Digitization cutting costs, improving productivity of offshore inspection

Robotics allow greater focus on office-based analysis

Danny Constantinis

EM&I

Recent oil price swings will continue to have a profound effect on the offshore industry over the coming years. Operators and service providers are determined to build on the reductions in cost that followed the downturn by increasing efficiency in every aspect of their businesses. One of the main priorities is asset integrity.

Complex offshore assets such as FPSOs, floating LNG (FLNG) vessels, floating storage and regasification units (FSRUs) and mobile offshore drilling units (MODUs) comprise many thousands of structural, pressure system and electrical components that require regular monitoring, inspection, and maintenance to deliver optimum safety and efficiency.

Inspection is a high-cost activity, but clearly necessary to comply with regulatory requirements. It is not practical to inspect every component of an offshore asset, so one answer has been to use some form of risk-based inspection (RBI), or priority-based methodology, to focus the scope and periodicity of inspections.

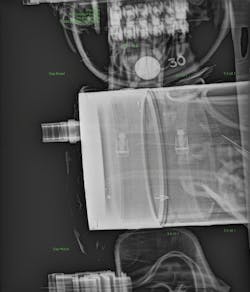

Above: Bladder repair using ODIN inspection tool. (All images courtesy EM&I) Below: Remote optical inspection of a cargo oil tank.

RBI is well developed for pressure systems, but less so for electrical equipment and structural inspections, although this is changing. However, even the more advanced RBI methods generally achieve a detection rate of anomalies of only around 5% during inspection campaigns. So is the industry ‘wasting’ 95% of its investment expenditure, and, if so, what can be done about it?

Use of emerging techniques in digitization and statistical analysis allow inspectors to see things that normally would not be visible. But a step change application is needed in order to safely reduce costs. Over a seven-year period EM&I has collected digitized pressure system inspection data on 15 assets. Traditionally, much of this type of information has been discarded because it reveals no anomalies, but the company’s statistical analysis methods use the data to prove that future inspections can be reduced without compromising integrity. Findings to date suggest that cost savings of 50% or more are achievable.

Quantifying inspection needs

The statistical analysis concept was first conceived in 1986, but at the time there was insufficient verifiable data and understanding of how the data related to corrosion mechanisms to apply the appropriate statistical methodology. The more recent development of `Big Data’ analysis, however, makes it possible to project how a component will age, and how much inspection data are required to assure the operator and regulator that the risk is within a pre-agreed level.

Robotics bring major advantages to asset integrity activities, being more efficient, effective, and safer than putting human inspectors at risk in hazardous environments - at height, in confined spaces, or underwater.

Various organizations, including the FPSO Research Forum, have been studying how to improve structural inspections, especially of confined spaces, such as tanks and the underwater section of hulls. One joint industry project created via the Forum is the Hull Inspection Techniques and Strategy JIP (HITS) which has representation from all the major class societies, regulators, the oil majors, lease companies, and service providers, and is managed by EM&I.

HITS, which was initiated around five years ago, has successfully introduced robotic methods of underwater hull inspections, inspections of cargo, ballast, and other confined space tanks and pressure vessels without the need for man entry. These methods have to date been applied on over 20 offshore assets for diver-less inspections, and for repairing damaged valves and piping.

One recent inspection program was a class-approved campaign that led to the repair of three sea valves on a drillship offshore Angola, while the vessel was on-station and in operation, saving 10 days’ off-hire time.

Robotic methods work well in combination with data digitization, but require substantial changes to present offshore inspection methods. With cargo oil tank inspections, for example, there will in future be a greater emphasis on prior engineering and planning to pinpoint high-risk areas and expected failure modes, derived from Big Data analysis.

The site team will likely be reduced to one or two engineers driving robotic systems using remote cameras, lasers or other advanced detection methods, often linked to an onshore support team in real time. Inspection data will be analyzed and information provided to the maintenance and operational management, for optimizing integrity and operating costs.

