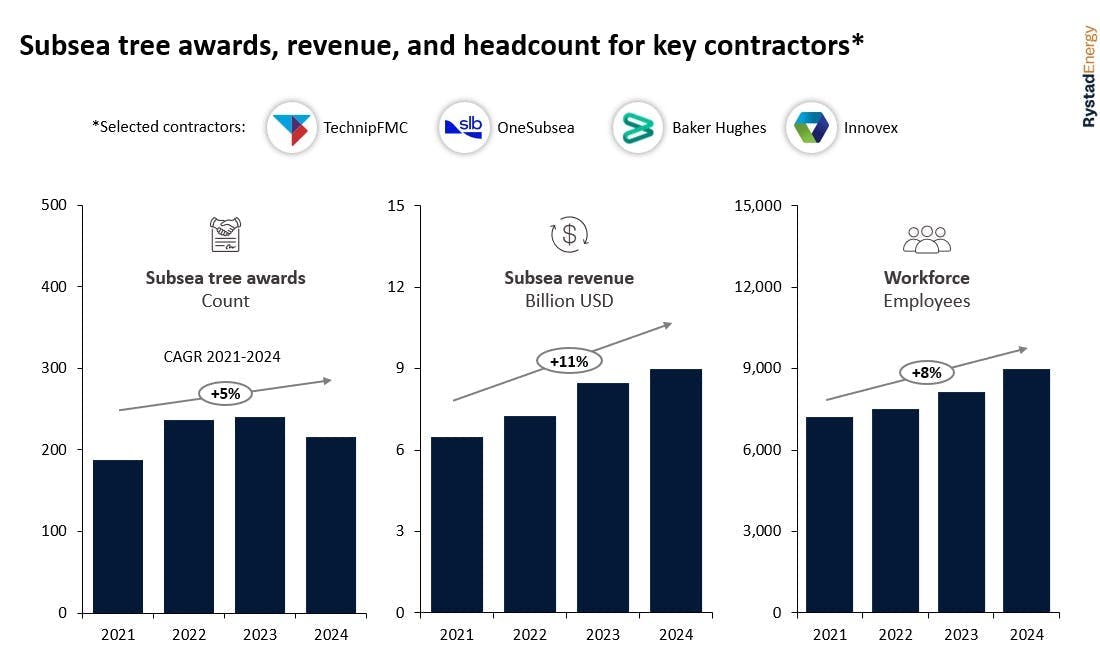

OneSubsea and TechnipFMC have been the dominant suppliers of subsea trees since 2020, followed by Baker Hughes and Innovex (formerly Dril-Quip). OneSubsea benefited from Petrobras’ developments in Brazil, while TechnipFMC has counted on ExxonMobil’s greenfield projects in Guyana to fill its backlog. TechnipFMC accounted for 65% of subsea trees awarded last year with Greater Turbot in Guyana and TotalEnergies’ GranMorgu project in Suriname.

The surge in awards since 2020 has led to a corresponding increase in supplier revenue related to subsea engineering and equipment services. Subsea revenue for the four leading contractors has grown at a CAGR of +11%, rising from $6 billion in 2021 to almost $9 billion in 2024 (Figure 1). In response, suppliers have expanded production capacities and increased their workforce. The industry's total employment in 2024 has grown by 24% since 2021, representing a CAGR of nearly 8%. Notably, all key suppliers have increased their workforce by more than 20% in the past three years, reflecting the substantial growth during this period.

