E&P growth driving demand for premium offshore support vessels

Offshore staff

LONDON — Growing investment in offshore exploration and production (E&P), and a rising rig count, will increase demand for offshore support vessels (OSVs) over the next two years, according to a report by Westwood Global Energy Group and Braemar ACM Shipbroking.

Upstream engineering, procurement and construction spending could reach $75 billion this year, an increase of 80%. The Middle East is the largest contributor with final investment decisions on projects such as QatarEnergy’s North Field Expansion Phase 1 and Saudi Aramco’s Zuluf Incremental.

Next comes South America, with projects such as Shell’s Gato do Mato offshore Brazil.

The number of globally contracted jackups is at a six-year high, with utilization (excluding cold-stacked rigs) of 82%. In Saudi Arabia, jackup drilling activity will ramp up further following Saudi Aramco’s tender for an additional 30 rigs for its projects.

Global drillship utilization is 79%, the highest since 2014, the report added. Dayrates in this segment are largely supported by activity in the U.S. Gulf of Mexico, where rates above $200,000/day are now commonplace.

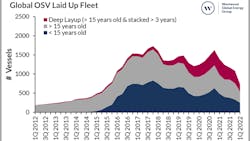

Support vessel owners have been reactivating their fleets to take advantage of the activity, following the large-scale stacking that took place during the pandemic. By the end of the first quarter, the total layup fleet was down by 32%, the lowest since 2016, with 321 vessels either reactivated, scrapped or written-off.

Only 33% of the current global laid-up fleet consists of premium vessels less than 15 years old. The majority (67%) of laid up OSVs are more than 15 years old. Many operators have age restrictions for their chartered tonnage and would not consider vessels in this age bracket for the tendering process, the report explained.

The tighter global OSV market has led to near-90% utilization in the Middle East. Rates also have risen for new tenders in the region.

Total take-up of the worldwide OSV fleet is around 63%, which is 7% higher than in 2021.

Complying with operators’ local content, age restrictions and low-emission needs will, however, put pressure on owners with aging fleets.

According to the report, the total order book of registered International Maritime Organization (IMO) newbuilds is presently 215, of which 67 are viewed as Tier 1 vessels likely to be delivered in the next 12 to 24 months.

Over the next two years, 430 vessels will exceed the 15-year age mark and will therefore be deemed "non-premium."

The issue facing vessel owners today is not the number of OSVs but the age and quality of available tonnage and whether owners can raise capital to invest in newer, cleaner vessels for future offshore operations, the report concluded.

06.10.2022