Brest’s growing offshore capabilities to be demonstrated at UDET

This June, the Ultra Deepwater Engin-eering and Technology Conference (UDET) makes its debut in the city of Brest, northwest France. UDET is intended partly as a showcase for innovative new concepts, but also as a forum for future engineering issues. How, for example, can the industry manage riser stability or flow assurance in water depths of 4,000 meters or beyond?

These and many other deepwater problems are under review by R&D institutes and commercial companies in Brest and the surrounding area. Outside Paris, the department of western Brittany, of which Brest is the largest city, hosts the broadest range of marine expertise in France. Historically, the French Navy, local shipyards, and oceanographic centers have been the main clients, but the mix is changing. According to Christian Charles, Deputy Manager of the science and technology park Technopole Brest-Iroise, offshore is viewed as the growing market. "With more discoveries expected in deep and ultra-deep waters, new technologies will have to be developed. We believe the companies here are equipped to give some of the answers."

The Technopole groups together private companies, research laboratories, engineering schools, and universities with specialties including oceanography and geosciences, underwater acoustics, and robotics. Three years ago, Brest Offshore built two new deepwater semisubmersibles for Transocean Sedco Forex at a drydock in Brest Harbor. Construction was managed by the French naval shipyard DCN, with the help of outfitting yard Sobrena and others.

DCN has since scaled down its interest in the offshore sector, and Brest Offshore was recently disbanded. The Technopole, however, remains committed, with the objective of increasing the share of its activity dedicated to offshore programs to one-third, according to Charles. Recently, it helped create Haliod, a new industry/R&D body intended as a center of expertise for offshore engineering. The President of Haliod is M. Dubost from Sofresid Ouest. Executive committee members include Eric Vanderbroucke from the Institut Francais du Petrole (IFP) and Lionel Lemoine from Ifremer.

"Brest is a relative newcomer to the offshore industry," says Vanderbroucke. "We’re not like Aberdeen, but we want to develop this market. Haliod is designed to group together relevant companies, schools, and research centers, with the aim of developing commercial services and products." Currently, there are 20 members in the consortium, with wide-ranging capabilities. Private company members include:

- Atlantide, providing services in geosci-ences, meterology, and oceanography

- Principia, a specialist in marine engineering, including transoceanic cable-laying studies, employing tools such as the Diodore and Deeplines software suite (also deployed for mooring analysis at the company’s base near Marseilles). This company also conducts studies at the Ifremer deepwater test tank in Brest.

Other members are:

- Sofresid Ouest, an engineering subsidiary of Bouygues Offshore, with a track record locally in shipbuilding

- Thales, providing geographical information systems and underwater acoustics engineering and manufacturing

- ECA, a specialist in autonomous underwater vehicles, based in Toulon, is the most recent addition to the consortium.

"We were already organizing workshops with them on robotics," says Vanderbroucke. "We share a common understanding of the AUV (autonomous underwater vehicle) market, and Haliod brings them technical expertise useful to their project."

Haliod is also helping with organization of the Sea Tech Week exhibition June 17-20, concurrent with UDET. This will include Deep sea acoustics and side-aperture radar workshops, and a demonstration of ECA’s new Alistar AUV and associated instrumentation devices at Brest harbor.

Two other companies have applied to join Haliod, one involved in subsea instrumentation, the other in seismic data management and interpretation. "We look for partners from many countries to participate in special development projects," says Vanderbroucke. "Our target especially is to increase our activity in deep offshore technology. We may also look at alternative energy techniques."

Research institutes participating in Haliod include:

- IFP, the well known petroleum R&D center based in Rueil Malmaison, near Paris, which covers the entire domain of the hydrocarbon industry, from exploration to auto engines. IFP is also known as an engineering school and a documentation center. Its work is considered complementary to the marine expertise of the other Haliod members

- Ifremer, the French institute dedicated to exploitation of the sea. Specific to the development of offshore oil and gas resources, Ifremer offers a variety of services such as R&D, consultancy and research in partnership. It conducts research on geology, geotechnics, metocean conditions, hydrodyn- amics, materials behavior, underwater acoustics, and underwater vehicles. It also operates several testing facilities in Brest, such as a test basin and hyperbaric chambers. Ifremer is also responsible for operating the French oceanographic fleet, which includes deepwater remotely operated vehicles (ROVs) and manned submarines

- Ensieta offers offshore engineering courses covering design of platforms, risers, and pipelines. It provides software to ECA to simulate the behavior of underwater vehicles

- ENST contributes expertise in signal processing for robotics and hydrodynamic behavioral studies.

