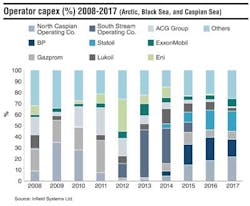

GLOBAL DATA

This month, Infield Systems looks at forecast operator capex offshore the Arctic, Black Sea, and Caspian Sea. The Caspian Sea area is expected to account for the largest share of capex over the five-year forecast. The most capital intensive development is expected to be the giant Kashagan along with the nearby Kairan, Akote, and Kalamkas fields. These developments are operated by the North Caspian Operating Co., a consortium including KazMunaiGaz, Eni, and ExxonMobil, and represent 14% of total capex over the period. The BP-led Shah Deniz project lies in the Azeri sector of the Caspian Sea and is expected to account for a further 14% of forecast capex. BP is also active in the ACG development in Azerbaijan, while Lukoil is developing three fields in the Russian sector of the Caspian Sea.

The Arctic region is expected to account for 38% of capex over the forecast period. Norwegian Barents Sea developments make up the largest proportion of Arctic capex, followed closely by Russia. Gazprom and ExxonMobil are expected to dominate Russian capex while Norwegian capex will see Statoil and Eni lead the market.

Within the Black Sea the largest single project is the South Stream pipeline running across the Black Sea, from Russia to Bulgaria. The pipeline, operated by the South Stream Operating Co., a consortium including Gazprom, Eni and others, accounts for 86% of forecast capex in the Black Sea and 12% of total capex across the three areas of analysis.

Over the forecast period the North Caspian Operating Co. and BP jointly hold the largest shares of capex, at 14% each. This is followed by Statoil and the South Stream Operating Co. with 12% each, while Lukoil and Gazprom both account for 7%. The six companies with the highest investment in the areas account for more than 66% of capex in the next five years.

– Kieran O'Brien, Energy Researcher, Infield Systems Ltd.