Increasing demand for natural gas, amended legislation drive US LNG port applications

With demand for natural gas forecast to outpace supply through 2020, regulatory legislation has been modified to allow the construction of deepwater ports to facilitate LNG imports for domestic consumption.

LNG imports to the US will continue to increase to meet the country’s growing need for natural gas. Demand is forecast to increase from 2006 levels by 10% in 2010 to 24 tcf and by 20% in 2020 to 26.3 tcf, according to the Energy Information Administration (EIA). Net imports of gas (LNG and pipeline imports minus exports) to the US is expected to increase from 2006 levels by 33% in 2010 to 4.6 tcf and by 56% in 2020 to 5.4 tcf.

By the end of this year, US natural gas consumption is expected to increase by 1.5% over total demand in 2006. To meet this projected growth, gross imports of gas are forecast to increase by 0.13 tcf, with LNG imports accounting for 0.21 tcf of the bump, offsetting a decline in pipeline shipments from Canada.

To overcome this projected imbalance of gas supply and demand, the US government adopted The Maritime Transportation Security Act of 2002 (MTSA), which amended The Deepwater Port Act of 1974 (DWPA) to include natural gas.

This enabled the construction of new LNG port facilities in waters beyond the US territorial limits. The amended legislation authorizes the Secretary of Transportation, together with the Maritime Administration (MARAD), US Coast Guard (USCG), and other federal agencies, to issue licenses for the construction, operation, and decommissioning of deepwater ports in federal waters.

Since MTSA was passed, MARAD has received 14 deepwater LNG port applications and has granted three licenses (one application was received and one license was issued before the passage of MTSA). All of the applications involve facilities for offloading and re-vaporizing or re-gasifying LNG, which is natural gas cooled to minus 259° F to convert it from a gas to liquid. This process reduces the volume of natural gas by 600 times for efficient transportation in vessels.

The DWPA was amended again with the Coast Guard and Maritime Transportation Act of 2006. That gives priority processing to applicants who will use US-flagged vessels.

“Deepwater ports will contribute to greater energy independence by enhancing our natural gas reserves and increasing our flexibility by enabling the US to receive large amounts of natural gas,” says the US Department of Transportation.

Licensed ports

To date, 15 deepwater LNG port applications have been filed and five licenses have been issued. All of the licensed projects are in the Gulf of Mexico region.

Among them, Chevron’s Port Pelican, licensed on Jan. 20, 2004, currently is inactive. Construction has been placed on indefinite hold. Shell’s Gulf Landing project, licensed on May 20, 2005, is moving forward with construction and development of monitoring and mitigation plans for impacts on the marine environment.

Excelerate’s Gulf Gateway Energy Bridge, licensed on May 26, 2004, has been active since March 20, 2005. The port has delivered 0.18 tcf of natural gas to domestic markets via the Sea Robin and Blue Water pipelines in Louisiana. The company also has delivered LNG by ship-to-ship transfer, between the LNG regasification vessel (LNGRV)Excelsior and LNG carrier (LNGC) Excalibur.

McMoran’s Main Pass Energy Hub was licensed on Jan. 3, 2007, and Neptune LNG’s Massachusetts Bay port approval was released on Jan. 30, 2007.

Active LNG in the Gulf

Excelerate Energy’s Gulf Gateway Energy Bridge deepwater facility is the only active offshore LNG port in the Gulf of Mexico, and the world’s first, and only, offshore LNG terminal.

The port is in West Cameron block 603 in 91 m (298 ft) of water, 187 km (116 mi) from the Louisiana coast. It has a baseload capacity of 500 MMcf/d of gas with a peak capacity of 690 MMcf/d.

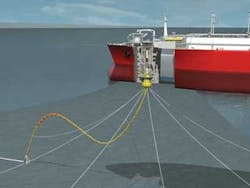

The Gulf Gateway complex is comprised of an STL (submerged turret loading) buoy, with associated anchor lines, flexible riser and subsea manifold, a metering platform for measurement of volume and composition of gas flowing to downstream pipelines, and LNG EBRVs (LNG Energy Bridge Regasification Vessels) for loading and offloading.

Once an LNG EBRV reaches the port, it retrieves and connects to the STL buoy and begins regasification of the LNG onboard. The natural gas then is discharged from the buoy through a 3.04-km (1.89-mi) pipeline to the metering platform. The buoy, designed to withstand 100-year storm conditions, submerges to a safe depth, typically about 30 m (100 ft) below the surface, when not in use.

The product then is distributed to market via pipeline connections from the platform to the Blue Water Pipeline and Sea Robin Pipeline systems. The export pipelines measure 2.20 km (1.37 mi), 18-in.; and 6.31 km (3.92 mi), 20-in., respectively.

Construction of the $70-million Gulf Gateway project began in August 2004 and was completed in February 2005. First cargo was delivery on March 17, 2005, from the company’s LNG EBRVExcelsior. In 2006 (through November), the tanker offloaded a total of 0.05 bcf of LNG from Trinidad to Gulf Gateway.

Excelerate controls four other LNG RVs:Excellence, Excelerate, Explorer, and Express. All were built, or are being built, by Daewoo Shipbuilding & Marine Engineering Co. (DSME). The company says its partner, Exmar, is building two larger vessels at DSME, which likely will join the EBRV fleet. The vessels are scheduled to be delivered in 2009.

Submerged turret loading

The STL system is a key technology component in the Energy Bridge system. Although this application of the system is new, it has a proven track record in the North Sea.

The concept comprises an anchored, conical-shaped, submerged buoy with an integrated turret. The STL buoy body can rotate around a central annulus through the buoy, which again connects to the mooring lines and riser for product transfer.