- CEDRE develops oil spill response programs

- Universite de Bretagne Occidental works in all branches of sea sciences.

According to Vanderbroucke, Haliod’s remit ranges from offering existing equipment, such as acoustics, to services (as provided, for example, by Atlantide or Sofresid Ouest), tailor-made studies, joint industry, multi client-sponsored projects and R&D partnerships. Fifty staff work for Haliod at various times, with two full-time executives in Vanderbroucke and Lionel Lemoine of Ifremer. The company will also be exhibiting at Offshore Technology Conference (OTC) in Houston this May.

Tracking systems

One of the Haliod members based at the Technopole is Orca Instrumentation, which was created in 1988 by two engineers from Ifremer. Orca provides acoustic transmission systems, portable tracking systems for tracking underwater vehicles, satellite-based buoy location, and data acquisition/processing devices. It employs a staff of 15, who design 90% of the company’s products. These may be in-house inventions or designs meeting customer specifications. All manufacturing is subcontracted, but the company manages its own product tests.

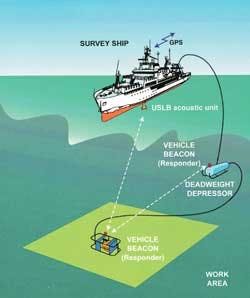

According to director Jean-Michel Coudeville, around 20% of the company’s business is in marine sensors and satellite systems, while acoustics/tracking generates 80%, and is increasingly dominating its activities. One of its best-known creations is the global positioning system (GPS) Intelligent Buoy (GIB), an underwater tracking system based on differential GPS and underwater acoustics.

"We adapted the standard GPS system to track various underwater vehicles, which are sometimes at high speeds," says Coudeville. "GIB locates a network of buoys equipped with DGPS receivers and hydrophones. These buoys can be anchored, moored, or drifting. A reference network is created. The underwater vehicles are equipped in turn with our synchronizable pingers. This leads to synchronization of the signals between the vehicles, controlling surface vessel station, and shore station." Ten of these systems, designed between 1996-99, have so far been sold. One of the customers was Oceaneering, for an application in the Gulf of Mexico. Another user is the German Navy.

Another Orca specialty is the Multimodulation Acoustic Transmission System (MATS), which is used by the offshore, marine, and naval sectors to transmit and receive digital data over an acoustic link. ROVs, AUVs, and mooring line sensors are typical applications. The systems are error-free, secure, and can operate at a rate of up to 30,000 bit/s. Offshore customers include ABB and Oceaneering in Norway. One of the newest applications relates to deployment of suction anchors, via systems equipped with gyros.

As part of Haliod, Orca intends to work increasingly with ECA to develop acoustic systems compatible with the latter’s new Alistar AUV range. "Offshore applications could include surveys of the pipelay touchdown point," Coudeville says. "In that situation, the AUV has to be controlled from the surface vessel, which means providing information via a bi-directional acoustic link." At UDET, during Sea Tech week, Orca will mount trials of a GIB system in the Bay of Brest involving four buoys spaced 1 km apart, controlled from a hired surface vessel or from a shore station. These will be used to track the prototype Alistar, with a potential range for the trials of 5-km.

Orca’s most recent offshore reference was at Girassol off Angola, where it designed a network of acoustic modems to aid remote control of the wells.

Acoustic positioning

Another company based at the Technopole is Oceano Technologies, which has undergone several incarnations. It was formed initially as Oceano Instruments in 1977. Eight years later, it merged with Brest-based oceanographic instrumentation specialist Suber (created in 1969), and then, following another takeover by the Mors group, became the Mors Environment Division in 1990. Mors, which had interests in aeronautics and the auto industry, was seeking to diversify. In 2000, Mors Environment was merged with Actielec Technologies, and has since re-adopted the Oceano name to better reflect its main activity, which is underwater acoustics.

Today the Oceano Technologies group employs 45 people at three locations. The head office in Brest is where the main R&D and product manufacture is performed. Oceano Instruments (UK) has been in Edinburgh since 1984, working with companies in the North Sea. Thetis in Toulon provides sales and rental services to local research and military institutes in the south of France. Now another merger is planned with the French company iXSEA, employing a staff of 35, which is a specialist in positioning with fiber-optic gyrocompasses and inertial navigation systems.

