Data briefs: Offshore oil and gas drilling and EPCI challenges and opportunities amid market recovery

Offshore rigs sector poised for recovery by 2027

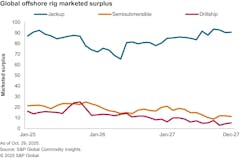

Deepwater contractors are becoming more optimistic about 2027 after a subdued period from 2024 to 2026. The drillship market is expected to improve, with forecasts indicating the marketed surplus will decrease from about 15 units in early 2026 to about four or five by late 2027. This improvement is driven by anticipated demand in West Africa, Mozambique and the US Gulf, alongside a robust market in South America. Meanwhile, the marketed jackup surplus is projected to remain between the mid-70s and mid-80s through 2026 and 2027, heavily reliant on the Middle East for incremental demand. Positive signs are emerging, as market sources report that Saudi Aramco is in talks to reactivate suspended rigs for 2026. While this may not significantly affect the global marketed surplus, it could provide a valuable boost for higher-specification units, enhancing market sentiment among contractors.—S&P Global Commodity Insights

Poll reveals top GoM challenges: Regulations, costs, infrastructure

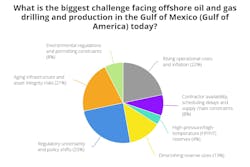

Offshore recently polled its readers over a two-week period (Oct. 27-Nov. 10) to assess the biggest offshore oil and gas drilling and production challenges in the Gulf of Mexico (GoM). Of the 106 poll respondents, the majority voted that regulations/policy, operational costs/inflation and aging infrastructure were the top three struggles operators are facing. For more information about this poll and the participants, visit www.offshore-mag.com/55331520.—Offshore staff

Sustained offshore activity expected in APAC region

Despite a turbulent year for global oil markets—marked by underwhelming demand and rising supply—offshore investment is expected to remain resilient. Between 2025 and 2029, offshore engineering, procurement, construction and installation (EPCI) investment is projected to reach $310 billion globally, with APAC accounting for 27% of this spend. Southeast Asia alone is set to award $37 billion in new offshore contracts, led by deepwater gas projects in Indonesia and emerging CCS initiatives in Malaysia.—Westwood Global Energy Group