PTTEP buys Hess’ share of gas-producing block in joint Malaysian/Thai offshore development area

PTT Exploration and Production Public Company (PTTEP) has agreed to acquire Hess International Oil Corp. for a base consideration of $450 million.

The deal involves Hess’ 50% interest in offshore Block A-18 in the Malaysia-Thailand Joint Development Area (MTJDA).

Both sellers, Hess (Bahamas) and Hess Asia Holdings Inc., are now part of Chevron following the recent Chevron/Hess merger.

The Block A-18 gas and condensate project produces about 600 MMcf/d of gas, delivered 50:50 to Thailand and Malaysia.

MTJDA, in the southern part of the Gulf of Thailand, also includes Block B-17-01 (PTTEP 50%), which produces about 300MMcf/d for markets in the same two countries.

Valeura enters farm-in agreement with PTTEP

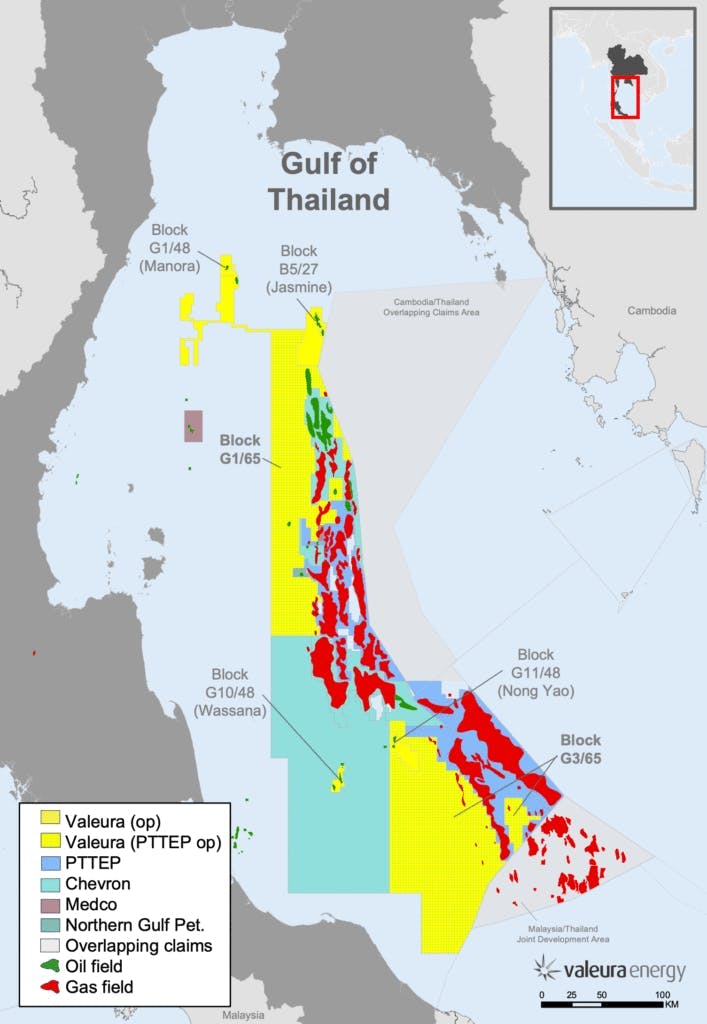

Elsewhere in the Gulf of Thailand, PTTEP has entered a farm-out agreement with Singapore-based Valeura Energy, which would give the latter 40% shares in offshore blocks G1/65 and G3/65.

Both are close to Valeura’s producing oil fields and infrastructure serving some of Thailand’s largest gas-producing fields.

The two blocks contain 15 oil and gas discoveries, with 27 of the wells drilled delivering oil and gas pay. Valeura sees potential for these and other exploration prospects to be tied back relatively swiftly to existing infrastructure.

A new exploration and appraisal program is underway, which includes four recently completed exploration wells and acquisition in the next few months of just over 1,200 sq km of new 3D seismic data.

Subject to approval by Thailand’s government, Valeura will pay 40% of back costs ($14.7 million to June 30, 2025) for its share of back costs for the wells, geological and geophysical studies and other general and administrative costs since the award of the blocks in March 2023.

It will also carry PTTEP on an additional seismic acquisition of roughly 165 sq km on Block G3/65, northeast of the Valeura-operated Nong Yao Field up to $3.7 million.

The production sharing contracts (PSCs) each cover a six-year exploration period, during which five wells must be drilled on G1/65 and three on G3/65 prior to expiry on May 2029. A three-year extension to the exploration period may be granted thereafter.

Block G1/65 is just to the south of Valeura’s 100%-owned B5/27 block (Jasmine/Ban Yen fields), and west of PTTEP’s large gas fields Erawan, Platong and Benchamas, which collectively are producing 900 MMcf/d of gas, 27 MMb/d of condensate and 23 MMb/d of oil.

PTTEP and Valeura have high-graded two focus areas on the block for their initial work program. These are the Jarmjuree South area, described as a liquids-rich gas and oil-bearing structural trend between Benchamas and Platong.

Of the recently completed three appraisal wells in this area, one has been confirmed as delivering gas pay. Valeura expects field development to begin shortly.

Maratee-Bussaba, the other focus area, contains a three-way closure structure and numerous structural/stratigraphic traps flagged as potential drilling candidates. The planned 3D seismic survey will be over the western part of the area, and it is designed to improve imaging of the reservoir to support further exploration drilling.

Block G3/65 is west of PTTEP’s giant Bongkot gas field, which is currently producing 850 MMcf/d of gas and 24 MMb/d of condensate. It covers the northwest flank of the North Malay Basin, with seven oil and gas discoveries to date, with 15 of the wells encountering oil and gas pay.

The initial focus will be on two areas: Nong Yao North-East may contain a potential oil-bearing fairway between the producing Nong Yao Field and the undeveloped Ubon oil field to the north. Some of the planned 3D survey will be over this area, which could provide a prospective tieback to processing infrastructure serving Nong Yao.

Bussabong-Angun, also west of Bongkot, is thought to contain large gas accumulations. PTTEP did prove gas with one recent well on Bussanbong, and Valeura sees potential here for a fast-track development.

PTTEP's CCS project approaching FID

Finally, PTTEP revealed in its results statement last week that it is approaching FID on its carbon capture and storage (CCS) project at the Arthit Field in the Gulf of Thailand. The project will likely take about three years to develop before carbon injection can start. At full operating capacity, the facilities should be capable of capturing and storing about 0.7 to 1 MM metric tons/year of CO2.

And at the Zawtika gas field in the Gulf of Moattama offshore Myanmar to the north, a new (Phase 1E) wellhead platform is under construction, designed to maintain gas production levels (currently 269 MMcf/d).

Want more content like this?

Visit the Regional Reports: Asia section for more offshore news, projects updates and technology trends.

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.