Vessels, Rigs, & Surface Systems

Stena Don upgraded with eight-point mooring system

Damen Verolme Rotterdam (DVR) has completed a major refit of the Stena Drilling semisubmersible Stena Don. The vessel arrived last October and departed for a contract for Total off the UK’s Shetland Islands in February.

The most significant aspect of the works was the installation of an eight-point mooring system. By using this for holding position, emissions will be reduced and savings on fuel costs will be made, DVR said. The upgrade also enables the rig to work in shallower waters than before.

DVR said that it began preparations for the installation of the new mooring system well before the rig arrived at the yard. Various elements of the system were manufactured by Damen in advance including the anchor chain lockers and sponsons. Weighing 1,200 metric tons they were fabricated at Damen Shipyards Mangalia before being shipped to Rotterdam. Other key components included eight anchor winches and the fairleads plus the winch control cabins, new VFD switchboards and brake resistor units. The eight ultra-high-holding power anchors were delivered by Damen Anchor and Chain Factory.

The yard also strengthened the hull to comply with the new regulations regarding the mitigation of wave impact forces. The extra weight required the fitting of two additional sponsons. The POB capacity was also upgraded from 120 to 140 persons on board. This included the fabrication and installation of two triple lifeboat systems.

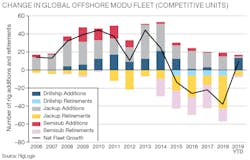

Offshore drilling rig fleet in net decline since 2015

Between the start of 2014 and March 2019, 230 rigs were retired, according to data from Westwood’s RigLogix service. During this time 163 rigs were delivered. All but six were ordered pre-downturn. While many owners have delayed deliveries to the maximum extent that they can, according to Steve Robertson, Director, Head of Rigs & Wells at RigLogix, this overhang of deliveries for units ordered during the last cycle means that despite 230 rigs being retired, the net reduction in the total fleet is only 66 units. One rig returned to the fleet after retirement.

Rig utilization for MODUs remains low at 54% on average. This suggests that without growth in demand there is substantially more trimming of the fleet required to bring utilization to levels that may see day rates improve, Robertson said. Yet there remains further newbuild units to be delivered. According to RigLogix data, 54 jackups, 13 drillships, and five semisubmersibles are scheduled for delivery this year, though most of these are expected to be pushed into 2020.Consolidation will allow some further control of the fleet by contractors, Robertson said. Last year Transocean acquired Ocean Rig and immediately scrapped two units. In early 2019, it scrapped two more. Prior to this, the company acquired Songa Offshore and scrapped the semisubs Songa Trym and Songa Delta. Ensco and Rowan (including the ARO JV with Aramco) also merged last year, creating the largest rig owner in terms of total units. Once the deal is completed it is likely that some attrition will take place. In 2017, Ensco acquired Atwood Oceanics, and while a few Atwood jackups were cold stacked, only one Ensco semi has been retired since.

With some contractors in default on their newbuilds some shipyards have become rig owners. These shipyards have started to release some of the rigs at a discount to normal newbuild prices, either through direct sale or lease to rig contractors, he said. A recovery in demand could see further such rigs acquired as a lower-cost route for contractors to expand fleets with newbuild units.

Most of the rigs removed are scrapped, with the steel content (usually more than 95% of the rig) cut up and recycled. Some rigs find uses elsewhere in the offshore supply chain. Since 2014, 23 rigs have been re-purposed for other uses such as accommodation units or mobile offshore production units.

Under Westwood’s base case scenario, a supply overhang will remain for some time, with the total number of working jackups, semisubs, and drillships reaching 410 in 2020. Assuming further scrapping of 10% of non-marketed rigs per year, Robertson said, this will bring utilization levels for the global MODU fleet to an average of 65%.