Analyst finds NOCs are ready for market moves

Offshore staff

LONDON– The end of one of the worst downturns in the history of oil of gas may be in sight, as OPEC’s November meeting looms large – bringing with it fresh hopes of a production cut and consequent market rebalancing. In this context, Douglas-Westwood (DW) has recently undertaken analysis of 15 major upstream companies to understand prospects for the industry should there be a near-term upswing in oil prices.

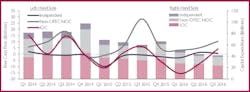

Since the downturn began, cutting capex across all business segments has been one of the primary methods of improving profitability and free cash flow for E&P companies. Spend in the first nine months of 2016 was around 45% lower than that of 2014, DW found. Over the same period, cash flow from operating activities has been squeezed, as falling oil prices have reduced revenues and price hedges have expired.

Despite the downturn, international oil companies’ (IOC) dividend pay-outs have remained fairly steady. The analyst found this to be due to an emphasis on maintaining investor confidence in future performance, thus sustaining access to liquidity and credit. However, IOCs have had to pay a heavy price, cutting capex, selling assets, and increasing debt, with free cash flows generally turning negative, despite relatively strong downstream performance.

While IOCs’ free cash flows have generally made movements back to neutrality in 3Q 2016, onlyShell, ExxonMobil, and Chevron have returned to the black. Given that dividend payments are unlikely to be cut by the group, a significant uptick in oil price after OPEC’s meeting will be required to spur new large-scale investment.

Non-OPEC national oil companies (NOC), on the other hand, have generally been quick to cut dividend payments during the downturn, alongside capex reductions, as greater emphasis is placed on profitability and free cash flow. Of the 15 companies studied by DW, national oil companies (NOC) had the highest free cash flow in 3Q 2016, amounting to $10 billion.

As a result, DW found this group is particularly well-placed in the current market, as well as being able to quickly react to any improvements in project economics in the wake of the OPEC meeting.

11/14/2016