In a typical application attached to the buoy are eight mooring lines which are anchored to the seafloor using wire rope and chain segments. The design of the mooring system is site- and application-specific. These mooring lines keep the buoy stationary and the vessel on station. The ship is connected to the system by pulling the STL buoy into a mating recess in the bottom of the ship. When the buoy is locked to the ship, the vessel can weathervane freely to minimize wind, wave and current loads.

When a ship is regasifying LNG, the resultant pressurized natural gas flows from the vaporizers on board the vessel through the annulus of the STL buoy and into a dynamic riser. Once the ship has completed the vaporization process for its cargo, the buoy is released, re-submerged to approximately 30 m (100 ft), well below the draft of any ship traffic that might inadvertently stray into the area.

Because of its inherent mobility, the STL and Energy Bridge system can be deployed and redeployed virtually anywhere in the world to meet incremental demand for natural gas, says Excelerate.

Main Pass Energy Hub has green light

On Jan. 3, 2007, McMoRan Exploration Co. received license approval from the MARAD for its Main Pass Energy Hub (MPEH) project.

The agency concluded that construction and operation of the deepwater port will be in the nation’s best interest, and will be consistent with US security and other policy goals and objectives, including energy sufficiency and environmental quality.

The organization also suggested that the hub will fill a vital role in meeting national energy requirements for the future, and that its location will help reduce congestion and improve safety in receiving LNG cargoes to the US.

The MPEH port facility will be positioned in Main Pass block 299 in 64 m (210 ft) of water, where four platforms exist, 60 km (37 mi) from Venice, Louisiana. Construction requires use of new and existing infrastructure, which will sit atop a 3-km (2-mi) salt dome. Here, natural gas will be stored in three proposed caverns with capacity for 28 bcf.

Proposed new infrastructure for the facility includes a metering platform and gas pipeline junction platform. The platforms will be installed in Main Pass block 164. Six gas transmission pipelines with a total length of 309 km (192 mi) are proposed to connect the port with existing gas distribution pipelines; one near Coden, Alabama.

The approved port will be equipped with capacity to offload LNG carriers at a rate of 250 MMcf/hr, regasify LNG at a peak rate of 1.6 bcf/d, and deliver 3.1 bcf/d of gas to market.

McMoRan is actively seeking potential LNG suppliers, gas marketers, and consumers in the US to develop commercial arrangements for the facilities. Once contracts are in place, construction of the port will take around 3.5 years at an estimated $1 billion (approximately half of which is for pipelines and cavern storage).

MARAD’s approval and issuance of the deepwater port license for MPEH is subject to additional terms and conditions.

Open-loop vs. closed-loop vaporization

Most of the LNG regasification facilities in the world use the open-loop process which uses heat available in seawater for changing the super-cooled LNG into a gas at normal temperatures.

The initial proposal for MPEH included use of open-loop, open-rack vaporizer (ORV) technology. As part of the licensing process, a final environmental impact statement (EIS) was prepared. The EIS analyzed variations of three alternate solutions: ORV with and without waste heat recovery, submerged combustion vaporization (SCV), also known as closed-loop technology, and intermediate fluid vaporizer (IFV).

The final EIS determined that use of ORV or IFV with the proposed MPEH would cause a number of adverse impacts, with the most import being its affect on fish eggs and larva that could be entrained in the seawater intake or affected by the process water discharge.

Within the EIS, MARAD notes that it has determined as a matter of policy that all future deepwater port facilities licensed in the GoM that use ORV technology would be required to have certain prevention, monitoring, and mitigation plans in place, consistent with Shell’s approved Gulf Landing terminal.

At this point, McMoran still was planning to use the open-loop system with its proposed MPEH.

However, shortly thereafter, Louisiana Governor Kathleen Blanco vetoed the construction of the proposed port in a letter to the MARAD, over concerns of potential long-term adverse economic and environmental impacts. This trumps all prior approvals.

“I will oppose the licensing of offshore LNG terminals that will use the open-rack vaporizer system,” said Blanco. “Until studies demonstrate that the operation of the open-rack vaporizer will not have an unacceptable impact on the surrounding ecosystem, I will only support offshore LNG terminals using a closed-loop system having negligible impacts to marine life.”

McMoran later submitted a revised application for its MPEH using the closed-loop system, which uses natural gas to regasify LNG. About 2% of the gas will be consumed to operate the entire facility to regasify LNG, compared to 1% with the open-loop system. In addition, according to McMoran, would cost about $30 million more to build the closed-loop system than open-loop, and the added cost of operation from consuming more gas depends on the price of the commodity, but currently is estimated at $25 million per year.

“Uncertainties raised by opponents to this process (open-loop) in the US have forced the use of closed-loop systems, despite the inherent inefficiencies of burning natural gas to heat LNG,” says McMoran.

Pending ports

Of the 10 unlicensed proposals, seven of them are under review. They consist of three LNG receiving terminals (Cabrillo Port LNG, North Star, and Ocean Way Energy Port) off the coast of southern California; one LNG facility (Northeast Gateway) in Massachusetts Bay; two LNG ports in the Atlantic, one (Safe Harbor) off Long Beach, New York, and the other off Florida; and one LNG terminal (TORP Technology’s Bienville Terminal) in the Gulf of Mexico.

Three applications have been withdrawn: ExxonMobil’s Pearl Crossing project was withdrawn on Dec. 8, 2005, and ConocoPhillips’ Compass Port and Beacon Port projects were withdrawn on June 8, 2006, and Nov. 3, 2006, respectively.

David Paganie

Managing Editor