What is decommissioning?

Decommissioning involves addressing infrastructure that is no longer required in a timely, safe and environmentally responsible manner. This can include full removal of structure or other alternatives.

*Definition by Woodside

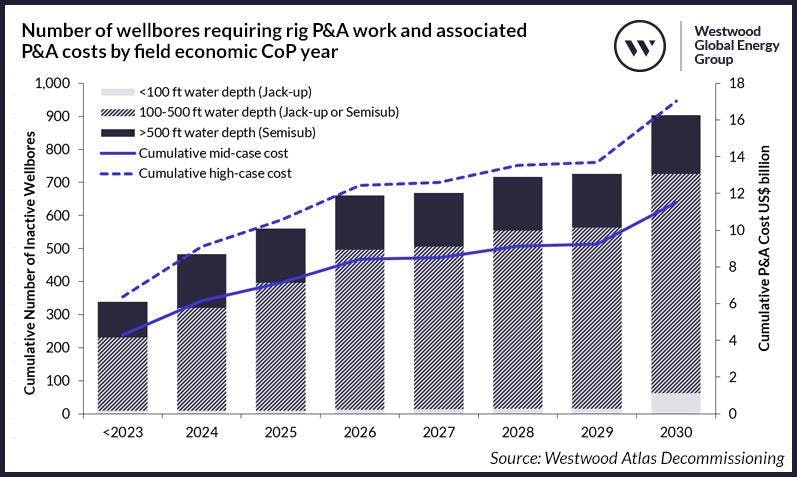

Decommissioning operations across the UK North Sea region could cost $26 billion over the next decade, according to Westwood Global Energy Group.

Well plug and abandonment (P&A) activity looks set to account for roughly 50% of the overall costs.

However, while the decommissioning workload is increasing, contract awards are lagging, particularly for rigs. Deferring work scopes, the consultants claim, could constrain the supply chain’s capacity to manage programs; if the delays persist and rig availability tightens, well P&A costs could soar by up to $5.5 billion, due to rising offshore rig day rates.

That would increase the financial liabilities for both operators and the UK government, which provides tax relief on decommissioning expenditure.

Yvonne Telford, research director with Westwood, said, “Based on current investment plans, up to 40% of UK fields could cease production before 2030. With the impact of decommissioning tax liabilities on abandonment expenditure, cost-effective P&A must be paramount.

Woodside exec: 'Emerging opportunities in decommissioning'

Meanwhile, Woodside Energy spent more than $800 million last year on decommissioning activities globally, according to Liz Westcott, Woodside's executive vice president and COO, during a speech earlier today at the Energy Exchange Australia Perth Convention and Exhibition Centre.

Much of the cost was incurred at the company’s campaigns offshore the northwest of Western Australia.

“Across our portfolio,” Westcott added, “there are emerging opportunities in decommissioning…

“Annual spend of that magnitude is right up there with what would be spent on a major development. This will see the removal of more than 350 km of rigid pipe, flexible flowlines and umbilicals, the plugging and abandonment of redundant wells and the recovery of a range of other subsea infrastructure. We estimate more than 35,000 mt of equipment will be removed, with the vast majority of this—approximately 95%—being recycled or reused.”

Woodside is sending most of the materials recovered from its decommissioning programs to other countries for handling, but it is looking to develop a recycling industry in Australia with local suppliers and contractors.

“We are working with a small number of international contractors who bring experience, technical expertise and the specialist offshore vessels required for our offshore decommissioning scopes. We have also engaged a range of Australian businesses, many with experience supporting defence, mining and refinery disposal," Westcott said. “Companies such as AusDecom, Birdon, C.D. Dodd, McMahon and RPA are playing leading roles in our onshore disposal scopes, adapting established processes and pathways to support the unique requirements of the oil and gas industry.”

Want more content like this?

Check out the Decommissioning section of Offshore's website for more news and insights about P&A technologies and services, platform/rig/wellhead removal projects, and dismantling and recycling operations.

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.