Project delays impacting offshore EPC awards

Offshore staff

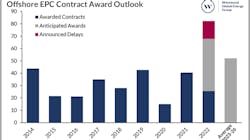

LONDON — Westwood Global Energy Group has revised down its forecast for global offshore EPC contract awards this year.

The consultant’s new overall estimate is for a total close to $68 billion, 18% below the projection in its January 2022 outlook.

One of the main factors has been delays in project sanctioning, according to Mark Adeosun, Westwood's manager of Offshore Energy Services.

Certain operators have remodeled their projects’ economics as a result of supply chain inflationary pressures, leading to potential cost increases of 10% to 15% for subsea equipment and production platforms.

And after having to downsize during the pandemic, the supply chain has struggled to scale up quickly for the upturn in offshore activity. For some EPC tenders, there has been a limited number of participants, leading operators to extend their bid deadline dates or re-tender for projects to increase competition.

Those issues have delayed timelines for project sanctioning.

Among the major offshore projects where final investment decisions and EPC awards have been delayed from first-half 2022 are Equinor’s deepwater Rosebank development west of Shetland in UK waters; TotalEnergies’ Cameia-Golfinho and Preowei projects, respectively off Angola and Nigeria; PetroVietnam’s Block B project off Vietnam; and Petronas’ Bestari in Malaysia.

All should be sanctioned over the next 18 months. However, others such as Norske Shell’s Linnorm in the Norwegian Sea and Aker Energy’s Pecan off Ghana have been put on hold.

Shell is examining alternative development concepts for the Linnorm gas field, while Aker Energy is looking for potential farm-in partners to cover Lukoil’s stake in the Pecan Field, due to possible future Western sanctions against the Russian operator.

In the US Gulf of Mexico, Shell and Equinor are working on completing and updating the field development plan for the Sparta Field, formerly North Platte, after TotalEnergies relinquished its 60% stake in the field earlier this year.

Offshore Suriname, TotalEnergies and partner APA Corp. are prioritizing appraisal of existing Block 58 discoveries and further exploration, with development of finds such as this year’s Krabdagu unlikely to begin until 2024.

At the same time, offshore oil and gas EPC-related contracting activity in first-half 2022 was strong, Adeosun said, with awards likely to total about $26 billion, a threefold increase compared to first-half 2021.

Contracts were issued for 123 subsea tree units and eight floating production systems (FPS)—four newbuilds, two conversions, and two upgrades/redeployments—along with awards for 52 fixed platform topsides, more than 1,600 km of subsea umbilicals, risers and flowlines, and 1,660 km of line pipe.

Big projects sanctioned during the period included the Yellowtail development off Guyana, LLOG’s Leon Castile fields (US), Shell’s Crux (Australia), Equinor’s Haltenbanken East (Norwegian North Sea), ADNOC’s Umm Shaif – Long Term Development Phase I (UAE) and Saudi Aramco’s Zuluf Incremental project.

Looking ahead

For second-half 2022, Westwood estimates total offshore oil and gas EPC-related awards of $42 billion, led by contracts for 138 subsea tree units, 15 FPS units, 119 fixed platform topsides, more than 3,870 km of SURF and 3,500 km of line pipe.

Aramco should account for 60% of the topsides contracts, driven by continued investment in the offshore Abu Safah, Manifa, Safaniya and Zuluf projects, with 50 platform jackets already awarded for these fields in the first half of the year.

Others pending include Shell’s Gato do Mato (Brazil), Aker BP’s NOA Fulla and Wisting projects (North Sea/Barents Sea), and QatarEnergy’s North Field Compression Phase 1 project.

Data from Westwood’s SubseaLogix and PlatformLogix market analytic tools indicate a sustained upturn over 2022-2026 in the absence of demand shocks, with offshore EPC spending predicted to total $276 billion, 71% higher than the preceding five-year period.

The Middle East and Latin America should dominate expenditure, with West Africa’s untapped gas discoveries set to attract investments over the forecast period, as Europe in particular looks for alternative supply sources to Russian gas.

07.21.2022