Future subsea orders driven by a resurgent Brazil, frontier markets

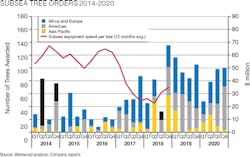

In 2018, 286 subsea trees were ordered, according to Westwood, the highest total since 2013. However, the growing order book has yet to translate into meaningful revenue growth for the hard-pressed subsea supply chain, according to Thom Payne, Westwood’s Head of Offshore. Its analysis suggests the average spend per subsea tree fell from $63 million in 2014 to $35 million in 4Q 2018, driven by operators’ continued focus on capital discipline, project simplification, and standardization.

However, the analyst believes that as backlogs continue to build OEMs may start prioritizing margins over volume. It expects awards for up to 400 subsea trees in 2019, with the focus for future activity on a resurgent Brazil and emerging deepwater markets such as Guyana, Mozambique, and Senegal.