UK offshore operators are piloting drilling, production technologies

UK offshore operators trialing multiple drilling, production innovations

Britain’s North Sea Transition Authority (NSTA) recently published its NSTA Technology Survey & Insights Report 2025, which details the latest tools and services UK offshore operators have been using to support drilling and construction, subsea systems, facilities management, digital and data advances.

The report also highlights technologies that have either been piloted or are progressing toward field trials.

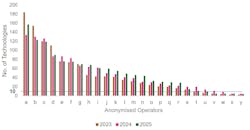

Some of the information came from the technology section of the UK Continental Stewardship Survey, completed by 46 licensees by the end of February 2025, and other advances reported by operators. These referenced 1,280 innovative solutions, with half of the technologies already deployed offshore.

Responding operators are expected to purchase £182 million ($238 million) of technology this year and to spend a further £77 million ($101 million) on their own R&D.

Among the tools cited was an electro-hydraulic device that emits pulses to remove scale buildup in wellbores, restricting flow.

One operator had also trialed a new system, developed in northeast Scotland, that employs minute bubbles to improve separation of oil from produced water, leading to higher oil production.

Other UK offshore operators are considering technologies that can support longer-distance and more cost-effective subsea tiebacks. The NSTA noted plans for remotely operated gas compression systems and pumps installed on the seabed to boost flow, avoiding the need for a new platform.

Emerging well intervention technologies reported included an automated positioning system for lubricators during wireline operations. The hydraulic lifting mechanism eliminates the need for crews to work under cranes, with risk and cost-reduction benefits.

One operator is contemplating use of a laser to cut into reservoir rock to create a clearer, less restricted path through which hydrocarbons can flow. This technique has been piloted onshore in the Middle East.

Among flare gas recovery developments, the report mentioned the application of eductors, which is a nozzle designed to increase the pressure of captured waste gases, thus reducing flaring. Eductors are said to have lower capital costs compared with pumps and compressors, and no moving parts, which lowers the maintenance requirement.

During 2024, several licensees deployed a valve that is designed to open in less than a second to safeguard their offshore flare systems. Others have been using miniaturized, lightweight sensors to quickly measure methane emissions while deployed on unmanned aerial vehicles, such as drones.

Additionally, some operators are considering the use of wave energy to power remote subsea systems that have experienced umbilical failures.

Norwegian sector urged to step up technology development for P&A

However, development and implementation of new technologies could cost the programs substantially.

Permanent plug and abadonment (P&A) of wells accounts for more than half of the cost of cessation of production and removal of old oil and gas installations on the NCS.

Half of Norway’s current production comes from wells drilled over the last five years, and the NOD estimates that 100 to 150 new production wells will be drilled annually in the near future.

At the same time, about 30 to 40 wells are plugged each year.

The NOD said costs vary from about NOK 50 million (US$4.8 million) for the most basic plugging operations to more than NOK1 billion (US$97.6 million) for more complex operations.

“All wells must be plugged permanently and responsibly. This is why it's important that the industry continues to develop new technology and solutions that can help reduce the time and costs needed for permanent plugging," said the NOD’s Assistant Director Niels Erik Hald.

To improve the costs and efficiency of P&A programs, the NOD has started an initiative that involves providing updated overviews of technological solutions, including the most recent methods for plugging wells and removing installations and pipelines; finding and assessing innovative techniques for simplifying the process; and calling on operators and the supply chain to cooperate in sharing best practices.

“We want to challenge the industry to use research funding available through the production licenses,” Hald added. “Such measures are important to ensure that the industry can face future challenges in a financially sustainable way. This also benefits society at large, because 78% of the costs are covered by the Norwegian State."

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.