Vessels, Rigs, & Surface Systems

Offshore rig market recovery still to come

While many thought the offshore rig market had “turned the corner” in 2018, analyst Westwood did not since there were few, mostly isolated areas of improvement.

RigLogix data show that 19 rigs were delivered in 2018, comprised of 15 jackups and four semisubmersibles. As of Dec. 31, 2018, there were still 112 rigs listed as under construction, including 75 jackups, nine semis, 21 drillships, and seven tender-assist units. Construction on the majority of these units is essentially completed and waiting on acceptance from the rig owners.

Rig attrition has taken center stage within the past few years, and that continues to be the case in today’s market, according to Terry Childs, head of RigLogix. During 2018, the number of rigs removed from the fleet hit an all-time high of 57. Since the downturn began in September 2014, there have been 212 units taken out of service through retirements, conversion to other modes, and total-loss accidents. In 2018, the split amongst rig types was jackups (37), semis (14), and drillships (six).

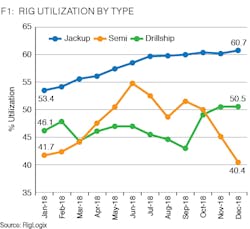

As for rig utilization, jackups and drillships both enjoyed increases for the year, but the gains made for semis during the first half of the year were erased in the final six months as utilization fell by some 14% from 54.7% in June to just over 40% in December.

There were several notable rig owner mergers and acquisitions either announced or completed during the year. Borr Drilling purchased Paragon Offshore and 24 jackups were removed from the fleet. Then Borr purchased nine newbuild jackups from Jurong Shipyard and KeppelFELS and began taking delivery of the rigs in 2018. Transocean purchased Songa Offshore’s floating rig fleet and then purchased Ocean Rig toward the end of the year. Ensco and Rowan also announced a merger that is expected to be completed in 2019.

As for day rates, only two regions experienced noticeable gains in 2018, Childs said. Rates for harsh-environment semis in the Norwegian North Sea rose from just under $200,000/d at the start of the year to $290,000-$300,000/d.

In the US Gulf of Mexico, consistent 100% take-up of the 12-strong jackup fleet pushed day rates for some long-legged units up by $20,000 or more to $85,000. Elsewhere, rates remained essentially static as rig supply continued to exceed demand.

As for drillships, Childs cited the recent Chevron hire of one of Transocean’s new ultra-deepwater drillships for a program in the US Gulf of Mexico. The vessel’s features include what is said to be the world’s first 20,000-psi BOP system. In this case, the day rate is around $454,000, although had the contract been signed during the peak period of 2011-2013, it likely would have exceeded $700,000, Childs claimed.

Most rig markets remain oversupplied, so there seems to be little chance of a substantial rate improvement. But in markets where rig supply and demand are tighter, rigs differentiated by key features will likely command higher rates.

In conclusion, the wheels for a recovery are in motion. Westwood believes as the year progresses that utilization and day rate increases are coming, but it will happen later rather than sooner. In the meantime, the market momentum will hopefully continue to build, with visible signs of wholesale improvement emerging in the second half of the year, according to Childs.

Seismic vessels complete tandem

drydocking at DSAm

Recently, the Oceanic Sirius and Oceanic Vega completed a round-the-clock, 10-day maintenance program at Damen Shiprepair Amsterdam (DSAm). For eight of those days the two 106-m (348-ft) vessels were in the yard’s 250-m (820-ft) drydock no.4 in a tandem arrangement, to maximize the efficient use of resources.

The Oceanic Vega (left) and Oceanic Sirius (right) at Damen Shiprepair Amsterdam. (Courtesy Damen)

The twin SX120 type seismic research vessels are owned by CGG Eidesvik Ship Management AS, a joint venture between Eidesvik Offshore and CGG.

The primary reason for their visit to DSAm was to have a series of repairs and upgrades as well as their hulls cleaned and repainted. The repairs and upgrades included maintenance on the propeller nozzles of both vessels and, by tenting the area around the propellers, DSAm was able to undertake the work without interrupting or delaying the paintworks. This helped minimize valuable time spent at the yard. •