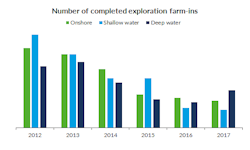

Overall farm-ins down, but deepwater transactions growing

Offshore staff

LONDON – Conventional exploration farm-in/farm-out activity has fallen by around two-thirds from 2012 to 2017 according to Westwood Global Energy Group, matching the reduction in overall drilling activity.

The average level of promote (the proportion above their equity interest that companies are willing to pay to access a drilling opportunity) in the offshore industry has come down from >2.0 in 2012/2013 to 1.5 in 2016/2017, while the average farm-in cost per percentage of equity is down by around 70% over the same period.

However, although overall farm-in levels remain subdued, the number of deepwater transactions has risen lately, with the 13 deals completed so far this year carrying an average level of promote of 2.2.

Since the start of 2012, and outside North America, the most active farm-in company has been Total with 25 recorded farm-ins, while Tullow Oil has been the most active farm-out company (16 recorded farm-outs).

Companies that have discovered the largest net volume from wells drilled on farm-outs since the start of 2012 on farm-outs have been BP, Hess, and CNOOC, Westwood adds, and these companies also achieved the lowest net farm-in finding costs, well below $1/boe.

Higher oil prices, cheaper deal terms, improved success rates and recent large farm-in discoveries are all positives for supporting a recovery in activity in the exploration farm-out sector, the analyst concluded.

But with farm-ins taking on average ~330 days between an opportunity coming to market and a deal being completed, and then a further ~250 days before an exploration well is drilled, the quality of today’s opportunities will not be fully apparent for at least two more years.

07/16/2018