US deepwater decommissioning market estimated at about $24.3 billion

Editor's note: This story first appeared in the September/October 2023 issue of Offshore magazine. Click here to view the full issue.

By Mark J. Kaiser, Louisiana State University

Since 2016, the Bureau of Safety and Environmental Enforcement (BSEE) has collected decommissioning expenditure data from operators on the US Outer Continental Shelf to estimate the decommissioning liability of leases. To date, no summary statistics or information based on BSEE data have been reported by BSEE or in the literature.

The purpose of this four-part series is to evaluate BSEE cost estimates in the deepwater US Gulf of Mexico, defined as water depth greater than 122 m (400 ft), across the main decommissioning stages and to infer unit cost statistics and cost functions in the region.

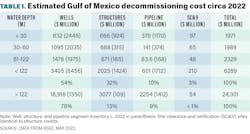

Here in Part 1, we review Gulf of Mexico deepwater production and decommissioning activity, and show that the decommissioning market is valued at about $24.3 billion c.2022. Wells and structures are the most important cost categories followed by pipelines.

Subsequent parts of this series will examine well plugging and abandonment, structure removal, and pipeline decommissioning cost estimates in greater detail.

Deepwater development concepts

Many different types of structures are utilized in deepwater development. Fixed platforms and compliant towers have jackets that extend throughout the water column, up to 1,353 ft (413 m) water depth for Bullwinkle (fixed platform) and 1,754 ft (535 m) water depth for Petronius (compliant tower), the two deepest fixed platforms in the world, while floating structures use a buoyant hull and are fixed at location using tendons and anchor lines.

There are four major categories of floating platform utilized in deepwater development – floating production storage and offloading vessels (FPSOs), semisubmersibles (semis), tension leg platforms (TLPs), and Spar structures – and all are used in the Gulf of Mexico. There are different classes and sizes for each floater type, and a few hybrids such as mobile offshore production units (MOPUs), which do not store oil onboard, and deep draft floating platforms.

In 2022, there were 45 fixed platforms and two compliant towers in the US Gulf of Mexico in water depth greater than 122 m (400 ft) and 47 floating structures: 18 spars, 14 TLPs, nine semisubmersibles, three mini-tension leg platforms (MTLPs), one MOPU, and two FPSOs. All the producing structures are primarily oil producers, meaning that most of their production stream is liquid hydrocarbons (crude oil and condensate), and all the structures were producing except fixed platforms serving an auxiliary (i.e., transportation hub) role.

More than half of completed deepwater wells in the US Gulf of Mexico c.2022 are subsea. In deepwater, subsea wells predominate on floating structures, and some floaters do not permit dry tree wells at all (e.g., FPSOs). Most deepwater fixed platforms, including compliant towers, use dry tree wells, but as production has developed in deeper water, many of these structures have also served as host for wet well tiebacks.

Production data

From 1947-2021, the US Gulf of Mexico produced 23.1 billion barrels (Bbbl) of oil and 190 trillion cubic feet (Tcf) of gas, or about 55 billion barrels oil equivalent (Bboe).

Natural gas production is long on its decline curve and in 2021 production fell below 0.5 Tcf, levels last seen in the early 1960s, while oil production is still on a roller coaster ride.

After the Deepwater Horizon tragedy in 2010, oil production declined for a few years because of a drilling moratorium and permitting delays, before bouncing back and hitting a new peak of 700 million barrels (MMbbl) in 2015. In 2020-21, the COVID pandemic was another shock to the system, and production fell dramatically to about half its peak value from shut-ins and labor issues.

The deepwater Gulf started producing in 1977 and through 2021 has contributed 47% of the oil and 16% of the natural gas produced in the US Gulf of Mexico – some 10.8 Bbbl of oil and 30 Tcf of gas.

In 2021, the deepwater Gulf produced 358 MMbbl of oil and 385 billion cubic feet (Bcf) of gas, representing 94% of the oil and 77% of the natural gas produced in the region. There were significant COVID-related impacts during the last few years, but the region is expected to fully recover and exceed pre-pandemic levels.

