Models describe BSEE deepwater decommissioning cost estimates

Editor's note: This feature article first appeared in the January-February 2024 issue of Offshore magazine. Click here to view the full issue.

By Mark J. Kaiser, Louisiana State University

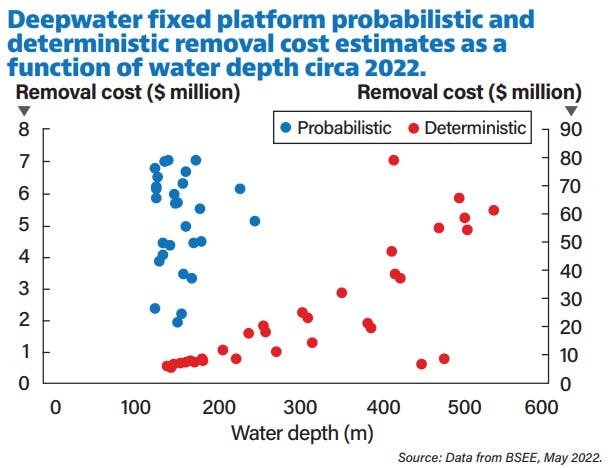

BSEE estimates platform decommissioning cost in the US Gulf of Mexico in water depth 122-250 meters at $4.8 million, about twice as expensive as removals in the 61-122 m water depth range. For platforms residing in 250-500 m water depth, cost estimates range from $10-80 million.

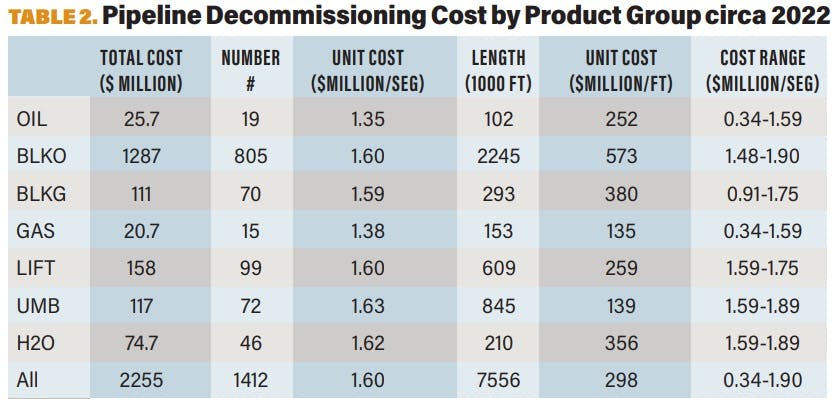

For pipeline decommissioning, a unit cost of approximately $1.6 million per pipeline segment is applied for bulk oil, bulk gas, lift, umbilical and water product classes, and $1.35 million per segment for oil and gas product classes. In part 3 of this article series, we examine decommissioning costs for fixed platforms and deepwater pipelines in the US Gulf of Mexico.

Decommissioning options

Shallow-water fixed platform decommissioning typically follows a complete removal procedure, removing the platform and scrapping the deck and jacket in a shipyard, or removing the deck and reefing the jacket in a designated reefing location.

In deepwater, fixed platforms and compliant towers are large heavy structures and all decommissioning options are evaluated for engineering and economic feasibility, including toppling-in-place. Most floaters will require complete removal but opportunities for reefing may be available.

A pipeline may be abandoned in place if it does not constitute a hazard to navigation, commercial fishing operations, or unduly interferes with other users.

Pipelines abandoned in place need to be flushed, filled with seawater, and plugged with the ends buried at least three feet below the mudline, typically under sand bags or concrete type mats.

Umbilical lines and flowlines are flushed and different vessel spreads are utilized depending on water depth, length and market conditions at the time of the operation, and unlike export pipelines, umbilicals and flowlines are expected to be completely removed from the seabed.

Fixed platforms: probabilistic cost estimates

From 2016-2021, eight fixed platforms, one compliant tower, two floaters, and several pipeline segments were decommissioned in the US Gulf of Mexico in water depth greater than 400 ft (122 m).

For fixed platforms in the ‘shallow’ deepwater (122-200 m water depth), BSEE estimated the decommissioning cost for 29 fixed platforms (FPs) using probabilistic methods. Total removal cost was reported at $149 million, or $5.1 million/FP.

All the structures reside within water depth <200 m and have estimated removal cost less than $8 million per structure. About half the structures are classified as major and manned.

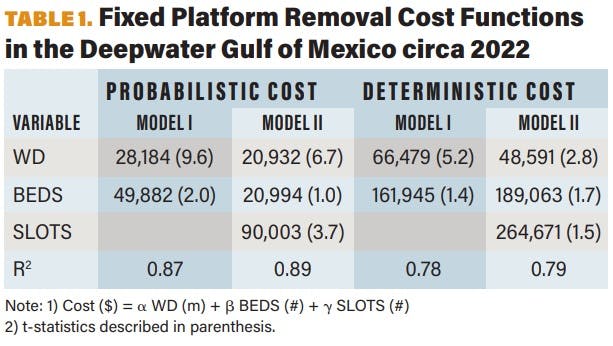

Correlating FP removal cost with water depth yields a robust correspondence for these probabilistic estimates:

FP Cost (Probabilistic) = 32,402 WD

where FP removal cost is reported in dollars and water depth WD is in meters. Model fit R2 = 0.89. The probabilistic estimates represent median (P50) values.

The cost function for the probabilistic one-variable estimate is robust and significant. Regression models that employ bed count and/or well slots as a proxy for structure complexity and/or size splits out the cost between factors but does not otherwise improve the model fit.

