Bruce Beaubouef • Houston

Drilling rig demand buoyed by higher oil prices,

cost efficiencies

Consistently higher oil prices and greater cost-efficiency in offshore projects are driving increased demand for offshore drilling rigs through 2020, particularly for deepwater projects, according to new analysis from IHS Markit.

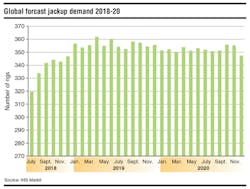

In its first worldwide mobile rig forecast for 2020, IHS Markit, which relies on data from its Petrodata RigPoint database, estimates the average global demand for mobile offshore drilling units, comprising jackups and floating rigs, is expected to increase by about 13% between 2018 and 2020 as the offshore market slowly emerges from its prolonged downturn.

The analyst expects global offshore rig demand will average 521 units in 2020, which exceeds the average of 453 units expected through 2018. These demand figures account for the entirety of 2018 through 2020, including seasonal fluctuations and regional trends.

Justin Smith, offshore rig analyst at IHS Markit and an author of the rig forecast, said: “Broadly speaking, much of this increase in global demand can be attributed to the price of oil being sustained at a higher level than when the downturn was in full swing.”

Smith also noted that “costs associated with the offshore industry have been slashed in recent years. This has led operators to reconsider exploration, appraisal, and development programs that were not economically viable while the market was bottoming-out.”

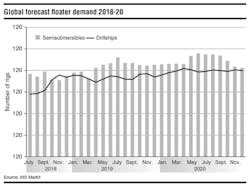

While the demand for jackups will improve during this period, the increase will primarily be driven by floating rigs, specifically semisubmersibles and drillships, as operators step up activity in deepwater areas around the globe, IHS Markit said.

“The vast majority of this offshore rig demand increase will come from the Middle East, led by Saudi Arabia, and other notable additions in Qatar and the United Arab Emirates,” Smith said. “Saudi Aramco alone will account for roughly a third of this increase as the operator continues its push for more offshore production, a sentiment echoed by Qatargas, which is aiming to increase its liquefied natural gas exports.”

For jackups, demand is expected to climb from an average of 321 rigs this year to an average of 352 in 2020, which would be an improvement of 9.7% during the period. Meanwhile, smaller upticks in the jackup rig segment are expected for several regions, including Northwest Europe, Central America, West Africa, and the Indian Ocean.

Interestingly, the US Gulf of Mexico has made a considerable rebound from its lowest point of the downturn of four contracted units in October 2016. This year, the US Gulf jackup market is expected to average about nine units, increasing to 11 by 2020, with potentially more on top of that, should local operators decide to undertake additional drilling programs, Smith said.

In the floating rig market, average annual semisubmersible rig demand is forecast to increase by more than 25% from an average of 71 units in 2018 to 89 units in 2020. Northwest Europe is responsible for one-third of this expected improvement, but it should be noted that the semisubmersibles typically used in the region need to be equipped for harsh environments, for which fewer units are suited, thus making the region more competitive, the analyst said.

This has resulted in charter rates for the top echelon of units in this segment increasing by about 65% in some cases during the last year. In Norway, operators are increasingly focusing on securing high-specification, sixth-generation rig capacity, while UK operators keep the market going for 1980s-built, third- and fourth-generation semisubmersibles.

Similarly, a significant increase is anticipated for the drillship portion of the floating rig market, for which demand in 2020 will average 79 units, marking a more than 27% increase from the average demand of 62 units for 2018. North and South America will be responsible for most of this growth, but for different reasons. In North America, the increase is mostly attributable to operators being reinvigorated to invest in development programs, while South America is benefiting from ExxonMobil’s exploration successes in Guyana and an influx of new operators in Brazil’s presalt areas, according to the analyst.

Deepwater rigs, which are defined by IHS Markit as units that can operate in more than 3,000 ft (914 m) of water, will see the most improvement with a number of longer-term programs set to begin in 2019 and to run throughout 2020 and beyond, particularly the drillship segment. In West Africa, the focus of the deepwater market will continue to be Nigeria, Angola, and Ghana, but high-profile campaigns continue to come to light for up-and-coming players, such as Namibia, Mauritania and Senegal, the analyst said.

Ahead of that, rig utilization rates have been slowly-but-steadily improving this year, a trend that is expected to continue. The total utilization of jackups, semisubmersibles, and drillships, which is defined as the share of all of rigs that are contracted regardless of whether the rigs are actively being marketed as available for future contracts, hit a floor of 51% at the end of 2017 after more than a year at this level. The total utilization level is now at 56% and should keep climbing steadily, albeit very slowly, as market conditions continue to improve, the analyst said.

Marketed utilization, which is the proportion of units offered for work that are contracted, has also been edging up since early 2017, and has increased from more than 69% to nearly 74%. However, that number will need to be closer to 85% before contractors can start pushing significantly higher day rates, Smith said.

Morrison, iSIMS unveil jacket design method

Chet Morrison Contractors has formed a strategic partnership with iSIMS to launch the iJacket, a new optimized method in jacket and foundation design.

The patented iJacket is more structurally optimized than the conventional true X-braced jacket design, supporting the same deck load, conductor/riser count, drilling deck, wind turbine or other payload as its conventional counterpart.

The iJacket, developed by Chet Morrison Contractors and iSIMS, is said to be more structurally optimized than the conventional true X-braced jacket design.

The new design is engineered to provide cost savings and reduce material and labor requirements over traditional foundations and jackets by up to 30%. Modern 3D engineering design and analytical tools allow engineers to design and arrange bracing in a configuration that offers further structural optimization, while still meeting or exceeding the industry design requirements for strength and fatigue performance.

Huisman to supply drilling system for Chinese semi

China Merchants Heavy Industries (CMHI) has contracted Huisman to engineer and fabricate a drilling system for a moored semisubmersible drilling rig constructed at CMHI Haimen.

This will be used for oil and gas drilling activities in shallow to medium water depths offshore Asia, and the South China Sea. It follows a cooperation between the two parties during the semi’s concept design.

Huisman says that its new dual multi-purpose drilling tower will be delivered during 2Q 2020 to CMHI Jiangsu Yard in China.

The drilling system will comprise a 1,800 kips static rated load dual multi-purpose drilling tower (DMPT), a single pipe setback drum, manipulator arms for pipe and tool handling, top drive, iron roughnecks, skid carts, catwalk machines, gantry and deck cranes, drillers cabins, and Huisman’s fully integrated control system.

It will be delivered during 2Q 2020 to CMHI Jiangsu Yard in China. Fabrication and final commissioning of the completed DMPT will take place at Huisman China. •