Industry easing the brakes on new production facilities, report finds

Offshore staff

LONDON – Westwood’s latest World Oilfield Equipment Market Forecast sees further improvements in offshore E&P activity between now and 2022.

In North America’s offshore market, the recent improvements in oil prices have boosted investor confidence, with total expenditure of $28 billion anticipated over the forecast period, of which $18 billion will likely come from FLNG developments, with eight LNG FPSOs set to be ordered by the end of 2020.

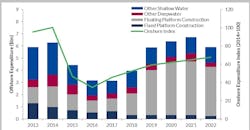

Globally, Westwood anticipates $148 billion of total spending, including capex on the engineering, procurement, construction, and installation of fixed platforms and floating production systems (FPS).

But for offshore rig construction, the outlook for expenditure remains weak due to the exceptionally take-up levels for the current fleet as a result of the previous build cycle.

Only four orders have been placed since the start of 2015 – two in the last six months (one jackup and one semisubmersible rig) – and with a relatively flat outlook foroffshore drilling this year, Westwood does not foresee any material increase in MODU use, except in a few markets.

And only eight orders are set to be placed between now and 2018-2022, which will not offset the declining backlog for rig builders.

06/22/2018