p2-Offline wells reduce value in US deepwater Gulf

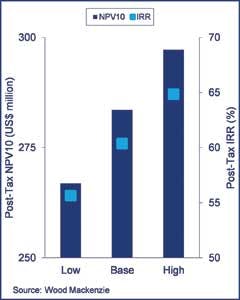

For a model Middle Miocene, single-well subsea tieback, the base case NPV is $284 million and IRR is 60.4%. An additional month of production each year increases the project valuation by $15 million and increases IRR over 3%. For a multi-well tieback, the change is proportional. A three-well tieback can see an increase NPV more than $50 million.

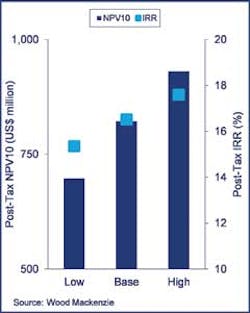

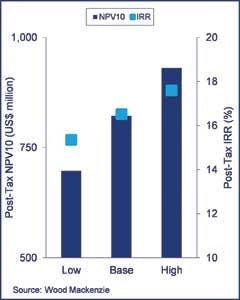

In the low case, production in earlier years is reduced and field life is extended, decreasing near-term revenue and increasing total operating costs. For the model Lower Tertiary field, producing the equivalent of nine months a year reduces NPV by 15% or $125 million. For the Middle Miocene field, NPV drops by 6% or $17 million. In both cases, the downside of losing a month of production a year outweighs the increased value from producing an extra month. To mitigate these risks, operators may choose to shorten field life and recover less reserves. However, this still likely reduces the overall valuation of the field.

Although three days a month seems like a small number, over the period of a larger field's life, this can defer production by years. In cases like Hurricane Ike, shutting-in production is unavoidable, but the effects can be mitigated by developing adequate contingency plans to bring production on sooner. Beyond that, optimizing maintenance, workovers and side tracks to limit non-productive time can improve a field's economics and increase earlier cash flows. Furthermore, operators should review redundancy and reliability of production equipment to limit time-consuming maintenance and preserve value in the long term.

Modeling assumptions: The models used for the generic Lower Tertiary and Middle Miocene fields evaluate a development project sanction forward.

The Lower Tertiary model assumes sanction in 2018 with first production in 2023 and the field developed via a standalone, wet-tree facility with third-party built oil and gas export lines transporting hydrocarbons to shore. The field was assigned recoverable reserves of 300 MMboe.

The Middle Miocene model assumes sanction in 2016 with first oil in 2018 and the field developed as a single-well subsea tieback to nearby infrastructure. The field was assumed to have recoverable reserves of 22 MMboe.

The low, base, and high cases were generated by varying the number of months a year a field was producing, from nine to 11 months. The field life varied between cases; however, all wells were permanently shut-in after oil production dropped below 300 b/d.

Economic assumptions: Wood Mackenzie's discount rate is 10% nominal. The discount date is Jan. 1, 2014, and the inflation rate is 1.9% in 2014 and 2% from 2015 onward.

Wood Mackenzie's Brent oil price assumption (nominal terms) is $103.25/bbl in 2014, $100/bbl in 2015, $98.73/bbl in 2016, $98/bbl in 2017, and $97.42/bbl in 2018, inflated at 2% per annum thereafter. This equates to a long-term Brent price assumption of $90.00/bbl (real, 2014 terms) from 2018 onward.

Crude from the model Middle Miocene field is assumed to trade at parity with LLS crude at (nominal terms): $98.73/bbl in 2014, $96.38/bbl in 2015, $95.29/bbl in 2016, $94.30/bbl in 2017, $93.72/bbl in 2018, inflated at 2.00% per annum thereafter.

Crude from the model Lower Tertiary field is assumed to trade at parity with Mars crude at (nominal terms): $97.75/bbl in 2014, $95.86/bbl in 2015, $95.42/bbl in 2016, $95.67/bbl in 2017, $90.94/bbl in 2018, inflated at 2% per annum thereafter.

Wood Mackenzie's Henry Hub gas price assumption (nominal terms) is $4.31/Mcf in 2014, $4.20/Mcf in 2015, $4.72/Mcf in 2016, $4.73/Mcf in 2017, and $4.74/Mcf in 2018, inflated at 2% per annum thereafter. This equates to a long-term Henry Hub price assumption of $4.38/Mcf (real, 2014 terms) from 2018 onward.