Offshore drilling rig reactivations have begun

Teresa Wilkie * Esgian

We expected it to happen just not necessarily this soon. But now it’s official: several cold-stacked rigs are about to be reactivated for new jobs in the Golden Triangle, and Valaris is taking the lead. Just last week, the driller confirmed that it will reactivate sixth-generation, ultra-deepwater drillship Valaris DS-4 for a minimum 580-day deal with Petrobras in Brazil. The rig has been idle for over two years.

This follows other recent announcements from the same rig owner for the seventh-generation drillship Valaris DS-11, which will also be revived for a long-term deal off Brazil with Petrobras; and Valaris DS-16, which will undertake a two-year deal with Oxy in the US Gulf of Mexico starting next year.

Last year, the driller took a tough stance on its uncontracted fleet, preservation-stacking a hefty 19 rigs (nine floaters and 10 jackups) due to the lack of opportunities in the market. Now it appears to be front of the queue to bring those rigs back out and take advantage of the recovering market.

Meanwhile, Seadrill will reactivate its seventh-generation drillship West Jupiter, also for a multi-year deal with Petrobras Brazil, starting in late 2022. Additionally, the stacked drillship West Carina (which has not worked in over a year) will also be ramped up and put out to work in 2022 for a long-term deal in Brazil.

Shrinking supply warrants resuscitations

So far, most reactivations have been confirmed for modern, ultra-deepwater drillships due to a rapid increase in competitive utilization. This, combined with a strong demand outlook for 2022 and 2023, is expected to result in longer-term campaigns and higher dayrates for these types of rigs.

Additionally, supply in this segment has also plummeted since the last upcycle. According to Esgian Rig Service, 44 drillships have been removed from the fleet since 2015. This is on top of the increased cold stacking that took place last year by the bigger rig players.

The drillship market is currently comprised of 58 units currently working, and 11 of the 16 hot/warm stacked assets now have future work in place.

With the pool of ready-to-go drillships shrinking, could this mean more of the remaining 18 cold-stacked units will return to operation? We expect to see reactivations initially for rigs that have been idle for the least amount of time, that have been well maintained, and that are still “top tier” younger assets.

Semisubmersible and jackup utilization have not yet reached levels comparable to drillships. As a consequence, there has been a limited number of confirmed reactivations for rigs of these types. But that doesn’t mean it may not happen further down the line if the market continues its recovery.

Youth versus experience

Stranded newbuilds are being considered again too, though there is still a preference for reactivating rigs with proven track records, rather than bringing out a newbuild that has never worked before. Supporting this idea are all the additional costs and potential issues that often come along with a newbuild shakedown.

Nevertheless, Saipem has confirmed a bareboat charter of the stranded seventh-generation drillship Samsung Santorini, which will be brought out of the yard in South Korea and put to work for Eni in the US Gulf of Mexico next year. Rumors suggest a few other newbuilds are currently under discussion too.

And there are plenty to choose from, with 18 under construction or categorized as stranded assets still in yards, and just three confirmed for delivery so far.

Reactivation economics

Valaris says that it will cost in the range of $30 to $45 million to reactivate each of its preservation-stacked floaters, and that in most cases it expects the initial contract to pay for these costs. Transocean, meanwhile, estimates that the total cash cost of reactivating a cold-stacked asset in its fleet starts at $60 million and could go upwards of $100 million.

Because most drillers will not reactivate unless they can be sure to recuperate costs, it may be that reactivation economics could become an important factor in setting drillship dayrate benchmarks in the coming months, especially if more cold rigs are brought into circulation.

Recent contracts fixed in the Golden Triangle have been as high as $300,000/day for active rigs, although the majority have been around the mid- $200,000/day mark. Ideally, a reactivation will be based on receiving a contract at a higher dayrate (somewhere around the $300,000 mark) and a duration of two years or more, but it is still possible to pay back the investment with one or the other assuming rig operating costs of around $120,000/day.

However, this may not be the case if reactivation costs are closer to Transocean’s estimates rather than those offered by Valaris. In such a case, the rig contractor would likely require the $300,000 dayrate plus a multi-year duration to make the reactivation investment worthwhile.

The difference in reactivation costs can vary depending on how the rig has been maintained during its stacked period, but also very importantly how long it has been idle for. The longer that a rig has been stacked, the higher the cost of reactivation; and hence for these rigs, the higher that dayrates must go before the rig contractor deems it worthwhile to put the rig back into the market.

Danger of oversupply

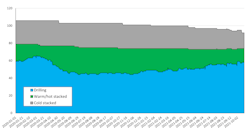

Competitive drillship utilization has recovered by 17 percentage points since this time last year and is now sitting at over 76%. Esgian Rig Service forecasts that this figure will rise above 80% before year-end, making its way to the sweet spot of 85% by 1H 2022, should all projects move ahead as planned.

Esgian reported previously that idle rigs can pose a threat to recovery if too many are brought back to the market at once, resulting in an oversupply which puts pressure on utilization and dayrates. Drillers must beware that this optimistic outlook could change quite quickly, and therefore caution must be taken.

However, so far there have been no reactivations based on speculation, and drillers appear to be sticking to their word about discipline. Rig restorations have only been confirmed for firm, long-term deals. Due to the new rebound in deepwater demand, the drillship market looks like it can handle the added capacity – for now, at least.

The author

Teresa Wilkie has 10 years of experience as a reporter and analyst in the oil and gas business. Prior to her current position with Esgian, she served as an analyst with IHS Markit, RigZone and Westwood Global Energy.