According to Sales and Business Development Manager Max Audric, 50% of the company’s turnover comes from offshore contractors such as Technip-Coflexip, SBM, Allseas, Halliburton, Stolt Offshore, and McDermott. It is best known in the offshore sector for its heavy-duty acoustic releases for deployment of heavy loads subsea. The Edinburgh division operates a hire pool of over 40 of these devices with safe working loads varying from 2.8 to 110.2 tons. They are used for a wide variety of installation tasks, including flowlines and umbilicals, riser arch buoyancy, mooring systems, and templates in all water depths. Previously, the releases were powered by motors, but a new generation will be introduced with hydraulics, which provides more power in the water. The new design also makes actuation by ROV easier, Audric claims.

The company’s other main thrust is into acoustic underwater positioning systems. Products include the Posidonia 6000 ultra short baseline system, which combines techniques such as Chirp and frequency modulation to provide accurate, long-range positioning in up to 6,000 m water depth. The Posidonia 6000 was originally developed by Oceano Technologies and Thales Underwater Systems (at that time Mors and Thomson Marconi Sonar) for Ifremer. Its applications include offshore construction and installation, ROV positioning, towed body tracking, pipelaying, and site surveys. Sea trials by Ifremer on the ROV Victor 6000 demonstrated a position accuracy of better than 20 m in 6,000 m water depth and position repeatability improved to less than 10 m in 2,000 m water depth.

"The system is unique in terms of its range," says Audric. "Over a 9 km range, the accuracy is better than 0.3% of slant range. We have well-known competitors, but their products are more limited in performance, as well as range." Since Thales Underwater Systems ceased operating in Brest, Oceano has secured an exclusive license for the product. "We are now developing a deeper water version (2-3,000 m) with a medium frequency ‘SPMP’ USBL system in a smaller container, which is more suitable for a vessel of opportunity. We’re also working on faster data transmission and better protection against noise. And we’re extending its capability to monitoring drilling riser shape in very deep water."

Recent applications include positioning of the Edgetech towfish for survey applications by the US Navy and GEOMAR, a German research institute, which also uses Posidonia for OBS mooring line recovery tracking. Posidonia will also be employed in the Alistar AUV project, and for the prototype Promaster, a new ROV being developed by B&A Industries in The Hague for a wide range of oilfield tasks.

Sidescan sonar

Groupe d’Etudes Submarine Atlantique (GESMA), a division of the French Defense Ministry (DGA), has two R&D centers on both sides of the bay at Brest. One has built up expertise over 35 years in sonar and acoustic measurement systems. These technologies are used by the French Navy for mine warfare, and increasingly with autonomous underwater vehicles. According to GESMA director Pierre Leca, "We work in fields such as propagation, scattering, antenna performance, acoustic and magnetic signatures. We have acoustic test tanks and experimental vessels.

"Over the past few years, we have developed the Redermor experimental AUV for mine warfare. We have focused our efforts on intelligence inside the vehicle – mission planning, environmental assessment, onboard data processing sensors.

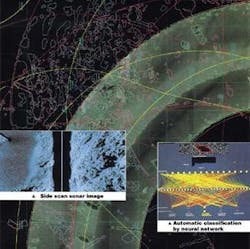

GESMA also worked on the improvement of sidescan sonars to offer better resolution. "Now we are working on raising the resolution further using the synthetic aperture sonar. We analyze the size and shape of shadows underwater so that the vehicle can distinguish between rocks and mines. We acquire data in the seabed, which is input into the vehicle's database. The vehicle can relocate itself using the object recognition facility, and eliminate the drift, so that it ‘knows’ exactly where it is," Leca said.

"With our system, the vehicle is equipped with a GPS sonar. Pre-programming allows the vehicle to be turned very quickly, or to do one or more investigative tasks in the same run. Our model allows you to simulate what the sensor should see at a given point, and in case of high turbidity obscuring the camera picture, to improve the position of the vehicle on its target.

"We used sonar for the oil pumping operation on the wrecked tanker Erika, off western Brittany, in 2000. At that time, the application was not mature and could not be used to image the wreck and guide ROV operations, but now it would take the operator only 20 minutes to shape the necessary image. Our technique may not generate the most precise image available, but it does produce a good one pretty quickly."