During recent cargo oil tank inspections on an FPSO in the North Sea using NoMan remote camera systems the work was completed in four man days: the client estimated it would have taken over 100 man-days to have achieved the same result using traditional methods involving higher risk, cost, personnel on board (POB) requirements, and out-of-service time.

Modern optical / laser methods can fulfil class and regulatory requirements for inspections involving a general visual, close visual, distortion structural survey, pitting measurements, or remote thickness readings, without man entry. However, the cameras employed must be able to detect and measure anomalies defined as being above the ‘defect tolerance standard’, both at long range (General Visual Inspection) and close up (Close Visual Inspection), which is defined as ‘arm’s length’.

Knowing where to look is also critical, and entails understanding of the specific structure and the kinds of anomalies expected, an area where classification societies bring extensive knowledge. Other challenges are where to position the camera system to avoid ‘shadow areas’, correct lighting, managing electrical hazard safety, and avoiding movement of the camera.

Above: Typical camera system deployed in a confined space. Below: Digital image of hazardous area equipment.

Often there is also a need to confirm the wall thickness of the steel structure for hull girder strength calculations, and to measure pit sizes and depths. The HITS JIP has defined inspection and cleaning requirements for these methods.

Choosing the optimal inspection and maintenance approach is also critical for Hazardous Area Equipment (HAE). Many of the larger offshore assets have around 20,000-30,000 items of HAE equipment, so it is important to know what to inspect and when. Current methods are largely prescriptive, and it is difficult to fulfil the inspection need because of the large volume of components.

But inspection efficiency is improving thanks to prioritized work scopes, suitable databases, hand-held ‘palmtop’ data loggers and Radio Frequency Identification (RFID) tags which help record, update, and store the data. Conventional RBI could be applied to improve the process if sufficient data could be gathered to link failure mechanisms (probability) to consequence, and this task is one where ‘Big Data’ analysis can have a major impact.

Because some of the failure mechanisms are linked to incorrect assembly rather than time-related degradation, much of the inspection cost is due to the need to isolate systems for equipment strip down and the shut-down, itself a costly exercise. However, there is good information out that can be analyzed to improve the inspection process, and EM&I is working on this as well as employing non-intrusive methods to ‘see’ inside critical components such as connectors, junction boxes and switches. This will facilitate assessment of component integrity without the need to isolate systems, currently mandatory for traditional inspection.

Planning is also under way for designing new-generation assets that will incorporate digitized and robotic integrity systems.

Leading global asset integrity companies are now changing their business models to harness the potential of digitization. The changes to how the industry deals with asset integrity will affect all organizations including regulators and classification societies, operators, service companies, training organizations and R&D centers.

Regulators will adapt their rules and guidelines in recognition that inspection scopes will be far more risk based, and will need to ensure that new data-gathering methods are validated as equivalent to conventional practice. There will also be a need for guidelines on engineer and inspector competency, while training and certification organizations will have to develop programs and facilities to deal with the new requirements. Service companies must rethink their business models, the competencies of their personnel, their in-house engineering expertise, investments in new equipment, and, of course, training.

The days of sending a multi-person inspection team with rope access capability to inspect a tank, piping or hazardous area electrical, equipment or a 20-man diving spread, each producing reams of unused data that sit on a shelf, will fade.

Instead, inspection will serve increasingly as a leading edge tool to confirm condition, accurately predicted by onshore engineers using statistical digitized tools, and verified offshore by a one or two-man team of engineering inspectors with robotic tools. Much less time will be spent offshore, and a greater proportion onshore planning and analyzing data.

Operators will adapt their operational and procurement practices to take advantage of the benefits of digitization and robotic methods.

Costs will come down, while the safety and environmental risks will be reduced, with fewer people placed in harm’s way, and with improved reliability of equipment leading to reduced loss of primary containment events, fewer repairs, and less unnecessary maintenance.