Historically, deepwater finds in the Gulf of Mexico have been oily. There were some large gas fields developed in the 1990s, but most of these played out early and deepwater gas production peaked in 2003 at about 1.6 Tcf. Today, most deepwater gas production is associated with oil fields, and after being used onsite for utilities and process operations, the rest is sent onshore.

Shallow-water decline is primarily responsible for the steep drop in gas production. In the future, if shallow water gas production continues to decline, gas production will be controlled mostly by deepwater oil developments and associated gas production. Lower levels of gas than have been seen historically are likely the new norm, certainly below 1 Tcf/yr, and probably below 500 Bcf/yr.

Deepwater oil production is now responsible for most of the oil produced in the US Gulf of Mexico, along with most of its gas. Both trends are expected to continue.

Decommissioning trends

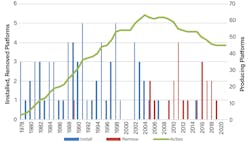

Since 1978, a total of 67 fixed platforms have been installed and 22 removed in the US Gulf of Mexico in water depths greater than 122 m (400 ft), leaving an active (producing) inventory of 45 fixed platforms c. 2022.

Three compliant towers have been installed in the Gulf of Mexico (Lena, 1000 ft; Baldpate, 1648 ft, and Petronius, 1754 ft). In 2020, Lena was decommissioned.

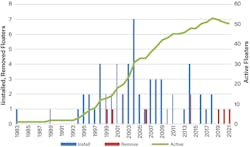

The first floating structure was installed in 1983, and since that time a total of 58 floaters have been installed and eight floaters removed, leaving 50 active floaters c. 2022. Most recently, the Independence Hub semi was removed in 2019, and the MTLP Morpeth was decommissioned in 2021.

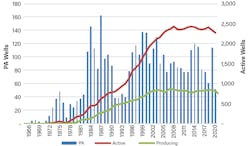

In terms of wells, a total of 7181 wells have been spud in deepwater since 1966, some 3,929 wells have been permanently abandoned and 991 wells have been temporarily abandoned, leaving an active inventory of 2,271 wells c. 2022. Of these 2,271 wells, about one-third are currently producing (767 producing wells c. 2022).

From 2016-2021, a total of 83 wells were permanently abandoned in 401-1,000 ft water depth, and 417 wells were permanently abandoned in >1,000 ft water depth.

Throughout the shallow-water Gulf of Mexico, well abandonment activity exceeded wells spud by about 6:1, indicating the mature nature of the <400 ft water depth and its declining production, whereas in >1,000 ft more wells were spud than plugged (546 spud vs. 417 plugged), indicating the continuing prospective nature of the deepwater.Market size

The deepwater US Gulf of Mexico decommissioning market is estimated at about $24.3 billion c.2022.

Well abandonment accounts for almost four-fifths of the market ($18.9 billion) followed by structure removal operations ($3.1 billion) at about 10% total market size. Combined, wells and structures account for over 90% ($22 billion) of the estimated market.

Pipeline decommissioning contributes almost 10% and site clearance <1% of total cost.

The majority of well abandonment costs are for wet wells associated with floaters, and only about 10% of the total cost comes from fixed platforms. In terms of structure decommissioning, floaters comprise about three-fourths of the total cost.

About the author: Mark J. Kaiser is a professor at the Center for Energy Studies with Louisiana State University in Baton Rouge, La.

About the Author

Mark J. Kaiser

Center for Energy Studies

Mark J. Kaiser is Professor at the Energy Institute at Louisiana State University. His research interests cover the oil, gas, and refining industry, and relate to cost assessment, fiscal analysis, infrastructure modeling, and valuation studies. Kaiser has led several studies and published extensively on decommissioning in the Gulf of Mexico. He holds a Ph.D. from Purdue University.