Demand for subsea equipment holds, but macro headwinds remain

Key highlights:

- Subsea EPC award value in 2025 was about $17 billion, down 20% YoY, influenced by low oil prices and supply chain costs.

- Despite cost increases since 2021, E&P budgets grew by 69%, indicating ongoing project development amid economic pressures.

- Demand for subsea equipment remains strong, with forecasts of up to $90 billion in EPC opportunities from 2026 to 2030, supporting about 1,300 subsea trees.

- Market challenges include an oversupplied oil market, with 3 MMbbl/d expected in first-quarter 2026, limiting new investments and causing project delays.

By Mark Adeosun, Westwood Global Energy Group

Subsea engineering, procurement and construction (EPC) award value in 2025 closed at c.US$17 billion, a 20% YoY decline, underpinned by 53 field final investment decisions (FID), c.230 subsea tree units, c.2,200 km of subsea umbilical, riser and flowline (SURF), and c.1,560 km of pipeline. Contracting activity was stifled by the lower-than-expected oil prices and high supply chain costs, which negatively impacted E&P’s investment appetite.

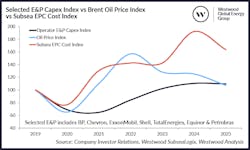

The subsea EPC cost index rose by approximately 25% in 2025 compared to the 2021 baseline but was 14% lower compared to 2024. In parallel, selected operators increased their E&P budgets by about 69% compared to 2021, reflecting a continued commitment to project development despite rising costs.

However, the average oil price in 2025 declined by 20% relative to the 2021-22 average of US$85.9/bbl. This price contraction has placed pressure on operators’ free cash flow, prompting a renewed focus on cost efficiency across the value chain. This led to a revision of the development timelines for projects such as Repsol’s Polok and Chinwol fields offshore Mexico and PTTEP’s Lang Lebah offshore Malaysia, with operators citing high supply chain costs and the need for project optimization.

In response, the supply chain is under increasing pressure to adopt new approaches and deliver cost reductions of approximately 15-20% from the 2024 subsea EPC cost index. This level of continued cost revision is considered essential, given the expectation of a persistently oversupplied oil market and continued downward pressure on oil prices.

While E&P companies sanctioned major subsea developments that required floating production systems in 2025, such as ExxonMobil’s Hammerhead development (Guyana), bp’s Tiber (US Gulf), Shell’s Gato do Mato (Brazil), Eni’s Coral Norte (Mozambique) and Petrobras’ SEAP II (Brazil), subsea contracting was widespread with several subsea tieback projects. Those tieback projects included Equinor’s Fram Sor, Johan Sverdrup Phase 3 and Isflak, all offshore Norway; ConocoPhillips Previously Produced Fields project (Norway); Chevron’s Gorgon Stage 3 (Australia); Beacon Offshore’s Shenandoah South (US Gulf); and Shell’s Mina West (Egypt). And E&Ps continue to utilize existing infrastructure.

Looking ahead, the demand for subsea production equipment is forecast to remain strong over the next five years, providing up to $90 biilion in EPC contracting opportunities for the supply chain during 2026-2030, with subsea trees demand estimated at c.1,300 units, averaging 260 units annually. However, challenges remain, as an oversupplied oil market, which is expected to reach 3 MMbbl/d in first-quarter 2026, the highest since 2020, continues to put downward pressure on oil prices, which will limit investments by E&P companies, which are poised to stay capital-disciplined, leading to project delays and deferred investment.

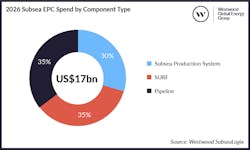

In 2026, Westwood anticipates subsea EPC spend will total c.$17 billion, mirroring investment levels seen in 2025. However, the number of field FIDs could increase 13% YoY, totaling 60, as unit cost is projected to continue its downward trend, as seen since second-half 2025, to support planned investment.

Subsea tree demand is forecast at 264 units, with Africa and Latin America accounting for 29% and 32%, respectively, but will only account for 19% and 21%, respectively, for subsea EPC award value, due to demand for rigid line pipe in Asia, Middle East and Europe.