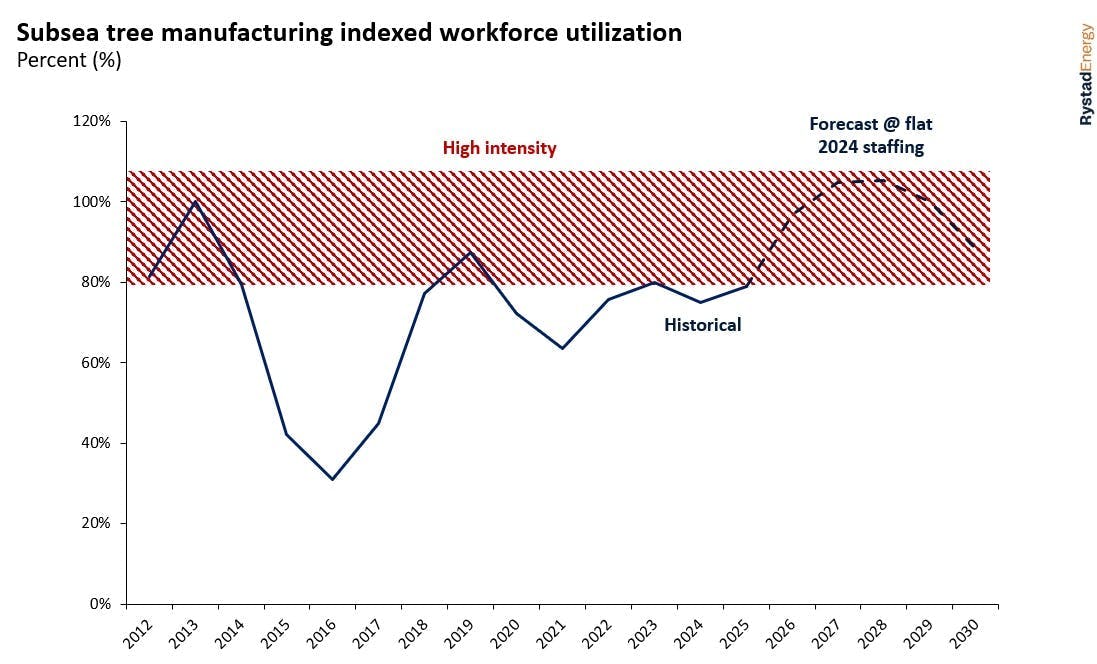

Even so, the headcount growth witnessed over the last few years is likely not enough to meet an expected increase in awards. Suppliers must continue to expand capacity to prevent the bottlenecks that impacted the subsea market 12 years ago. After the peak in 2013, the utilization rate dropped significantly through 2016 because of declining awards (Figure 2). However, it began to steadily increase in 2019 as awards began to recover. Since then, the rate has remained relatively stable, maintaining a high and consistent level. If the workforce remains at last year’s levels, the market will likely face capacity constraints due to an anticipated surge in subsea contracting. To mitigate this risk, a further increase in workforce capacity is expected to help manage utilization rates, keeping them below the capacity limit and mitigating bottlenecks.

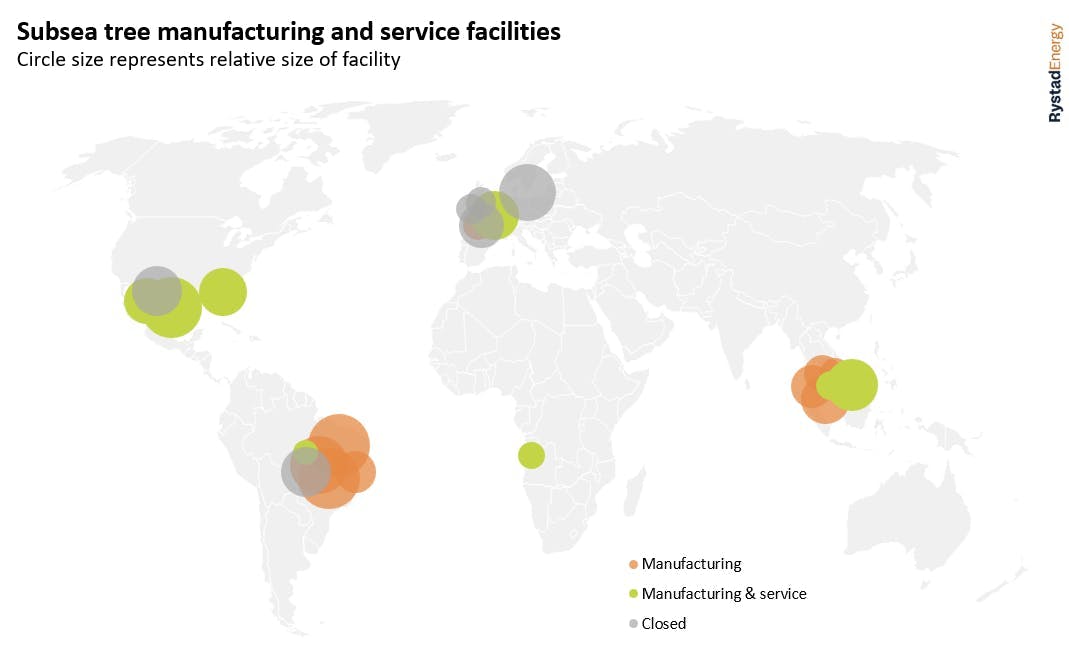

To better respond to this steady growth in awarded contracts and maintain capital discipline, production facilities have been optimizing manufacturing in recent years with a focus on streamlining operations. Overall capacity has been centralized into fewer, more productive facilities with a more concentrated workforce. This trend has gradually developed since 2016, marked by the closure of some facilities and expansion of others (Figure 3). Domestic centralization may be driven in part by local content requirements, which aim to boost in-country employment and manufacturing. TechnipFMC migrated its Houston manufacturing and service center in 2016 to a newly built company campus.

The company has concentrated workers and increased capacity at other key facilities, including Rio de Janeiro (Brazil), Nusajaya (Malaysia) and Dunfermline (UK). Each of these facilities expanded staffing by between 20% and 40% in 2024 compared to 2021. Baker Hughes has followed a similar strategic streamlining approach in Brazil recently by relocating production from its Jandira facility near Sao Paulo to the port city of Macae. Baker Hughes has also significantly expanded its manufacturing workforce in Asia, North America and Europe, notably at its Batam facility in Indonesia, where the workforce has seen an estimated 40% increase between 2021 and last year.

OneSubsea has also had a notable impact on streamlining production efforts. Aker Solutions’ closure of its Tranby manufacturing facility outside Oslo in 2021 was followed by a significant headcount increase at its Port Klang facility in Malaysia and the Sao Jose dos Pinhais facility in Brazil. Greater integration between OneSubsea and former Aker Solutions operations will likely lead to further consolidation of operations into fewer, more efficient regional plants. In terms of production consolidation in Malaysia, it could be a strategic opportunity for OneSubsea to transfer capacity from Port Klang to its facility in Johor, which is currently the largest in terms of workforce, solidifying its position as a hub.

About the Author

Marit Lenes

Marit Lenes is a supply chain analyst with Rystad Energy, specializing in the subsea market with a focus on the supply and demand of subsea equipment, SURF and subsea services. She holds a master's degree in engineering and ICT, with a specialization in petroleum geosciences and engineering, from the Norwegian University of Science and Technology.