UK well P&A execution rates not matching demand

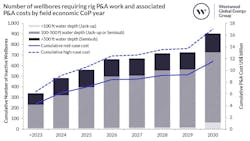

Westwood Global Energy Group has identified 483 wellbores at fields in UK waters requiring rig-based P&A activities at the end of last year.

Based on benchmarking by the UK’s North Sea Transition Authority (NSTA), this amounts to mid-case P&A durations totaling 70 years of P&A work, said Yvonne Telford, director Northwest Europe E&P at Westwood.

The NSTA is pushing for P&A to be completed within two years of a field’s Cessation of Production (CoP) or a maximum of five.

But 73 of the identified wellbores have had well P&A work outstanding for more than 10 years, Westwood found.

By the end of 2030, a further 420 wellbores will likely be added to the pool requiring rigs, representing a further 61 years of activity.

Theoretically, that should sustain rig day rates in the near to mid-term for jackups and semisubs. However, P&A execution rates are at present not keeping up with demand, and only a small number of rig P&A contracts are currently being issued.

Of the eight semisubs and 14 jackups based in the UK at the moment, four are engaged in P&A while three others (two semisubs and one jackup) are stacked. Other rigs in the pool could be relocated elsewhere for contracts or be retired, which would restrict the future supply capability for the UK’s P&A needs and serve to push up rig day rates and supply chain costs.

P&A costs for wells set to become inactive by the end of 2030 could increase to $5.5 billion, Westwood claims, due to cost inflation and potential execution inefficiencies.

While the P&A workload is sufficient to keep available rigs and the associated services sector occupied through the mid-2030s in the UK, contract awards are not aligning with available work, Telford added.

And if operators continue to defer P&A programs, the uncertainty this creates for the supply chain increases, with a detrimental impact on efficient delivery of decommissioning targets in the UK.