GESMA employs 100 full-time staff, half of which are engineers. It also works within the framework of Haliod and is involved in the Alistar program. Following trials with the prototype at UDET, the plan is to produce a version of the AUV capable of operations in 3,000 m water depth, says ECA’s commercial director Jean-Pierre Hainsselin. "This will be equipped with side-scan sonar for use in surveys and touchdown monitoring of pipelines and inspection. We want to propose this functionality to oil companies for use in deepwater fields." In March, ECA also performed tests with a hydrogen/oxygen mix, which could form the basis for a future fuel cell on the seabed for re-charging the vehicle.

Turbidite study

Ifremer is the leading institute for marine geosciences research in Brest. One three-year project drawing to a conclusion is ZaiAngo, an integrated study of the Gabon/Congo/Angola margin based on exploration surveys between 1998-2000 in water depths ranging from 400- 5,200 m. Funding is shared between Ifremer and partner TotalFinaElf.

The main aims are to improve knowledge of the Zaire river turbiditic system, in order to develop a reliable deposition model, and also of the geodynamic setting of the entire margin, to improve understanding of the hydrocarbon system (migration, traps, and so on). Another area of study is slope stability, a major concern affecting field development in deep waters in this area, as the stability of the sedimentary cover could be disturbed by circulating fluids or the presence of gas hydrates.

Data was collected during nine cruises across the area, lasting a total of seven months, using an Ifremer-owned research vessel. Instrumentation deployed by Ifremer included an EM12 multi-beam echosounder, deep sea coring, heat flux measurement systems, deep-tow high resolution side-scan sonar, and monotrace seismic. Some of the techniques applied had to be adapted for ultra-deepwater exploration, notably the use of 2D high resolution multi-channel seismic profiling. New tools also had to be developed specially for the project, such as a 4,500 m long digital seismic streamer and an ocean bottom seismometer for seismic refraction. Samples were collected by an ROV equipped with chemical analysis capability. Twenty-five staff were employed on this project, and results were to be presented at the end of March.

According to Bruno Savoye, ZaiAngo project manager at Ifremer, TotalFinaElf is planning to acquire new seismic over the area. "Now they know where the sand is better than they did before. Over the longer term, one of the more important issues is the areas at the end of the valleys, far from the coast, where the sediments accumulate. Another is the large-scale ‘escape’ of sediments. We can do measurements near the sea floor of different channel elements to gauge what could be the quantities of oil 2,000-3,000 m below the seafloor … The project is also investigating the nature of the very deep structure of the margin. Are there any ultra-deepwater basins that are worth exploring for oil? The main problem in this area is a thick bed of overlying salt, which makes it very difficult to image what is below," Savoye said.

"We are now hoping to organize a similar research project in other areas of interest for offshore oil and gas operators."

Another participant in the ZaiAngo study was IUEM, the marine research institute in Brest affiliated to the University of Western Brittany (UBO). IUEM employs 150 full-time researchers, engineers, and technicians, and also has access to eight laboratories for use in geophysical, geological, chemical marine, microbiological and other studies. It specializes in analysis of continental margins and rifts, ocean plates, and areas of volcanic activity.

According to Jacques Malod, a senior scientist at IUEM-UBO, "The deep offshore has taken up a big part of our activity since 1998. Our projects have included studies of the margins along the Bay of Biscay and the Gulf of Lyon, with some co-operation from oil companies. Currently we are doing research on the Atlantic Margin offshore Morocco. Here we have had discussions with permit holders/license participants including Vanco, Total FinaElf, and Agip.

"We can provide information to the oil industry on the evolution of a margin and its thermal temperature history. Data is captured using the Nadir research vessel, towing a 5,500 m, 360-channel digital streamer. We also use ocean bottom seismic and deep seismic reflectors. Typically, we look at the transition area between the crust and the mantle, around 10 km below the seafloor," Malod said.

"The water depth of the margin off Morocco is typically 4,000 m. The geology of the margin between North America and Northwest Africa is well known on the US side, but not on the African side, which also happens to be one of the oldest passive margins in the world, having been opened 180 million years ago. That makes it older than Brazil or the Gulf of Guinea. So far, we have achieved some very nice results – we could image the crust transition from the continental crust to the oceanic crust. There are overlying salt domes, so it is very important for the oil industry to know what happened during the early phase of rifting. We believe the salt was at sea level when the margin was formed, now the salt is at a depth of 5-7 km. That suggests a strong vertical motion, but we don’t know how quickly it happened. With IFP, we will work on developing a model for thermal and subsidence history."