Offshore staff

ESSEN, Germany — Late last month, RWE agreed to acquire the entire UK Norfolk Offshore Wind Zone portfolio in the southern North Sea from Sweden’s Vattenfall for £963 million ($1.226 billion).

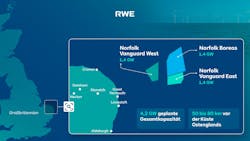

This comprises the Norfolk Vanguard West, Norfolk Vanguard East and Norfolk Boreas projects, each with a planned capacity of 1.4 GW, and located 50-80 km from the Norfolk coast in eastern England.

Following 13 years of development, the projects have secured seabed rights, grid connections, development consent orders and other main permits.

Norfolk Vanguard West and Norfolk Vanguard East are more advanced, with procurement in place for most of the critical components. The next step for RWE will be to secure a contract for difference (CfD) in one of the UK government’s upcoming renewable energy auction rounds.

The company expects to commission all three projects this decade.

UAE fabricator Lamprell has signed a large capacity reservation agreement for Norfolk Vanguard at its Hamriyah yard. The base work scope covers the supply of 2 x 92 wind turbine generator (15 MW) foundation transition pieces for both Norfolk Vanguard West and Norfolk Vanguard East, and shipping of these to Tees Work Port in northeast England.

The yard’s modern renewable energy production line will construct wind turbine generator jacket components including transition pieces and monopiles.

Vattenfall said it would now focus on other developments such as the 1.5-GW Nordlicht cluster offshore Germany, in a partnership with BASF.

But the company also stressed its committment to the UK, with the 798-MW Muir Mhor floating offshore wind farm under development in a joint venture with Fred.Olsen Seawind.

Pending regulatory approvals, the sale of Boreas, Vanguard East and Vanguard West should close in first-quarter 2024, with Vattenfall until then continuing to develop Vanguard East and Vanguard West.

RenewableUK’s CEO Dan McGrail said, RWE’s decision, coming just after Ørsted announced FID on Hornsea 3 in the UK southern North Sea, “shows that Britain is regaining its position as the leading market for offshore wind investment, moving past the disappointment of this year’s CfD auction.

“We have to give a lot of credit to the government and the new secretary of state, who have been working even closer with the industry over the last two months, bringing forward a series of positive announcements including more sustainable administrative strike prices, permanent full expensing for investors in green technology and funding to support clean energy manufacturing in the UK.

“We’re now back on track, and we hope to secure a record amount of capacity in next year’s auctions for new clean energy projects.”

01.07.2024