Note that as new attributes are added to the model, the water depth coefficient decreases [from 32,402/m to 28,184/m (one attribute) to 20,932/m (two attributes)] since the elements enter as positive variables.

The cost functions depicted are expected to represent the cost data reported by operators with a reasonable degree of accuracy; the cost functions are also expected to reflect the cost estimation algorithms employed by BSEE.

Fixed platforms: deterministic cost estimates

There are 34 FPs and 2 compliant towers (CTs) in the deepwater Gulf of Mexico where deterministic estimates were performed at a total reported cost of $843 million, or $21.4 million/FP and $59 million/CT.

Most of the platforms reside in water depth between 200-500 m and have decommissioning cost that range from $10 million up to $80 million (Figure 1).

Deterministic costs are performed when operator-reported cost data is not adequate to perform a reliable statistical assessment. In such cases, work decomposition methods or a simple average/median cost estimate are applied.

Work decomposition methods are a formal hypothetical approach performed by breaking down operations into several tasks and then estimating the time and cost of each task to arrive at an estimate.

Work decomposition methods are similar to AFE (authorization for expenditure) estimates made by engineers for well drilling and related project development cost, and are a standard and accepted approach in industry, but when performed over a large and diverse collection of assets special care needs to be made in providing reliable assessments.

Excluding three data points from the sample because of their exceptional nature (for reasons described below), a water depth correspondence yields a robust relation with a slope coefficient about two-and-a-half times larger than the probabilistic relation:

FP Cost (Deterministic) = 85,141 WD,

where FP removal cost is reported in dollars and water depth WD in meters. Model fit R2 = 0.80.

Again, since bed count and well slots are positive variables, if these attributes are used in the model the water depth unit cost will necessarily decrease with each new attribute [from $85,141/m to $66,479/m (one attribute) to $48,591/m (two attributes)].

Three platforms with individual removal cost >$100 million each were excluded from the evaluation: Bullwinkle (23552) in GC65 in 429 m, Taylor Energy’s MC20 platform (23051) in 169 m, and McMoRan’s EW947 platform (23925) in 253 m water depth.

Operators for these structures probably acquired third-party decommissioning cost estimates or performed their own detailed engineering study because of unique circumstances. Bullwinkle is the largest fixed platform in the world and is estimated to cost $434 million for structure removal, while the MC20 platform and EW947 platform were both toppled by hurricanes (and currently lie on the seabed) with expected decommissioning cost of $125 million each.

For the MC20 platform, one or more wells have been leaking since the platform was toppled in 2008. In 2020, $42 million was spent to install a device to collect leaking oil at the site. At least a dozen wells still need to be plugged and the eventual fate of the downed structure is unknown since much of it is buried under mud and may simply not be amendable to lifting/removal without significant hazards. In 2021 Taylor Energy dissolved itself after forfeiting its $475 million bond for decommissioning.

The two compliant towers in the Gulf of Mexico, Baldpate (33039, 503 m) and Petronius (70012, 535 m), have an estimated decommissioning cost of $55 million and $62 million, respectively. Using these two data points, a water depth function like the FP cost formula results, but with greater unit cost:

CT Cost = 113,000 WD

where the CT removal cost is reported in dollars and water depth WD is in meters.

In 2020, ExxonMobil decommissioned its compliant tower Lena in 305 m water depth. Using the above cost function, Lena’s decommissioning cost would be estimated at about $34 million. Lena was toppled in place, and the operator donated $10.7 million to the Louisiana Artificial Reef Program, half of the estimated savings from complete removal. If BSEE did not include the operator donation in its assessment, the actual cost for Lena’s complete removal would have been either $45 million or $56 million depending on how the reefing savings were allocated.

Whether toppling in place is viable for the two remaining compliant towers and permitted by the government will determine future decommissioning costs.

Cost functions derived from deterministic estimates provide a descriptive means to better understand BSEE procedures and compare unit cost by structure class. However, unlike the probabilistic fixed platform (<200 m) cost functions derived above, which are believed to reflect (or proxy) BSEE cost estimation models, the cost functions for fixed platforms in deeper water (>200 m) and floaters (to be discussed in Part 4) should not be interpreted as a proxy for BSEE cost models since such models were not employed by BSEE in cost estimation. They are simply a means to compare and describe the cost estimates along one dimension.

Pipeline decommissioning

All BSEE pipeline decommissioning cost estimates are reported in deterministic terms, probably an indication of the wide variation in reported data. This is not surprising considering the sparsity of pipeline decommissioning cost data, nature of operations, and the diversity of pipeline types.

Apparently, a unit cost approximately $1.6 million per pipeline segment is applied across bulk oil, bulk gas, lift, umbilical and water product classes, and about $1.35 million per segment is applied for oil and gas product classes.

The unit cost applied is likely determined by a simple aggregate average (or median) of operator cost data.

Reported pipeline decommissioning cost data may have been calibrated with work decomposition algorithms.

About the author: Mark J. Kaiser is a professor at the Center for Energy Studies, Louisiana State University, Baton Rouge, Louisiana.

About the Author

Mark J. Kaiser

Center for Energy Studies

Mark J. Kaiser is Professor at the Energy Institute at Louisiana State University. His research interests cover the oil, gas, and refining industry, and relate to cost assessment, fiscal analysis, infrastructure modeling, and valuation studies. Kaiser has led several studies and published extensively on decommissioning in the Gulf of Mexico. He holds a Ph.D. from Purdue University.