Key projects to watch for Africa in 2026 include Azule Energy’s PAJ development (Angola), Chevron’s Agbami Infill Program (Nigeria) and TotalEnergies’ Venus Phase 1 development (Namibia), following reports that TotalEnergies received attractive bids from contractors for the project’s work scope. However, the operator awaits regulatory and fiscal clarity, which could delay the FID, which is anticipated in fourth-quarter 2026, if negotiations are protracted.

In Latin America, Petrobras’ continued investment in its presalt basin offshore Brazil will remain key, with equipment callout from several of its global frame agreements (GFA) signed with multiple contractors for subsea trees and SURF, including from the 82 subsea trees and associated services that was awarded to Baker Hughes and TechnipFMC in third-quarter 2025.

In addition, ExxonMobil’s activities offshore Guyana will see the sanctioning of its Longtail development, while Karoon Energy plans to sanction its Neon project offshore Brazil.

Subsea contracting in the Asia-Pacific region will be weighted toward gas developments, with Eni’s Kutei North development (Indonesia) a key project to watch. Inpex is also evaluating the development of the Ichthys Phase 2c project offshore Australia, while CNOOC is expected to sanction its Kaiping 11-4 and Kaiping 18-1 development offshore China, following the prequalification of contractor that commenced in first-half 2025.

Western Europe will account for 20% of forecast subsea EPC award value in 2026, with activities offshore Norway and Cyprus dominating, as the fiscal and regulatory posture in the UK continues to stifle investment appetite in the UK North Sea and the West of Shetlands.

Projects to watch in the region include brownfield investments by Equinor, including the Troll Phase 3 Stage 3 project, the Johan Castberg expansion and the Heidrun expansion. Var Energi plans to sanction the next phase of its Balder project offshore Norway, with greenfield tieback fields such as Dugong/Beta and the Ofelia fields reportedly under consideration to be sanctioned in 2026.

Offshore Cyprus, Eni is advancing its Cronos gas field, having recently signed commercial agreements to connect it to Egypt’s infrastructure.

The SURF market and the subsea pipeline sector will each account for 35% of subsea EPC award value in 2026, with activities in the Middle East accounting for 33% (c.$1 billion) of subsea pipeline spend. Key subsea pipeline awards anticipated in 2026 in the region include brownfield infrastructure demand across Aramco’s Safaniya, Marjan Berri and Abu Safah developments offshore Saudi Arabia, ADNOC’s Belbazem Phase 2, the Umm Shaif project and the Abu Dhabi Offshore 2 development offshore the United Arab Emirates. The Karish to Larnaca Pipeline (Israel) and Durra export pipeline (Kuwait) will also support demand for rigid line pipe in 2026.

Overall, a total of 4,200 km of subsea pipeline is forecast to have an EPC contract award in 2026. The SURF market will remain robust, with a 20% YoY increase in demand, with 3,950 km. Demand from Petrobras will account for 20%, leading demand from E&Ps, while Western Europe will lead regional demand at 30%, accounting for c.1,200 km.

Beyond 2026, contracting opportunities abound across all regions, with exploration successes in the Eastern Mediterranean Sea, offshore Brazil and Namibia, including the recently acquired Mopane discovery offshore Namibia by TotalEnergies from Galp Energia, which could progress in the latter years of the forecast.

Long-delayed projects, such as Equinor’s Bay Du Nord (Canada) and Wisting (Norway), Woodside’s Browse gas development (Australia), Shell’s Bonga SW (Nigeria), and Inpex’s Abadi development (Indonesia), are expected to be sanctioned before the end of the forecast. However, these projects are susceptible to delays should downward pressure on oil prices continue, given an oversupplied oil market.

About the Author

Mark Adeosun

Research Manager, Offshore Field Development

Mark Adeosun is currently the Research Director for Westwood Global Energy Group’s SubseaLogix and PlatformLogix market analytic tools. Since joining Westwood in 2013, he has worked directly with as well as advised several clients within the oilfield services supply chain, as part of both analytic and commercial advisory projects.