Norske Shell investments extending life of Draugen

Production on the Draugen Field in the Norwegian Sea will be extended until around 2015, following Norske Shell's decision to implement a NKr 3 billion investment program over the next three years. The program involves both in-fill drilling on the main reservoir and the development of fresh reserves at Garn West and Rogn South.

When it came onstream in 1993, Draugen was the first field to be developed in the Norwegian Sea off mid-Norway. The estimate of recoverable reserves has been raised from 400 million bbl of oil at discovery in 1984 to a current 700 million bbl. Even so, with production now running at around 225,000 b/d, it was unlikely that Draugen would have remained in production until 2010 without an additional shot of investment.

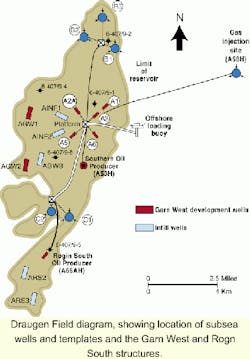

The new initiatives will help maintain the level of plateau production, which otherwise would have fallen away in a couple of years' time, according to Vidar Yverlie, head of Draugen development. Both the Garn West and Rogn South structures are part of the Draugen Field. Garn West lies in the western part, and Rogn South in the far south. Both will be developed with subsea facilities. As they are not separate fields, no new plan for development and operation is expected to be required.

Garn West first up

First up for development is Garn West, which is scheduled to come onstream in late 2001. The base case is two production wells tied back to the platform by a 3-km pipeline. Rogn South is likely to follow in 2003, though some more work still has to be done here before the licensees commit to this project. There are likely to be three producers, tied back some 9 km to the platform. Shell recently extended the contract of the Draugen maintenance and modifications contractor Aker Maritime, which will have responsibility for platform modifications needed to accommodate these two projects. Drilling and pipelay contracts for Garn West have yet to be let.

In addition, up to three infill wells are currently planned, located to the west of the platform. These will presumably be drilled by a modular rig, as the original platform rig was dismantled and removed once the original drilling program had been completed.

High flow rates

A state-of-the-art drilling system was used to locate the productive sections of the wells two to six metres below the top of the reservoir to ensure optimal production. In compensation, the oil flows freely from the reservoir, and the wells are among the most productive in Europe. The latest well, A4, flowed at 76,775 b/d when brought onstream, a world record for an offshore well.

In addition to the platform wells, there are also two subsea producers, both to the south of the platform. One is the Southern Oil Producer, located at a distance of 2.6 km, while the other is on the Rogn South structure at a distance of 8.6 km. Reservoir pressure is maintained by the injection of filtered seawater through a further five subsea wells. Three are housed on a template 5.3 km to the north of the platform, and two on a template 5.2 km to the south.

There is an eighth subsea well which is used for gas injection. Like the two subsea producers, this is equipped with a protective structure made of fiberglass, the first time such composite materials had been used for this function in the North Sea. The gas injection well has been drilled into the Husmus structure, which lies some 10 km east of the platform, well beyond the limit of the main reservoir.

Draugen contains some 3 bcm of associated gas reserves. The bulk of this is to be exported starting in October. It will be routed into the Åsgard Transport System pipeline through a 75-km, 16-in. line which Stolt Offshore's laybarge LB 200 was due to lay in May. Exports are expected to continue to 2008 at an initial plateau level of 2 MMcm/d.

Improved economics

Together with its Draugen partners, BP Amoco and Chevron - the State's Direct Financial Interest (SDFI) also has a stake of more than 50% - Shell has done much to improve the field economics. Monitoring of the reservoir through 4D seismic surveying has made an important contribution to increasing the recoverable reserves estimate and optimizing well location - it saved the latest well from producing water at an early stage, Yverlie says.

Process plant capacity has been en hanced by a number of de-bottlenecking projects which have enabled production capacity to be raised from the original 100,000 b/d to more than 225,000 b/d. Since 1994, unit operations costs have been reduced from NKr 25/bbl to NKr 6. Operations have been running smoothly; recently, the field ran a total of 176 days without a single production shutdown.

While Shell faces a busy and expanding future on Draugen, the firm's perspectives elsewhere in the Norwegian sector have also brightened in recent months. The company has been designated production operator for the giant Ormen Lange Field, which could come onstream in 2006. Under an agreement with the development operator, Norsk Hydro is also responsible for subsurface planning, including drilling, and gas marketing. And in the recent 16th round, it was awarded the prize PL 255 licence, which includes the 6406/5 block which has the potential to hold large gas reserves. It is also a participant in a second new licence in the Norwegian Sea.