Report identifies regional bright spots among dulled offshore spend

Offshore staff

LONDON – Douglas-Westwood (DW) said its new 3Q 2016 World Oilfield Equipment (OFE) Market Forecast generally paints an “unattractive picture” for offshore OFE spend through to 2020.

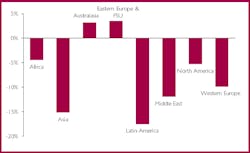

Year-on-year expenditure contractions of 11% are expected between 2016 and 2020, due primarily to an oversupplied rig market and a sharp reduction in production platform orders.

Despite the negativity, DW Researcher Joel Hancock reported two regional bright spots in its global offshore OFE expenditure analysis.Australia and Eastern Europe and the former Soviet Union are set to record year-on-year growth of 3% and 5%, respectively, between 2016 and 2020 – bucking a global trend of shrinking spend.

Historically, both growth regions account for a small proportion of total offshore OFE spend, with Australasia and Eastern Europe accounting for 5% and 3% of cumulative 2011-2015 expenditure, respectively. From this small base, the analyst firm said it has identified growth potential as these regions develop their offshore resources through the forecast period. By 2020, DW expects Australasia and Eastern Europe’s share of offshore expenditure to have increased to 6% and 4%, respectively.

Australia’s LNG projects are the key driver for Australasia’s positive offshore OFE outlook. Despite cost overruns and difficulty in obtaining long-term supply contracts, the analyst expects LNG projects, fed by offshore gas fields, to increase Australia’s gas production 37% over 2016-2020. This drive will boost offshore OFE spend, with Ichthys (INPEX), Scarborough (ExxonMobil), and Greater Western Flank Phase 2 (Woodside Energy) in particular.

Production in Eastern Europe and FSU has historically been dominated by onshore fields, with 92% of total production in the region attributed to onshore developments in the five-year period ending in 2015.

A similar dominance is expected in the forecast, however, numerous high profile offshore developments will cause a surge in offshore OFE expenditure – resulting in the region’s positive offshore growth outlook.BP’s Shah Deniz 2 project, due onstream in 2018 with a subsequent four-year ramp up, is one such project.

Further regional upside is possible beyond the forecast period from developments in the Russian Arctic, however, DW has taken a negative view of these projects due to high start-up costs and the effect of international sanctions.

With Australasia and Eastern Europe both showing positive expenditure outlooks, DW concluded from its analysts that opportunities for growth still exist, even in the current depressed offshore OFE market.

11/09/2016